Mega Deal1 Activity Booms

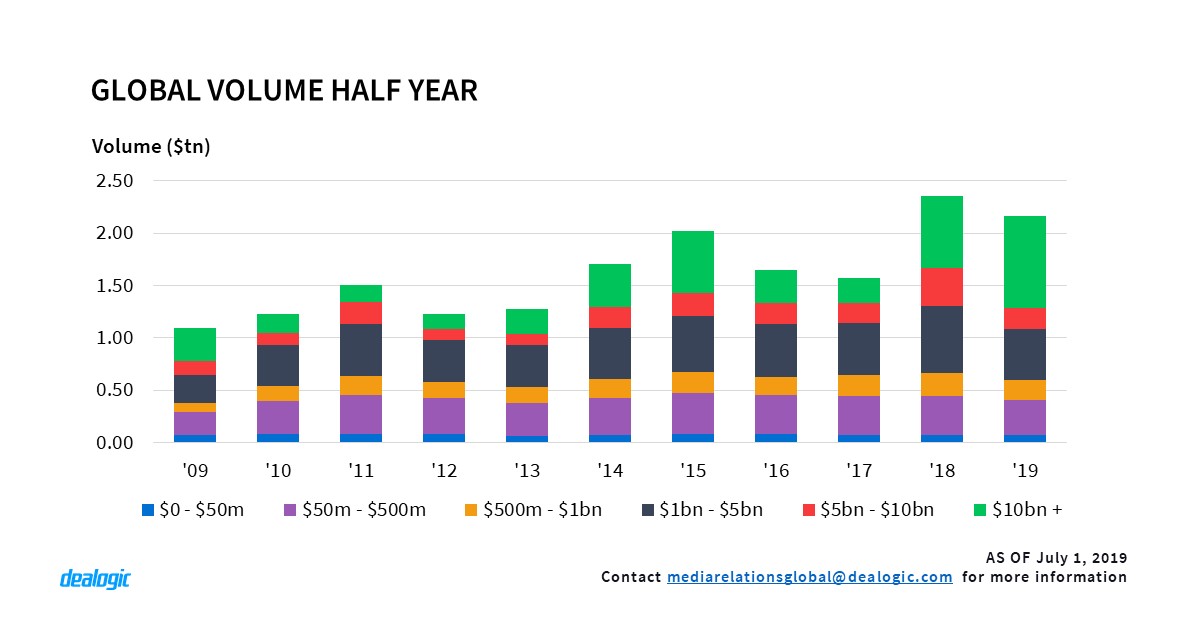

Global H1 2019 M&A volume decreased by 8.3% to $2.16tn, compared to $2.36tn in H1 2018. Despite this fall, 40.6% of this year’s global volume has been made up of mega deals, setting a record high in both volume and deal count for H1. Mega deals, so far this year, have generated $878.9bn via 28 deals, a 26.7% increase from H1 2018, when volume stood at $693.8bn from 27 deals. A contributing factor for the increased market share of mega deals is that H1 2019 has seen a decline in deals between $1bn to $10bn, which made up only 32.0% of the total volume for H1 2019 ($692.0bn) – the lowest H1 volume on record.

