Private equity eating into food & beverage industry

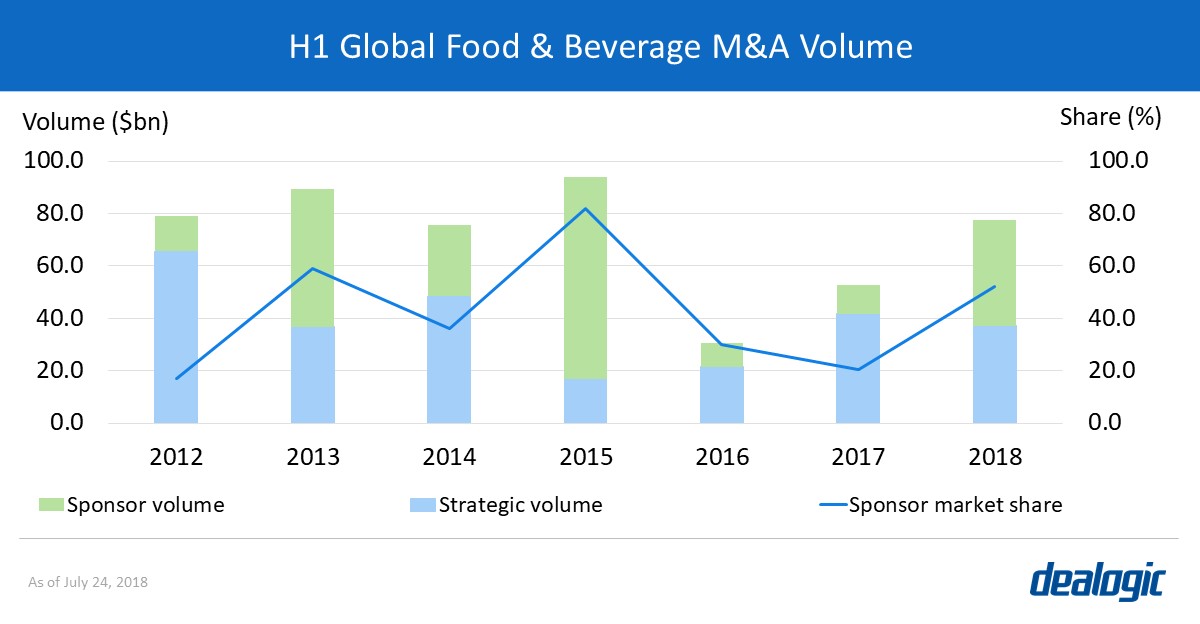

The food & beverage sector has witnessed an increase in sponsor activity this year, after a relatively muted period since H1 2015 which was boosted by the $62.6bn HJ Heinz/Kraft Foods Group mega deal. Sponsor-related deal volume in H1 2018 jumped to $40.2bn and accounted for a 52.0% market share—up from $10.8bn and a 20.5% share in H1 2017. Unsurprisingly, US-targeted sponsor deals have been the driving force in the sector ($36.1bn from 24 deals), but Chinese food & beverage companies are also becoming more attractive, with volume reaching almost $7bn in H1 2018.

