January record in a volatile quarter

The ECM market kicked off the year with $10.5bn raised globally in the first week alone, with total volume by the end of January standing at $76.7bn—a new record for the month (eclipsing $63.6bn in January 2014).

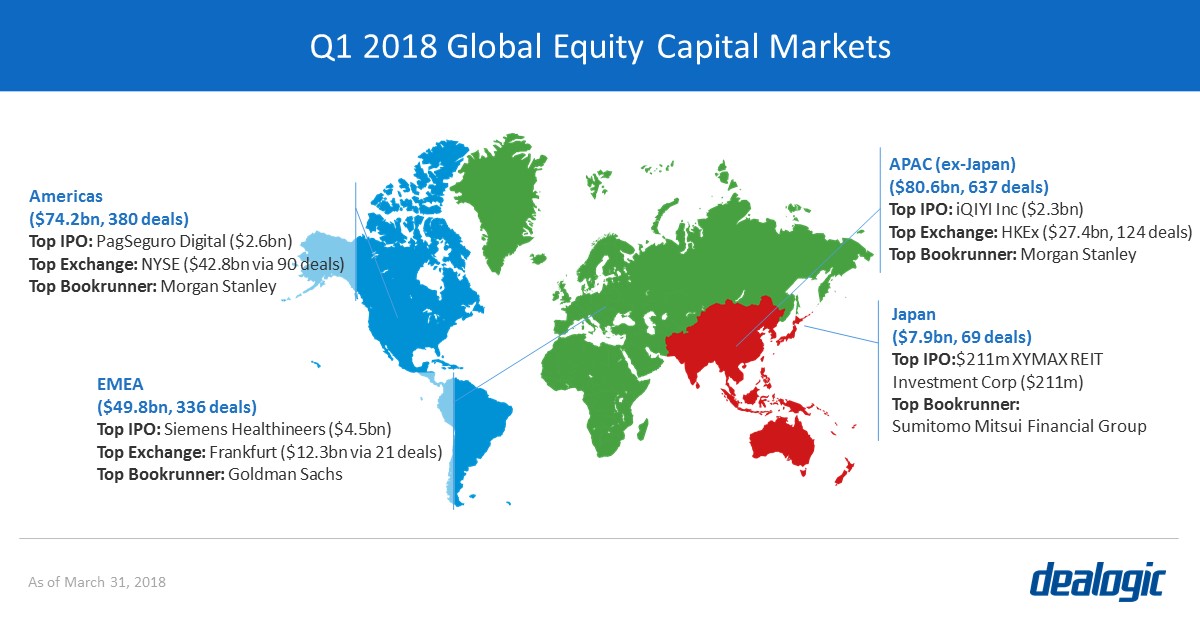

Issuance was then dampened following market volatility in early February which led to a spike in the VIX and the Dow Jones seeing its largest single-day drop of 1,175 points on February 5.1 However with the IPO market in EMEA opening up with the world’s largest IPO of the quarter from Siemens Healthineers in March, and the world’s largest block trade in Tencent later in the month, volume for Q1 recovered to end at $212.5bn—the third-highest Q1 level on record.

APAC’s largest block trade and brisk equity-linked issuance

Chinese issuers continued to dominate ECM (with volume of $55.5bn up 15% year-on-year) in the region, though mostly attributed to companies listed in Hong Kong and the US (accounting for 44.7% and 8.5% of Chinese issuance). In fact, A-share ECM volume and deal activity dropped by roughly 40% and 50% respectively year-on-year, with a tightening in approval processes affecting IPO and private placements. Meanwhile, Australia has shown signs of recovery from its 2-year slump (volume totaled $5.9bn via 165 deals), and India saw 2017 momentum continue with the highest Q1 level for IPOs on record ($2.8bn via 56 deals).

The largest global ECM transaction in Q1 was South African-based Naspers’ $9.8bn sell-down of Chinese tech giant Tencent Holdings on March 22. The deal equated to a 2% stake of Tencent and was priced at a discount of 7.8% to last close. This was also the largest block trade in Asia Pacific on record and the largest accelerated offering worldwide since the US Government’s $20.7bn sell-down of AIG in September 2012.

Equity-linked issuance had a strong showing, with volume of $17.0bn from 51 deals setting a new Q1 record for the region. Volume was driven by a wave of convertibles from Chinese property companies listed in Hong Kong, and an increase in Ashare volume (up 61% year-on-year, with 15 more deals) due to tighter regulations on other capital raising methods such as private placements.2

