Micro Focus takes a plunge

Earlier this month, UK tech firm Micro Focus International plc issued a sales warning, which subsequently saw its share price plummet by 46% and the departure of its CEO.1

The company had financed its acquisition of Hewlett Packard Enterprise’s software business last year with $5.5bn in leveraged loans. Micro Focus places a spotlight on EMEA leveraged loans which climbed to a record $440.8bn in 2017, up 49.2% from 2016, and also generated a record $2.4bn in fees last year for banks.

Technology a driver for EMEA leveraged loans

The tech sector has been a powerhouse for the leveraged loan market, both volume- and revenue-wise. Total volume from the sector climbed to a record-high of $50.1bn in 2017, which was up 52.5% on 2016. Similarly, tech accounted for 30.4% of fees paid in 2017, also a record share.

Tech loans also increased in size last year, with the average deal for leveraged acquisition loans expanding to $1.0bn, up 67.1% from 2016.

However, activity in 2018 YTD has been subdued with only four completed leveraged loans from the tech sector, totaling $4.1bn. This is a signficant year-on-year drop in both volume (down 56%) and deal flow (down 82%).

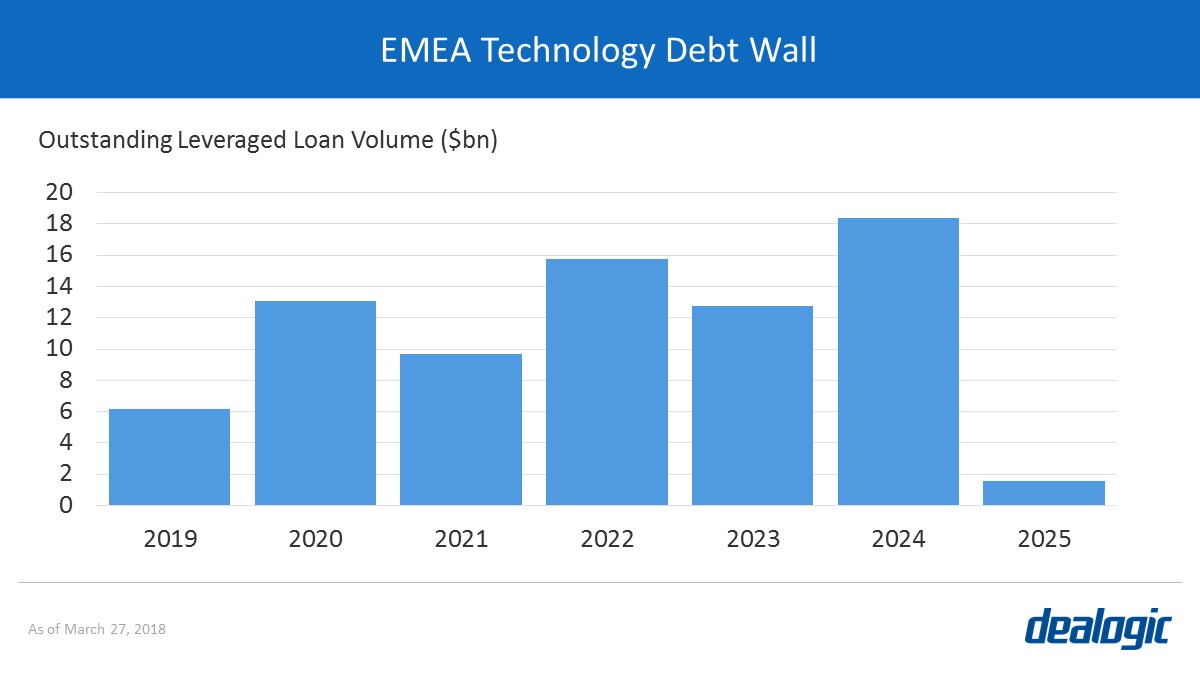

Tech firms face an $80bn debt wall

Outstanding debt from EMEA’s tech sector stands at $80.1bn. The software industry itself has originated 70.0% of total outstanding leveraged loan volume until 2025. The maturity wall will peak in 2024 with a total of $18.4bn coming due, of which $17.4bn of outstanding loans are from the software industry.

Whilst there is a healthy refinancing pipeline and relatively low pricing (Q1 average margin of 380bps), the turmoil faced by Micro Focus could spark wider concerns from investors and regulators and for the region’s leveraged loans market.

– Written by Beata Solti, Dealogic Research

1.Source: www.londonstockexchange.com

Data source: Dealogic, as of March 27, 2018

Contact us for the underlying data, or learn more about the powerful Dealogic platform.