Jumbo loans hide timid activity

While global loan volume crossed the $1tr mark ($1.03tr) in Q1, jumbo loans ($1bn+) accounted for 64.2% of the total (the highest Q1 share on record), with the likes of Axa, Keurig Green, and PRPC Refinery tapping the market for new money via jumbo facilities. Jumbo volume masked a 29% dip in deal activity from Q1 2017, which was characterized by record volume and deal activity on the back of refinancing levels, particularly for leveraged loans.

While refinancing continues to be the main narrative across geographies, strong investor demand and falling margins for leveraged loans has further grounded a borrower’s market. Despite a lukewarm start to the year, a healthy new M&A pipeline is also likely to bolster both volume and revenue.

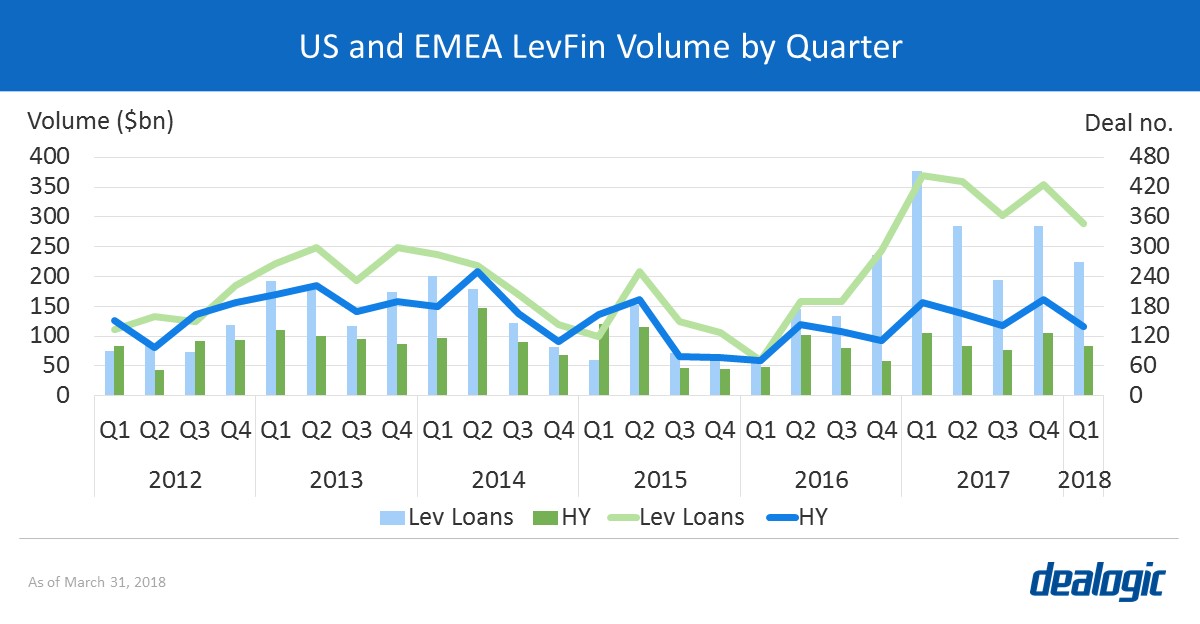

Leveraged Finance: A tale of two markets

Across the US and EMEA, both institutional loans and high-yield bonds saw a drop in Q1 volume. Institutional loans totaled $224.3.5bn and was the slowest quarter since Q3 2017; while high-yield bonds worth $81.8bn was the lowest quarterly level since Q3 2017.

New LevFin issuance however, climbed to a record Q1 level of $80.4bn. Since Q2 2017, Europe has been increasing its share of new money, and in Q1 2018 accounted for 37.2% of new LevFin deals, the highest quarterly share on record.

Looking ahead, the tech sector, which saw Q1 volume of $34.9bn (contributed by a $7.1bn facility for SS&C), is also likely to dominate future refinancing opportunities, with a total of $47.5bn worth of outstanding debt due by 2022.

Leveraged finance new issue is a tale of two markets so far in 2018. Floating rate loan issuers have seen massive demand resulting in heavily oversubscribed books, compressed pricing and increases in tranche sizes. The CLO pipeline remains full and SMAs continue to grow as LIBOR rises, making L+175-200 executions frequently possible for the first time in over 10 years. Conversely, the high yield bond market has been more challenged by rising rate increases and the prospect of more rate hikes, resulting in outflows, secondary market volatility, and some higher coupon executions.