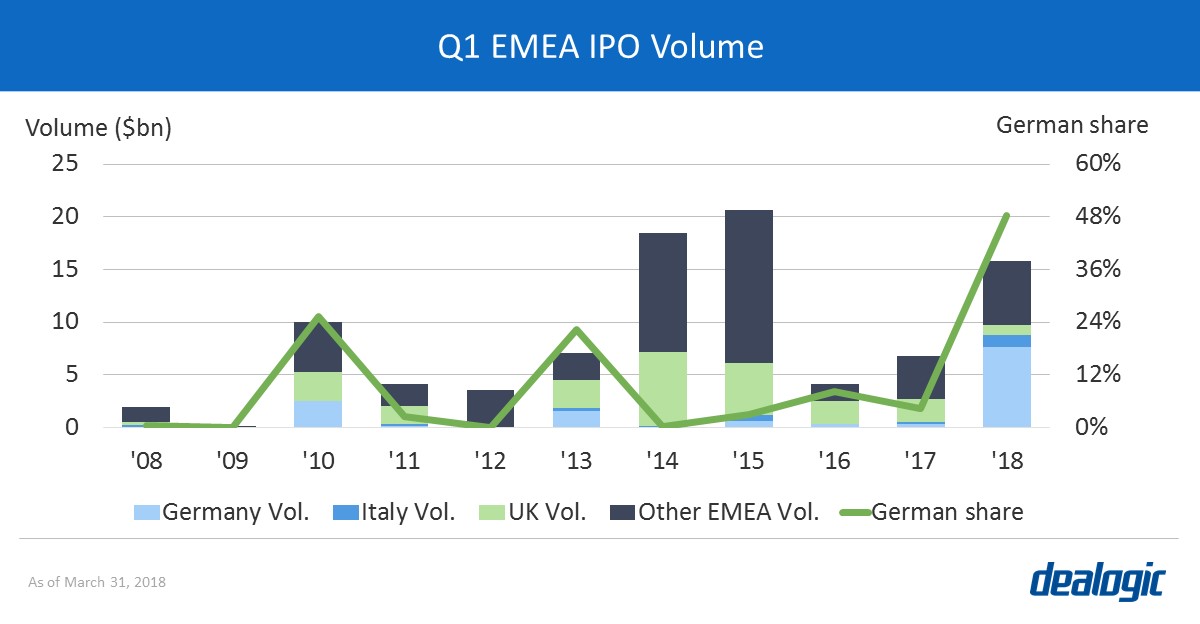

Germany leads EMEA ECM and IPOs hit 3-year high

Although EMEA ECM activity in Q1 2018 was led by the UK (122 deals totaling $8.7bn), Germany boosted volume in the region ($12.6bn via 32 transactions) after pricing the two largest deals of the quarter—Siemens Healthineers’ IPO ($4.5bn) and Covestro’s accelerated offering ($2.2bn)—making it the country’s biggest Q1 for ECM volume since 2000, when German issuers raised $13.2bn via 60 transactions.

Driven by robust economic growth and general optimism in the market, EMEA IPO volume reached $15.8bn from 58 deals in Q1 2018—the highest Q1 level in 3 years ($20.6bn via 81 deals in Q1 2015). Carve-outs were a signficant contributor to IPO issuance in Q1, as EMEA’s top three IPOs were carve-outs—Siemens Healthineers, DWS Group, and Elkem. With their aggregate proceeds totaling $7.0bn they accounted for 44.3% of total IPO volume, the highest Q1 share since 2002, when carve-outs accounted for 46.1%

IPO volume from special purpose acquisition companies (SPACs) in EMEA hit an 8-year high of $1.4bn from seven deals in Q1, and accounted for 8.9% of total IPO volume in the region. Italy alone saw four SPACs come to the market in Q1 2018 for $1.2bn, and ranked second to the US in SPAC IPO volume by nation. The quarter saw Italy’s largest SPAC IPO on record from SPAXS ($746m), also the world’s largest SPAC listing in Q1 2018.

MENA ECM issuance also climbed to a 3-year Q1 high of $1.7bn via 20 deals ($4.3bn via 18 deals in 2015), led by Israel ($1.2bn via 13 deals), UAE ($348m via three deals), and Oman ($72m via one deal). Israel priced not only the largest deal of Q1 2018 in the region and the country’s second-largest ABB ever—Israel Chemicals’ accelerated offering worth $705m—but also led the region in IPO activity (five IPOs raising $271m).

Americas ECM outperforms Q4 2017 as SPACs continue momentum into 2018

Americas ECM issuance totaled $74.2bn via 380 deals in Q1 2018, up 35% on Q4 2017 ($54.8bn via 380 deals). While this was down 9% from Q1 2017 it was still up 51% from the $49.0bn raised in Q1 2016 which was the lowest amount raised in the first quarter since 2009 ($21.5bn).

Following a resurgence of SPAC IPOs in 2017, which saw full year issuance reach a 10-year high of $10.0bn from 34 deals, the momentum showed no sign of slowing in 2018. Volume in Q1 totaled $2.3bn from 11 deals—making it the most active quarter for such deals since before the financial crisis in Q1 2008 (12 deals worth $3.4bn). Financial sponsor involvement in SPAC listings also came to a head in 2017, where more than one-third of IPOs were sponsor-related (12 out of 34 deals), the highest share on record. In Q1 2018, there were two sponsor-backed IPOs – One Madison Corp’s $300m listing backed by Blackstone, and Leo Holding Corp’s $200m offering backed by Lion Capital.

Data source: Dealogic, as of April 1, 2018