Firms expand with expected infrastructure boom

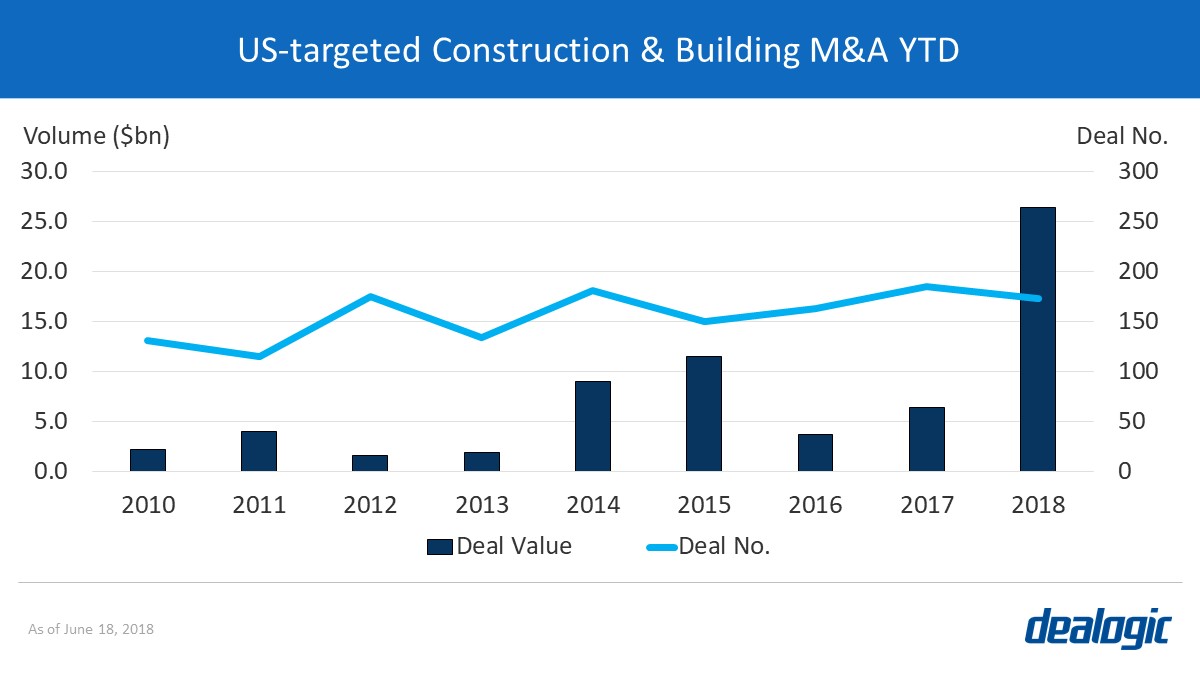

US-targeted construction & building M&A reached its highest YTD volume on record this year with 173 deals totaling $26.4bn. This marked an increase of 312% compared to volume last YTD ($6.4bn via 183 deals). High expectations in the sector were largely a consequence of the federal government’s push for a massive increase in infrastructure spending. In addition, tax reform has increased investment in the industry with possible new infrastructure projects on the horizon.

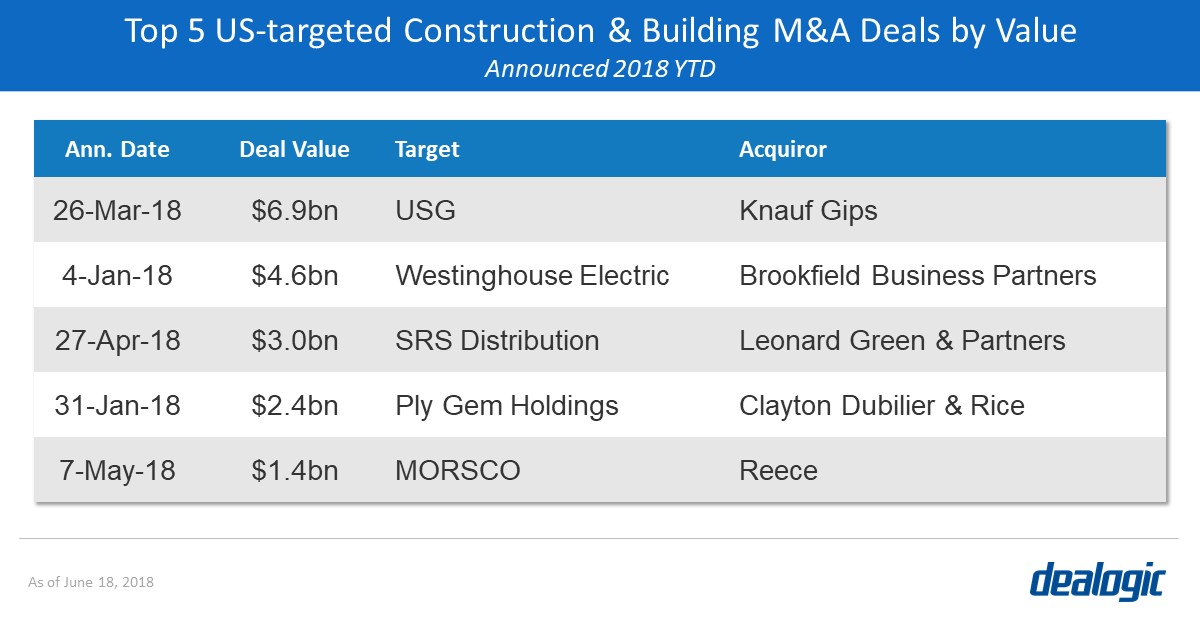

As firms use strategic acquisitions to expand into new markets, volume for such deals reached their new record thanks to the announcement of several large deals—including the acquisitions of USG ($6.9bn), Westinghouse Electric ($4.6bn), and SRS Distribution ($3.0bn).

Slowdown in the forecast

Although market sentiment has been bullish, several factors may lead to a drop in the sector’s M&A volume in the near term. They include California’s new mandate requiring all new homes to have solar panels, increasing the overall cost for homebuilders. Interest rates have also been on the rise leading to higher mortgage rates for home buyers. With higher costs expected for both homebuilders and home buyers, the construction industry may see a decline in demand and M&A activity.

– Written by Lawrence Santoruvo

Data source: Dealogic, as of June 18, 2018

Contact us for the underlying data, or learn more about the powerful Dealogic platform.