June 6, 2017

Written by Chunshek Chan and Andrew Philbey, Dealogic Research

Qatar’s sovereign wealth fund invests far from home

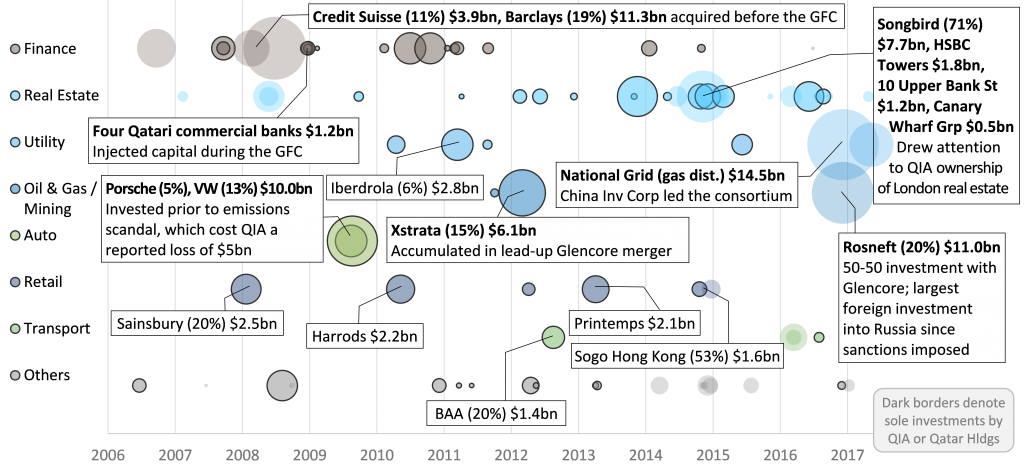

On June 5 2017, seven countries announced the severing of their diplomatic ties with Qatar.* The small but wealthy nation now faces an uphill battle to restore relations with its neighbors even as it continues to acquire assets around the world. Here is a look at Dealogic data on past M&A investments and recent public equity holdings by the Qatar Investment Authority (QIA), the nation’s sovereign wealth fund, and its 100% subsidiary Qatar Holding.**

*The countries include Bahrain, Saudi Arabia, United Arab Emirates, Egypt, Yemen, Libya, and the Maldives.

**M&A deal values include amounts contributed by co-investors. Market values for holdings data are as of the last report date of the holding.

***Stake % and market value reflect the propotional holding by QIA via a 50-50 jointly owned vehicle with Glencore.

Data source: Dealogic, as of June 5, 2017