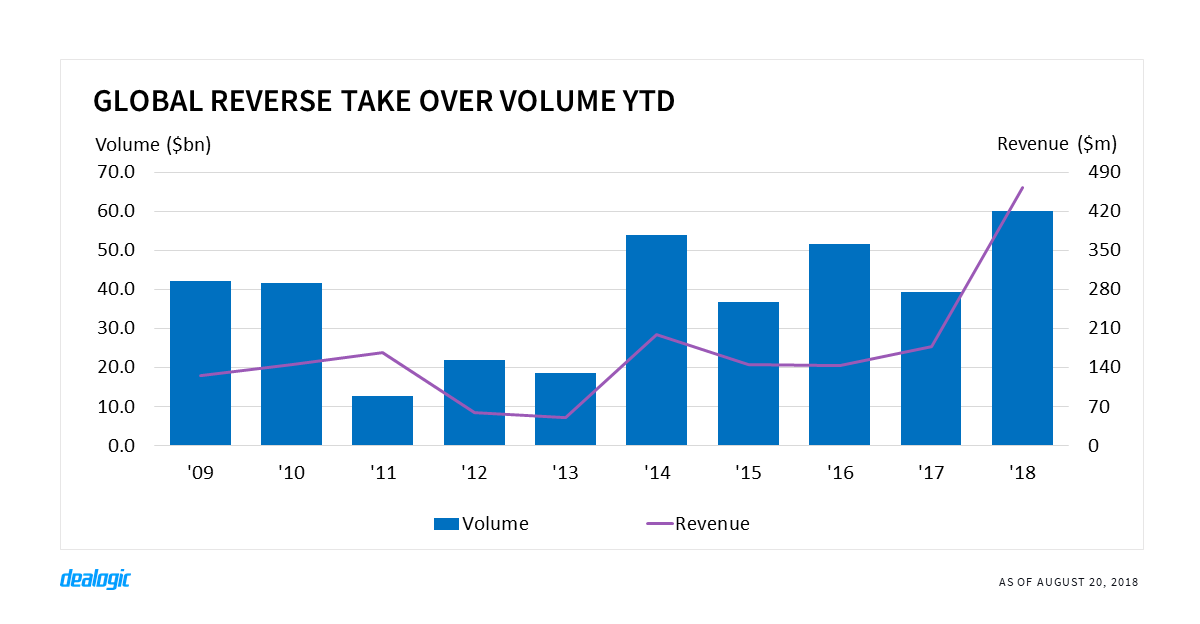

Reverse takeovers at a 10-year high

Following a 30% dip in year-on-year volume in 2017 YTD, reverse takeovers have soared to $60.1bn this year—the highest YTD level since the financial crisis ($61.3bn in 2008), and up 53% from last year ($39.4bn in 2017 YTD). Unexpected sectors and countries have driven volume, with the biggest deals this year being Melrose Industries’ acquisition of GKN for $12.1bn in the United Kingdom, Bharti Infratel’s $6.5bn offer for Indus Towers in India, and Pebblebrook Hotel Trust’s $5.1bn bid for LaSalle Hotel Properties in the US.

As such, reverse takeovers have generated $463m in revenue so far this year, a record YTD level that has eclipsed the 2014 figure ($200m).

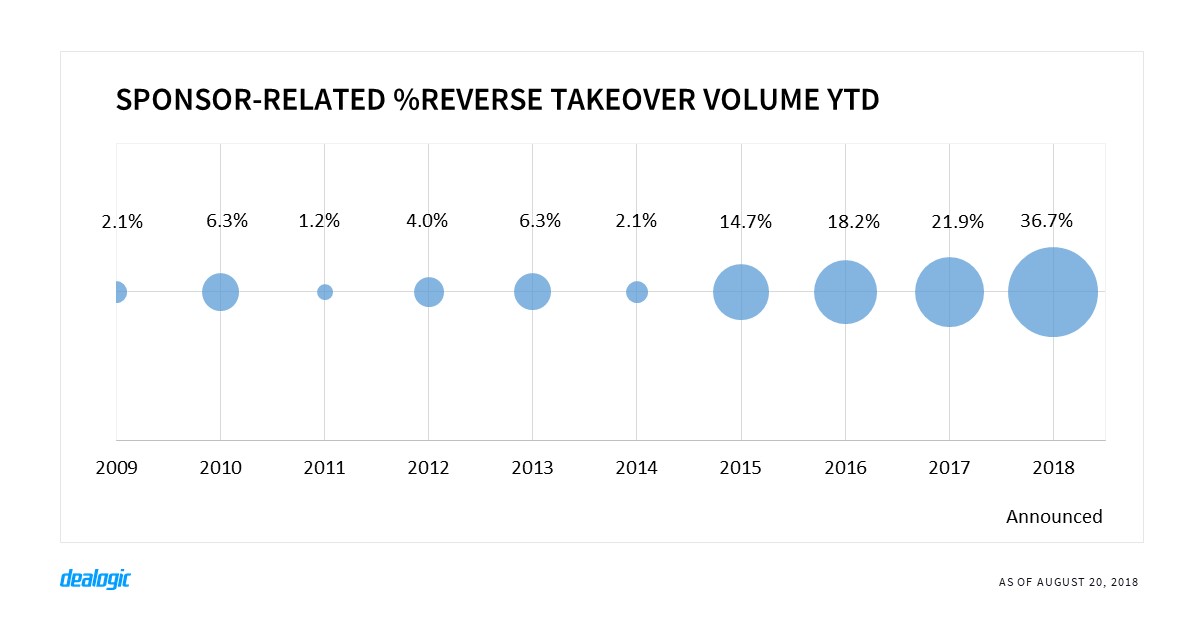

Sponsors on the rise

Since 2015, financial sponsors have become increasingly involved in reverse takeovers, and have provided a huge boost this year—accounting for a record 36.7% of volume. Deals such as the TPG-led $3.2bn acquisition of EnerVest have contributed to the volume increase this year.

– Written by Bálint Bencsik

Data source: Dealogic, as of August 20, 2018

Contact us for the underlying data, or learn more about the powerful Dealogic platform.