Biotech (Footnote 1) IPOs in the US surpass 2018 YTD

The highly-anticipated Uber IPO might have stolen the spotlight for now, however, the biotech sector is still going strong. Due to the large number of SPAC IPOs the finance industry dominates the US ECM IPO activity this year with a 35% share of IPOs, closely followed by healthcare with 31%. Biotech accounts for 77% of this.

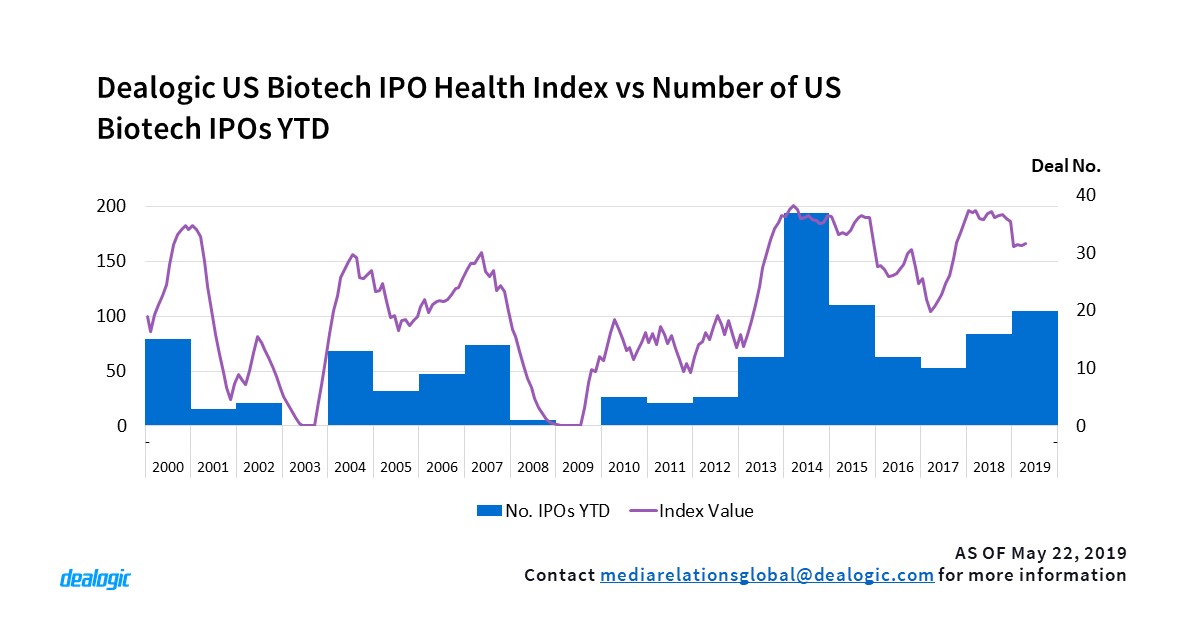

The start of 2019 brought about an unprecedented 35-day long government shutdown that lead to an uncertain road which resulted in the slowdown of US IPO issuance. The Dealogic US Biotech IPO Health Index fell from the near record highs as seen in 2018 at the start of 2019, but still remained at historically high levels and has since started to gradually tick up again. Despite this moderate start, US IPOs for the biotech sector have surpassed 2018 YTD’s volume by 15% and deal number by 25% ($1.9bn raised via 20 IPOs in 2019 YTD compared to $1.7bn via 16 IPOs in 2018 YTD).

The largest biotech IPO in the US region has been Gossamer Bio’s IPO so far, raising a total of $317m. The IPO was priced in February 2019 and its stock opened 12% above its offering price and continued to steadily rise. It was recently trading 29% above its offering price.

SVB Leerink tops the ranking again

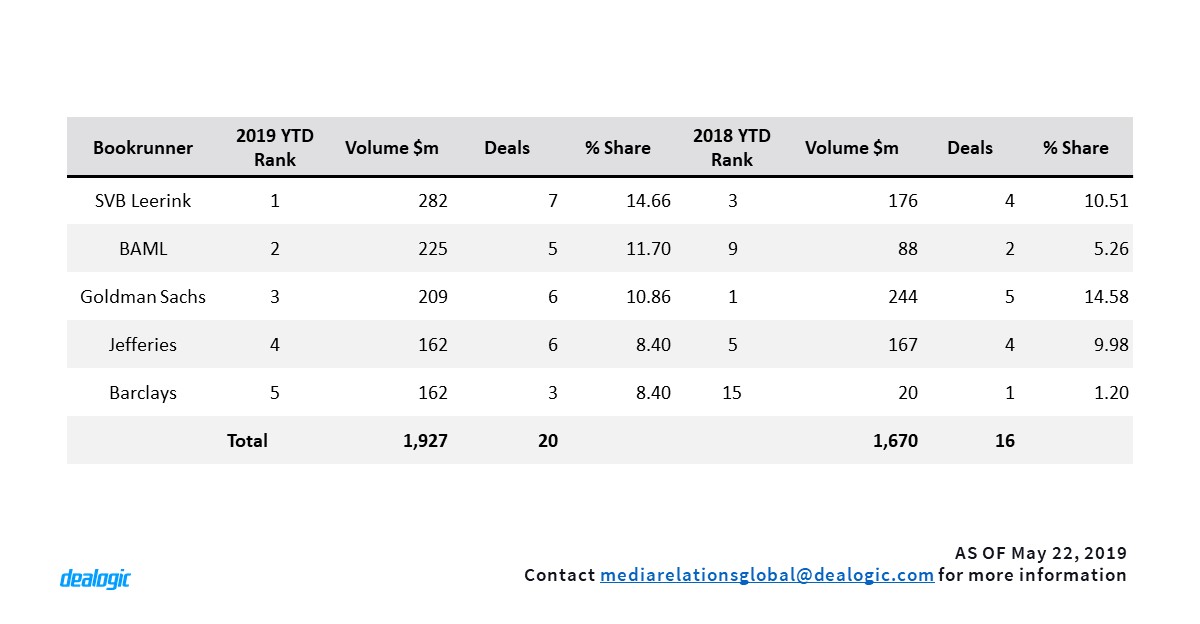

SVB Leerink ranks as the top bookrunner for biotech sector in 2019 YTD, the same position it held in 2018 YTD but with an increase in market share from 10.5% to 14.7%. BAML moved up 7 places to enter the top 5 at second while Barclays has soared up 10 places for this YTD ranking, ascending from 15th to 5th place.

1Biotech consists of Drugs/Pharmaceuticals and Biomed/Genetics sectors

– Written by Bernadett Füziné Herzog & Dóra Deményi

Data source: Dealogic, as of May 22, 2019