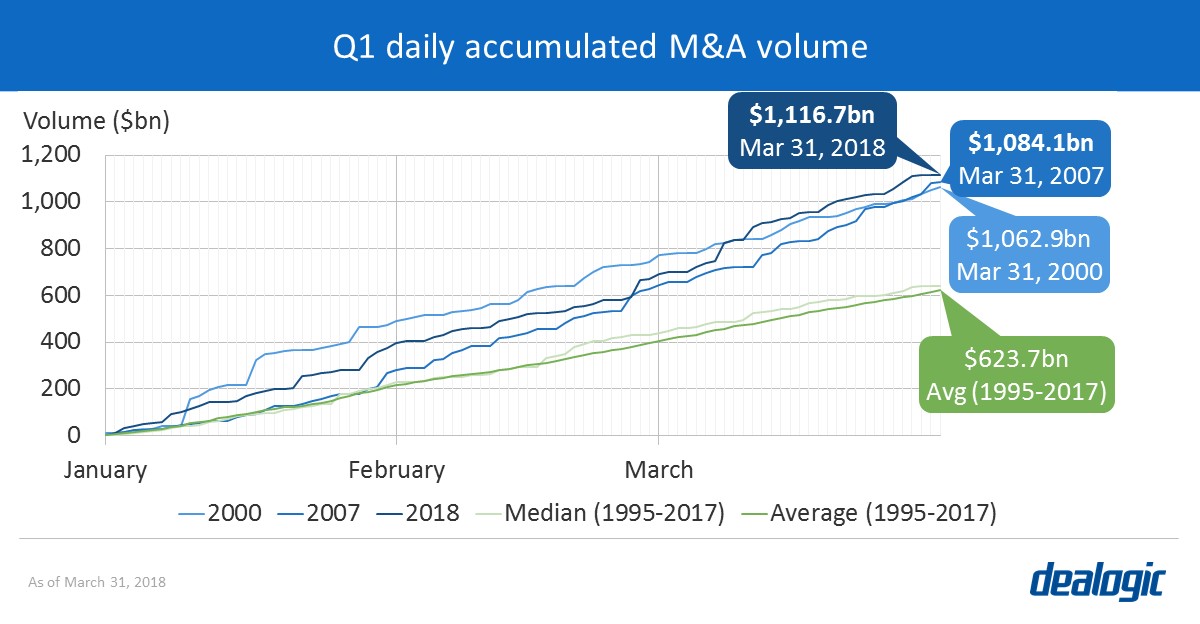

Fastest start on record

On the back of the strong momentum from late 2017, Q1 2018 global announced M&A volume reached $1.12tr. This is the fastest Q1 ever, surpassing the previous two record years: 2007 ($1.08tr) and 2000 ($1.06tr). It was also significantly above the 23-year average Q1 volume ($0.62tr).

Deal size balloons as global valuation plateaus

The global median EV/EBITDA multiple reached 14.1x in Q1 2018, slightly below 14.3x in FY 2017 but still hovered at historic highs due to lofty valuations for acquisition targets in Asia Pacific. Curiously, while deal multiples showed signs of retraction in the Americas and EMEA, average deal sizes jumped to all-time highs in both regions. Global average deal size reached $274m, the highest on record.

China outbound M&A falls off a cliff

Increased protectionism from the US and the EU, as well as pressure from Beijing to curb heedless foreign acquisitions, both contributed to the worst start to the year for China outbound M&A since 2013. With only $13.7bn in announced outbound M&A volume in Q1 2018, the focus has turned to domestic deals, which hit a new Q1 record of $110.6bn.

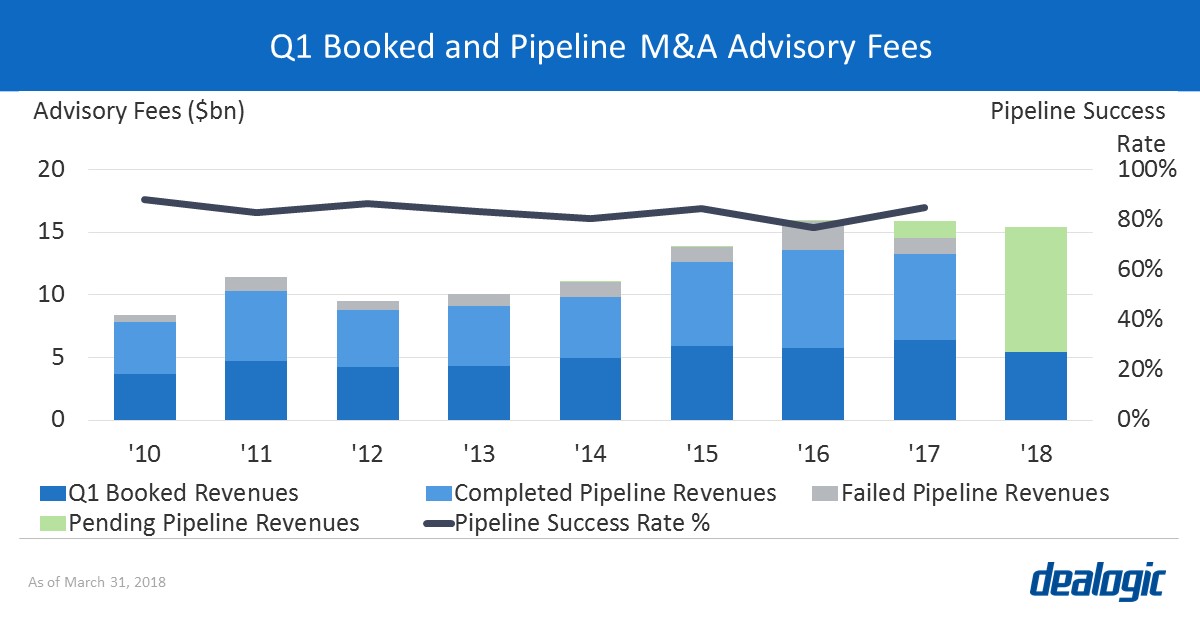

Small pullback on booked advisory fees with promising pipeline

Global investment banks booked an estimated $5.4bn in M&A advisory fees during Q1 2018, dropping by 14% year-on-year. Despite that, dealmakers are eyeing $10.0bn in fees from announced deals still pending completion – the second strongest M&A fee pipeline at the end of Q1 on record (M&A fee pipeline at the end of Q1 2016: $10.2bn with a final success rate of 77%). The expected announcements of such megadeals as Viacom/CBS, Nissan/Renault, and Wal-Mart/Humana could continue to fuel the advisory fee pool as we head into Q2.

Data source: Dealogic, as of April 1, 2018