Recovery since the Dot-Com Bubble

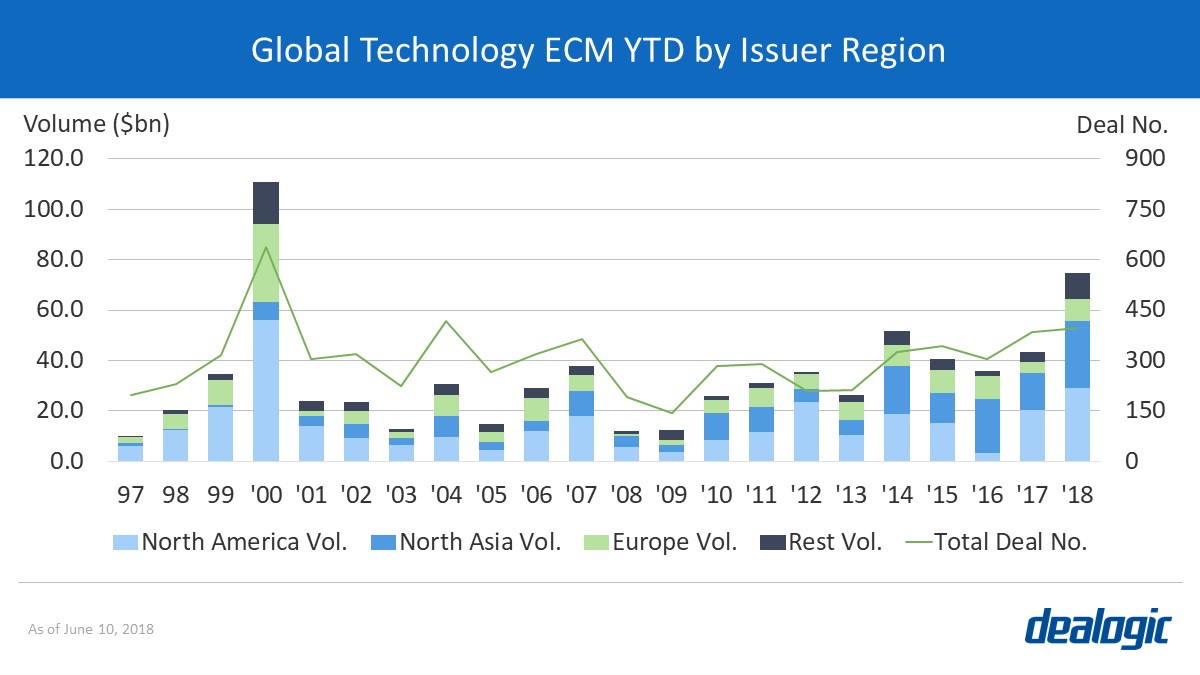

The US has seen a relatively better recovery compared to other countries since the Dot-Com Bubble; American technology companies reached $28.2bn via 81 ECM deals in 2018 YTD, compared to $54.3bn via 195 deals in 2000 YTD. Meanwhile, some other countries are still struggling to get back to half of their 2000 highs.

European tech companies have seen a slower recovery. They had a total of $31.1bn via 218 deals in 2000 YTD, more than three times the volume in 2018 YTD—just $9.0bn via 99 deals. Japan also experienced the same slow recovery, with $5.0bn via 25 deals so far this year compared to $12.3bn via 44 deals back in 2000 YTD.

The rising star for global tech

While most countries are still trying to recover to previous highs, tech issuers from North Asia have rapidly expanded their market presence. Back in 2000 YTD, they issued only $7.1bn via 114 deals—compared to $26.6bn via 106 deals in 2018 YTD. China has been a particular source of growth. Historically, US semiconductors have been the top ECM issuer for almost every year until 2014, when Chinese semiconductors took over the top spot. They have stayed on top every year since then.

North Asia’s volume is now on par with the total issuance from North American companies so far this year ($28.9bn via 92 deals). Combined, the two regions make up 74.5% of the total global tech ECM volume in 2018 YTD.

The rivalry of exchanges

US stock exchanges have been the dominant place for global tech companies. Since 2000, half of all tech ECM volume happened on US exchanges. While old rivals from Japan and Europe have failed to challenge their dominance, new stock exchanges in China and Hong Kong are finding success. Shanghai, Shenzhen, and Hong Kong hosted a combined $20.6bn via 57 ECM deals in 2018 YTD, and they are positioned to keep domestic companies local instead of listing overseas.

No matter if tech issuers choose to list in the US or elsewhere, US banks continue to serve their needs. In 2018 YTD, Morgan Stanley ranked number one in the global tech ECM volume rankings ($12.2bn via 59 deals), followed by Goldman Sachs ($9.3bn via 44 deals) and Bank of America Merrill Lynch ($7.3bn via 22 deals).

– Written by Andy Ye

Data source: Dealogic, as of June 10, 2018

Contact us for the underlying data, or learn more about the powerful Dealogic platform.