A strong quarter, which could have been better

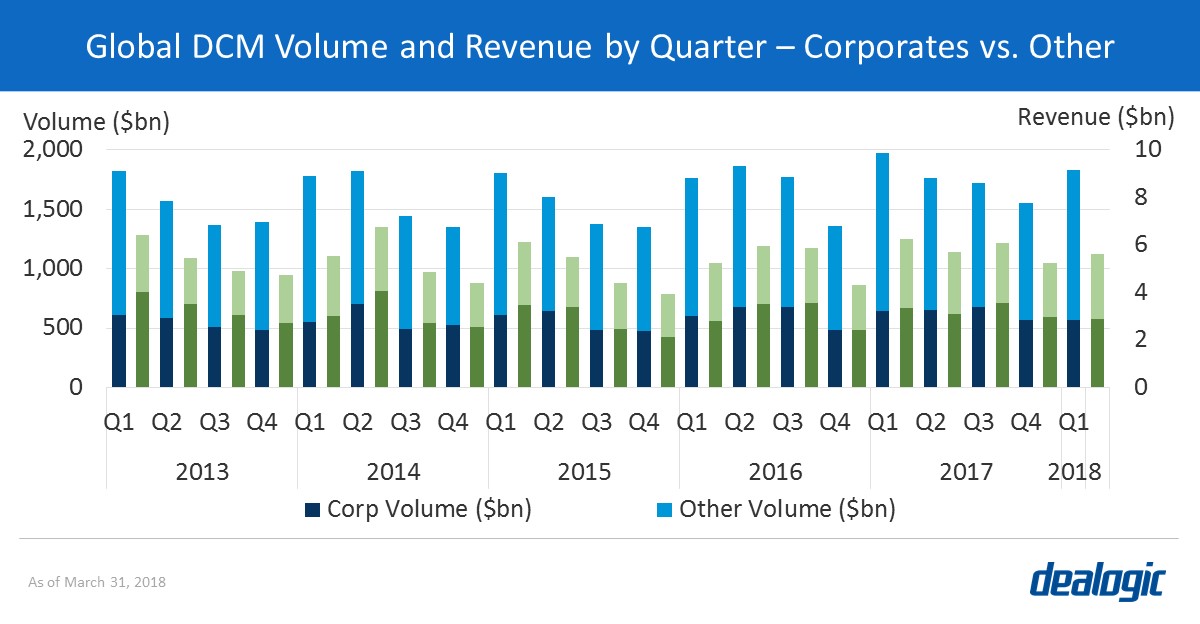

Global DCM markets had a robust start of the year with volume in Q1 totaling $1.89tr from 5,479 deals. This was the second strongest initial quarter since 2013 ($1.98tr issued last year) and the third largest in total for the past 10 years ($2.02tr in Q1 2012). Despite hefty volume, bond activity has been affected by interest rate hikes and instability in stock markets. Deal pricing took sharp swings, with deal flow almost halving in February and at the end of March.

Corporate and financial issuers were mostly affected, as SSA borrowers were not deterred and kept a more consistent pace issuing debt. With budgeting plans for the year to be fulfilled, governments were kept busy this quarter. Spain issued a total of $19.5bn of debt, with Belgium, Sweden, and Italy also surpassing the $10bn mark. In total, developed governments distributed $96.1bn sold by 13 issuers.

Emerging market governments also issued an abundant level of bonds: Argentina, Oman, Egypt, Slovenia, Ecuador, Kenya, Senegal and Ivory Coast, to name a few, sold hefty amounts of paper, taking total issuance to $69.1bn from 27 countries. This follows a strong Q1 2017 ($69.7bn sold by 33 countries)—the two highest quarters on record and only 2 of 3 single quarters to break the $50bn mark. This illustrates the willingness of investors to diversify their portfolios and explore geographical frontier markets (many remote countries have made their debut bonds these last 2 years) as well as virtual ones (the first bond denominated in cryptocurrency Ether was sold at the end of 2017 using blockchain technology).

Corporates slow the pace but remain lucrative

The unstable ground for corporate issuers resulted in the worst start to the year since 2014 ($565.1bn from 1,464 deals). High-grade debt saw the biggest decline, which dropped to $29.0bn from $51.2bn in Q4 2017 and $70.0bn in Q1 2017. Only two mega deals from pharma firms Sanofi (€8bn) and Novartis (€2.25bn) pushed EMEA to a 4-year record and saved the quarter. Medium-grade bonds kept a strong pace ($304.0bn) and non-investment grade saw slight decreases quarter-on-quarter (4%) and from Q1 2017 (17%). Despite the dip in volume, underwriting fees paid by corporates totaled $2.9bn and represented 51.1% of the wallet shared by banks in Q1.

EMEA first quarter issuance at 4-year high despite volatility

Despite market instability and the European Central Bank cutting its Asset Purchase Programme to €30bn per month in January, bond volume in EMEA reached $760.9bn in Q1 2018 (up slightly from $734.1bn in Q1 2017). It was the highest Q1 level since 2014 ($782.9bn).