Keurig Green Mountain got Dr Peppered up

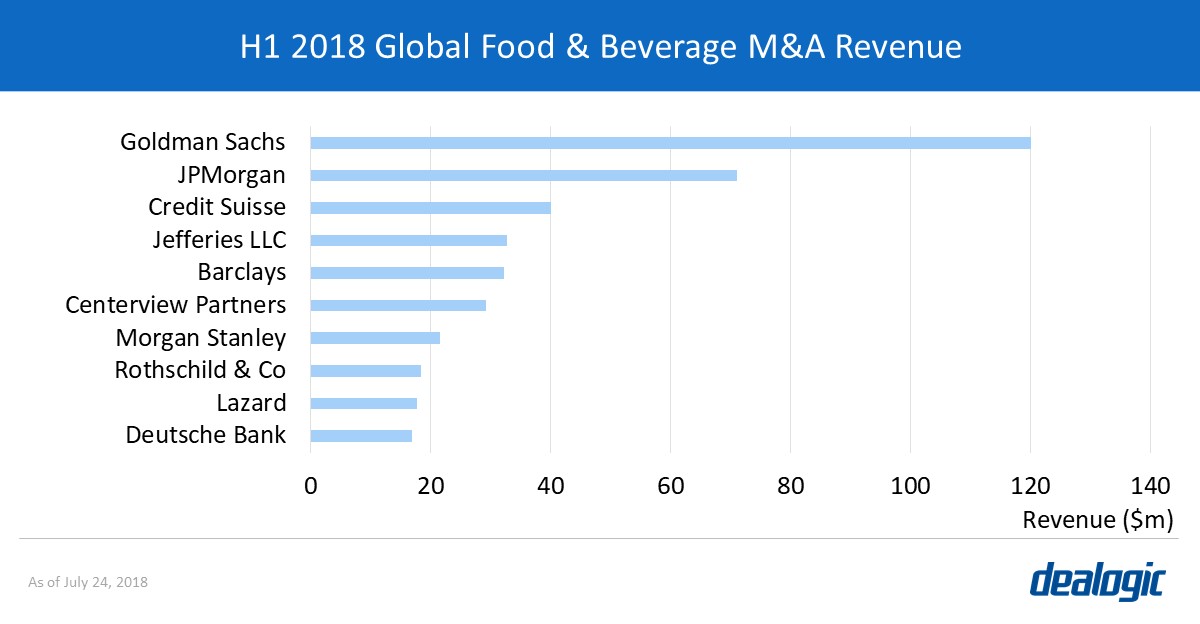

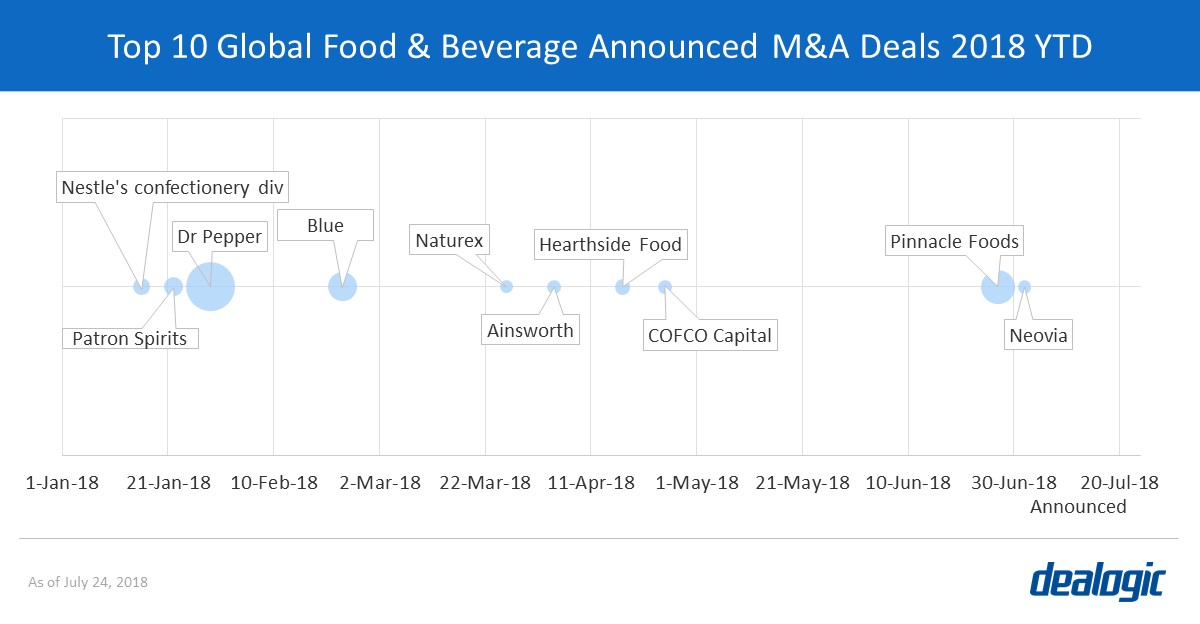

Keurig Green Mountain’s $27.3bn merger with Dr Pepper Snapple Group is the sector’s biggest deal so far this year (and the eighth-largest on record), and was sponsored by BDT Capital. With an EV/EBITDA multiple of 17.3x, North America’s third-largest beverage company was created and KGM’s shareholders were granted the freedom of trading their stock on the NYSE. Buyside advisors were Goldman Sachs, Bank of America Merrill Lynch, BDT & Co, JPMorgan, and boutique firm Centerview Partners. Credit Suisse was the sellside advisor.

– Written by Gábor Rácz

Data source: Dealogic, as of July 24, 2018

Contact us for the underlying data, or learn more about the powerful Dealogic platform.