Reverse Yankees shift into lower gear

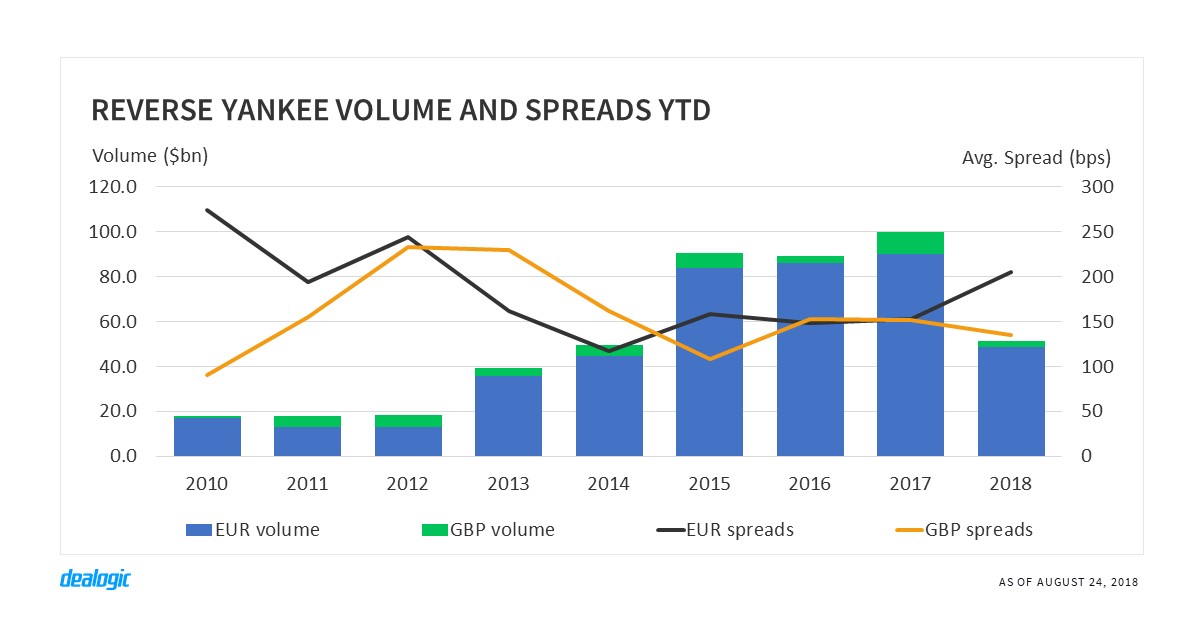

The reverse Yankee bond market was set on a bullish trajectory in 2015, after the European Central Bank implemented its asset purchase program—issuance in 2015 YTD subsequently jumped 45% year-on-year to $90.7bn, and peaked at $99.8bn last YTD.

Tax reform in the United States has seen the tide turn however, prompting US companies to bring their cash home. The impact has been a 48% year-on-year volume drop in the reverse Yankee DCM market so far this year to $51.4bn, marking the lowest YTD level in 4 years. Deal activity of 69 deals is also at a 3-year low, and down 43% year-on-year.

Sterling-denominated spreads tighten

In the midst of declining activity, the reverse Yankee market has shown a clear preference towards euro-denominated issuance over sterling-denominated deals. Spreads on euro-denominated reverse Yankees have reached a 6-year high of 205.79bps in 2018 YTD (244.48bps in 2012 YTD), in spite of their average maturity of 6.6 years being the shortest since 2011 YTD (5.6 years).

Spreads on sterling-denominated reverse Yankees however, have tightened to 135.16bps—a 3-year low (108.25bps in 2015 YTD) and in line with an average maturity of 6.7 years, the shortest since 2006 YTD (4.9 years).

FIG versus corporate issuance

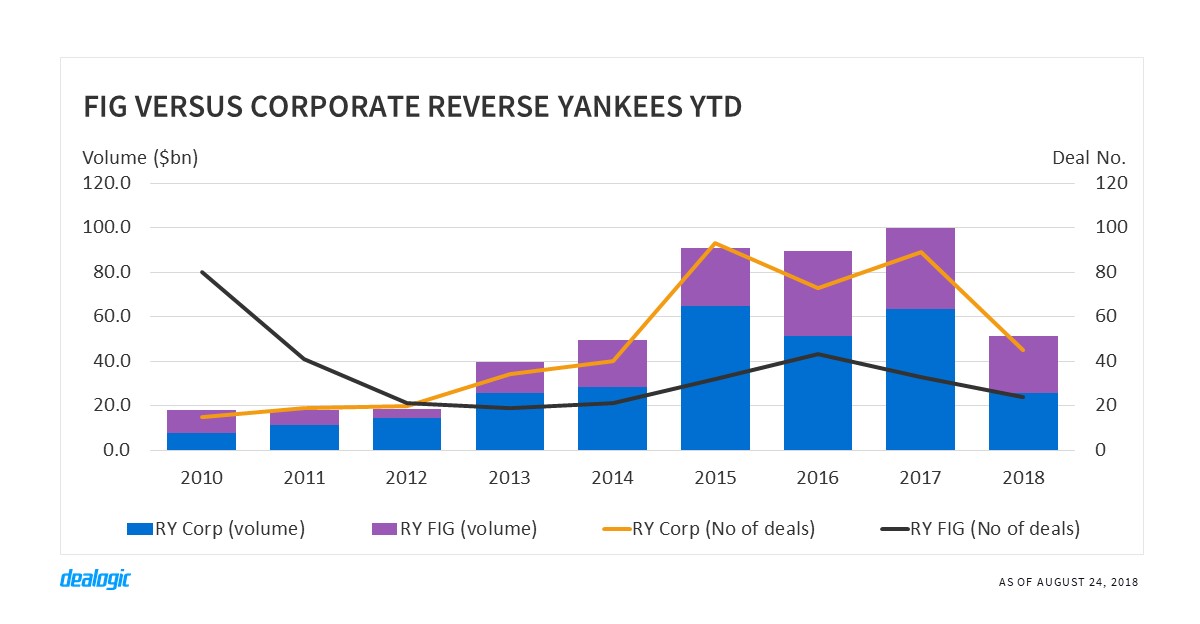

Both FIGs and corporates have cut back on their reverse Yankee issuance significantly this year. While FIG reverse Yankee volume has dropped 28% year-on-year to $26.0bn in 2018 YTD, corporates have taken even more dramatic measures, with issued volume plummeting by 60% to $25.4bn over the same period—the lowest YTD level seen since 2012 ($14.2bn).

The biggest declines have been in the healthcare, technology, and food & beverage sectors, which are down 79%, 62%, and 48% year-on-year to $3.3bn, $1.9bn, and $629m, respectively.

Despite muted issuance in the reverse Yankee bond market, the rest of the year may yet see an uptick in activity.

– Written by Gergely Szűcs

Data source: Dealogic, as of August 24, 2018

Contact us for the underlying data, or learn more about the powerful Dealogic platform.