US and China continue to top global ECM issuance

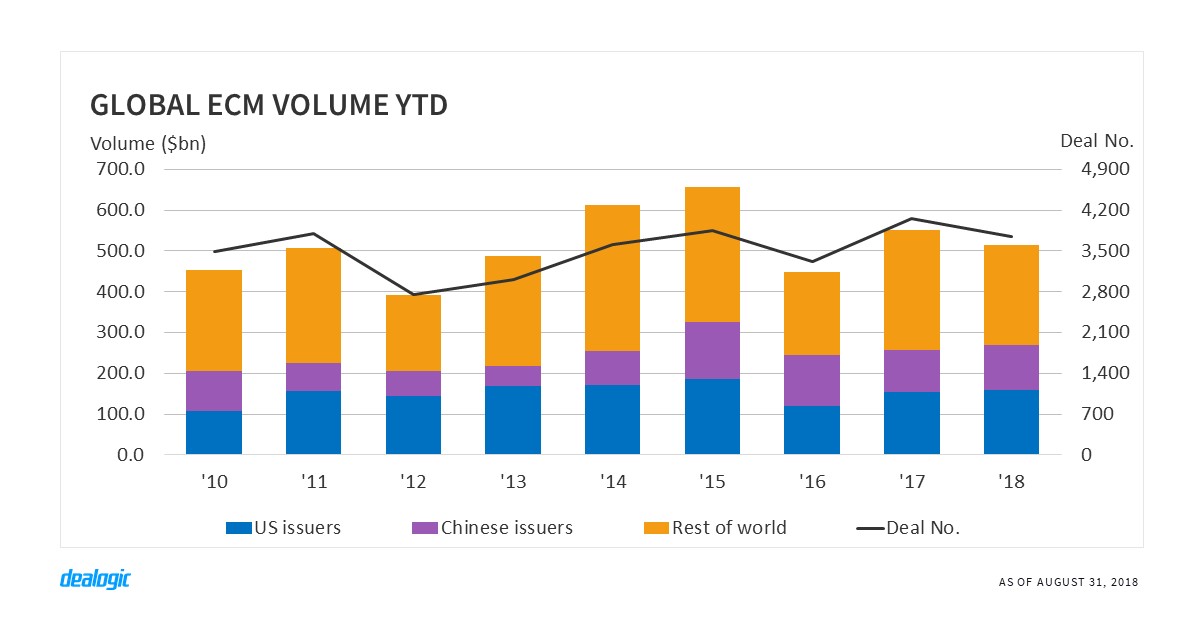

ECM investors appear unfazed by trade tensions between the US and China which have been ongoing since April this year. US ECM volume stands at $159.5bn via 676 deals this YTD, which is slightly higher than the $155.3bn raised via 663 deals last YTD. Chinese ECM follows a similar trend, with issuance reaching $110.3bn via 398 deals so far this year, also slightly higher than the $103.0bn via 646 deals recorded in 2017 YTD.

In 2010, China overtook Japan to become the second-largest economy in the world, and ECM issuance from Chinese companies also jumped to second place that same year. Since then, the US and China have been the top two countries for ECM issuance year after year. In 2018 YTD, the combined volume from both countries has reached $269.8bn, and accounts for 52.4% of the global market. This is higher than the average market share of 47.4% between 2010 YTD and 2017 YTD.

Tech remains the firm favorite

Though the US government is targeting Chinese tech companies, that hasn’t stopped investors from investing in the sector this year. Chinese tech firms have seen record YTD volume of $28.3bn from 80 deals, of which $5.5bn was directly raised on US stock exchanges.

In the US, technology also tops all industries with $40.3bn via 119 deals. This is the second-highest YTD volume on record after $69.2bn via 283 deals during the dot-com bubble in 2000 YTD.

So far this year, 7 out of the top 10 technology deals have been from either the US or China. Tencent Holding’s $9.8bn accelerated bookbuild in March, is the largest issue from the sector, and the largest ECM deal globally in 2018 YTD.

There is still a healthy amount of US and Chinese tech issuance expected to come to market. The most notable ones include a $4.0bn offering for Meituan Dianping which is expected to price on September 13, 2018; and a rumored $3.0bn listing for top bitcoin mining company, Bitmain, on the Hong Kong Stock Exchange.

– Written by Andy Ye

Data source: Dealogic, as of August 31, 2018

Contact us for the underlying data, or learn more about the powerful Dealogic platform.