Among sectors, corporates bounced back with $163.6bn of debt after two previous modest quarters. Sovereign and FIG issuers also had a strong quarter—financial institutions set a 4-year high with $245.0bn. The bank capital market segment, helped by regulatory clarity, took issuance to $33.4bn for subordinated deals, and a record quarterly high of $60.3bn for senior resolution notes*. Clear targets for capital ratios seemed to have had a knock-on effect on the rest of the FIG market: senior bonds totaled $83.1bn, and covered bonds reached $67.9bn (up 15% from $59.2bn raised in Q1 2017).

APAC G3 issuance robust and more banks lead deals

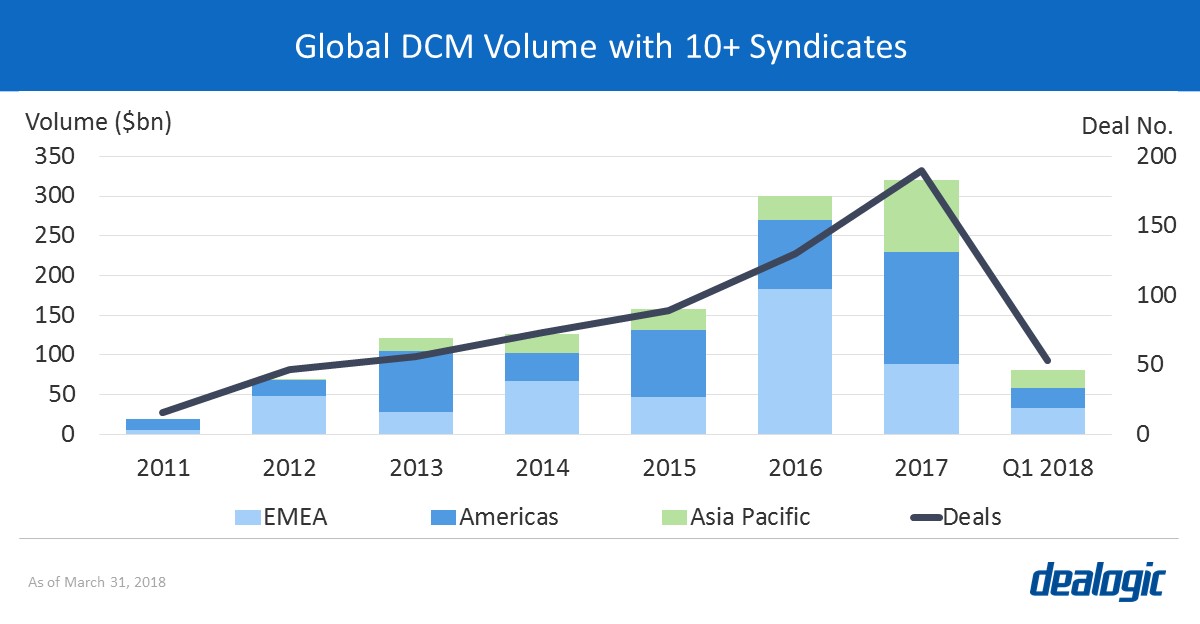

After a record 2017, the G3 issuance boom in APAC (ex-Japan) continued this year despite higher funding costs and political uncertainties for the region. Volume totaled $106.2bn in the first quarter,15% shy of the record quarterly level set in Q1 2017 ($124.8bn). Chinese issuers continued to dominate G3 debt, accounting for a 48.1% market share ($51.1bn via 86 deals), which was down 9% compared to the record $56.1bn sold in Q1 2017. An emerging trend for Chinese G3 deals is for borrowers to engage more banks on their issues—ChemChina hired 18 bookrunners (15 international banks and 3 Chinese banks) on its $6.4bn dual-currency trade in Q1. There was a total of 16 deals in Q1 2018 with 10 or more bookrunners, in line with the numbers registered each quarter in 2017 for the region, and considerably higher than previous years.

Subdued US-marketed DCM but FIG makes a comeback

Despite two mega deals issued in March—a $40bn offering for CVS Health Corp and a $10bn transaction for Anheuser-Busch Inbev—US-marketed DCM reached $837.0bn from 1,893 deals in Q1 2018, declining 10% from $926.5bn issued in Q1 2017. US FIG issuance made a comeback and registered the third strongest quarter on record with $172.3bn from 345 deals ($204.6bn in Q1 2017 and $176.2bn in Q2 2014). Nearly half of the total came from GSIB institutions selling TLAC compliant debt: $67.6bn sold from 22 transactions.

Meanwhile sovereign deals took international LatAm debt issuance to $45.2bn via 46 deals, just 2% lower than the record quarter of $46.2bn issued in Q1 2017. Canadian volume this year was $37.2bn, the lowest quarter in the past 2 years and reflected the general trend in the region.

Data source: Dealogic, as of April 1, 2018