Jeff Cohen, Credit Suisse

Global Head of Leveraged Finance Capital Markets

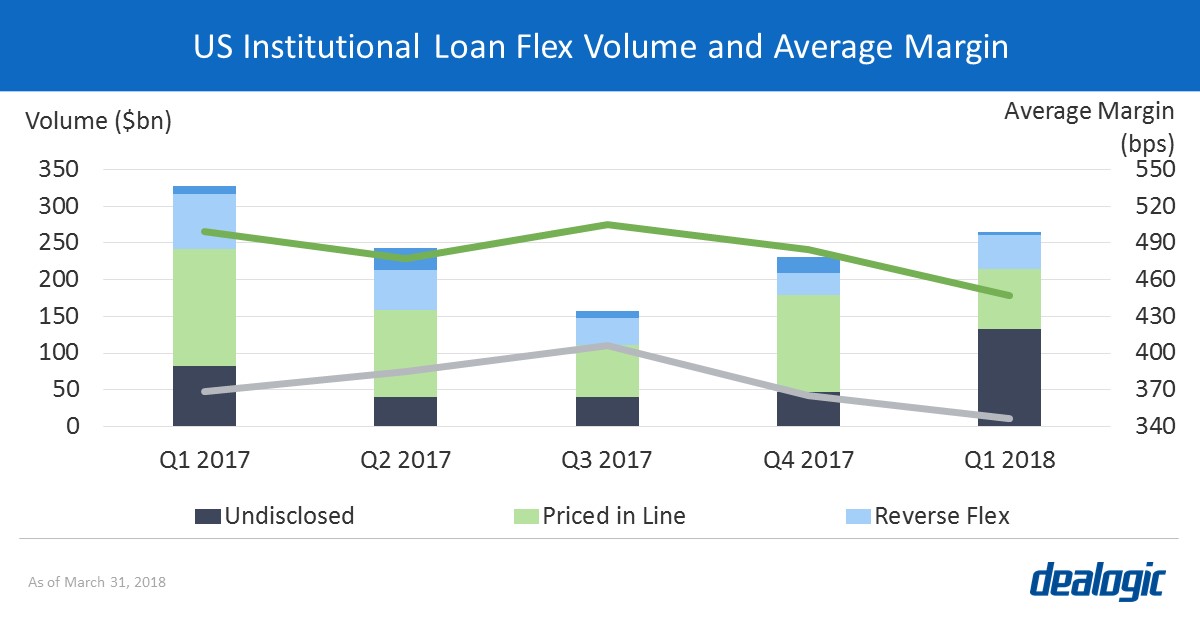

Americas: Reverse flex the new norm

Investor demand for yield continued into 2018, despite a record level of amendments and refinancing in full-year 2017. As such, reverse flex in US institutional loans,1 has grown to account for 25.5% of volume in Q1 2018 ($180.8bn) compared to 22.8% in Q1 2017 ($328.1bn).

Falling margins offer further evidence of a borrower’s market—in Q1 the average pricing on US institutional loans declined by 24bps to 388.5bps from 412.5bps in Q4 2017. The decline is even steeper for M&A-related loans, which saw the average margin steadily decrease to 447bps in Q1 2018 from 505bps in Q3 2017, the lowest since Q1 2014 (437bps).

EMEA: New M&A financing warming up with LBOs a bright spot

Overall EMEA loan volume fell 7% year-on-year to $266.1bn in Q1 2018—this was cushioned by the highest volume of jumbo deals ($204.5bn) since 2008 ($241.9bn).

Despite, a year-on-year drop by 19% for new M&A-related lending, volume quarter-on-quarter was up by $19.3bn. Compared to Q1 2017, the share of non-investment grade loans increased by 18 percentage points to 44.0%. LBO-related issuance climbed to $15.6bn in Q1, the highest Q1 volume since 2008 ($36.7bn). The increase was driven by food & beverage loans, led by the largest LBO of the quarter—a $5.8bn funding for KKR’s buyout of Unilever’s spreads business.

The leverage loan market has started 2018 with very similar enthusiasm to 2017 from all the constituent parties. However, it seems unlikely that the same level of supply & demand imbalance will continue at levels that have driven the most advantageous borrower terms ever. We don’t expect a cliff edge to the market and liquidity remains robust but we anticipate investor tolerance may not be as reliable as we have seen to date. However, with new buyout opportunities coming forward, no-one is ready to call the end of the market.

Charlotte Conlan, BNP Paribas

Head of Loans & HY Syndicate

APAC optimism with local banks expanding beyond borders

Following a sluggish start to the year for the APAC (ex-Japan) loans market, the quarter ended with total volume of $99.5bn in Q1, down 8% year-on-year. Volume was driven by project finance related loans, which saw Southeast Asia project funding set a new Q1 record of $14.7bn, and Australia loans climb to the second-highest Q1 level of $4.0bn.

The banking landscape continued to be competitive in the first quarter, where the average margin for US-dollar denominated lending compressed to 191bps from an average of 228bps in full year 2017. As fees dropped, more local banks made an effort to expand their overseas balance sheets. Taiwanese banks have gained market share in the US-dollar market, participating in 14.7% of dollar lending in Q1 2018—increasing their share by 2.4 percentage points year-on-year.

Whilst volumes look slightly down across Asia-Pac in Q1, growth is looking positive for Q2 with M&A, new capital expenditure, and green loans building momentum alongside a large refinancing pipeline.

Phil Lipton, HSBC

Head of Loan Syndications, APAC

Data source: Dealogic, as of April 1, 2018