Spin-off Deal Volume Spinning Away

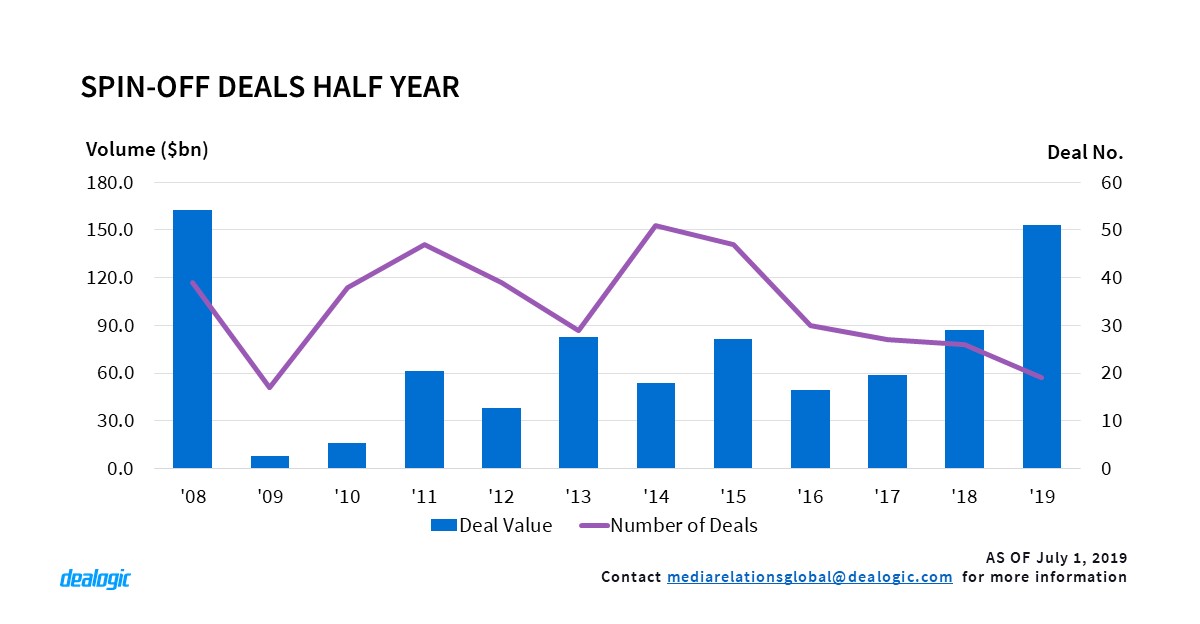

Spin-off volume is at its highest since H1 2008 with $152.9bn announced during H1 2019. This is a 75.9% increase compared to the same period last year ($86.9bn). This year’s boom is largely due to four transactions, including DowDuPont Inc’s divestment of Dow Inc for $55.2bn and Novartis AG’s divestment of Alcon Inc for $31.4bn. These four deals alone accounted for 86.0% of the spin-off volume. Corporate clarity is a big driving force behind these spin-off deals, as companies try to increase shareholder value by having a simplified corporate structure. However, the number of spin-offs is at its lowest since H1 2009 (17 deals) with only 19 deals so far this year.

Sponsors Target Americas; SBO Exits Fall

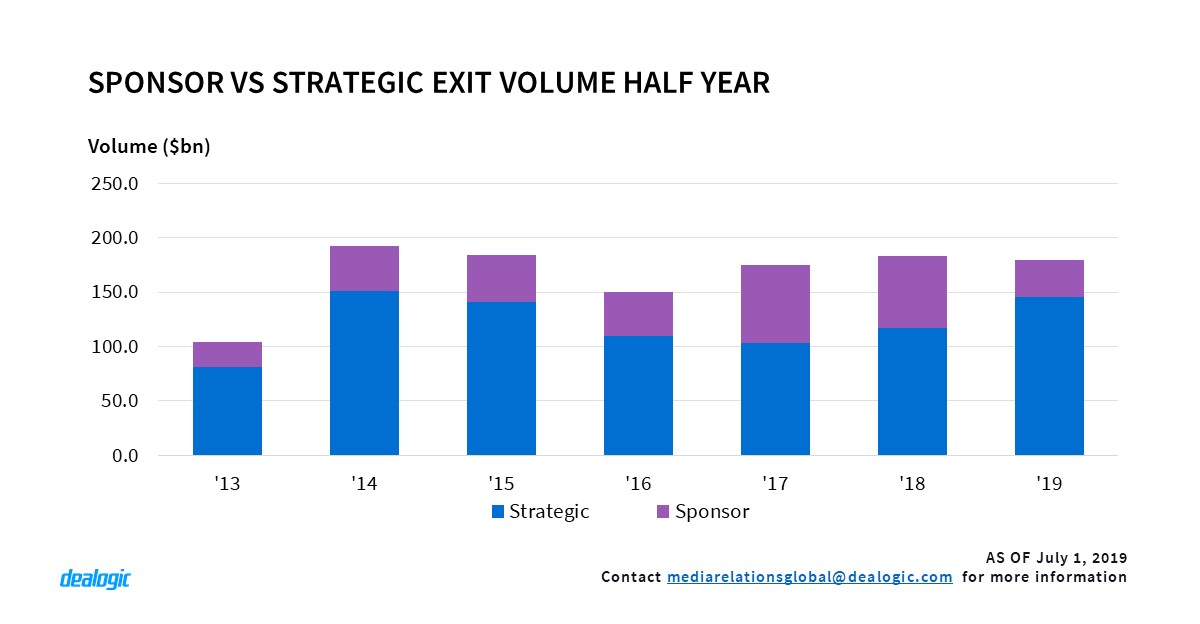

During H1 2019, global sponsor volume reached $403.6bn via 1,172 deals, a year-on-year decrease of 1.3% in volume and 16.2% in deal count. The same trend can also be observed in global sponsor revenue, with H1 revenue reaching $2.05bn, a year-on-year decrease of 16.6%. Despite global sponsor volume and revenue living in the shadow of a highly successful 2018, America-targeted M&A sponsor volume has reached its highest level since 2007, with sponsor involvement totalling $242.8bn across the region. The largest transaction was Fiserv Inc’s $39.4bn acquisition of US-based First Data Corp whereby KKR & Co sold their 39% stake in First Data Corp in the process. The acquisition of First Data Corp also highlighted another H1 trend, that sponsors favoured exits of their investments to strategic buyers rather than to other sponsors via Secondary Buy-Outs (SBO). During H1 2019, sponsor exits to strategic buyers accounted for $144.8bn, the highest volume since 2014 with SBOs accounting for only $33.7bn, the lowest recorded volume since 2013.

US-targeted Activity Booms

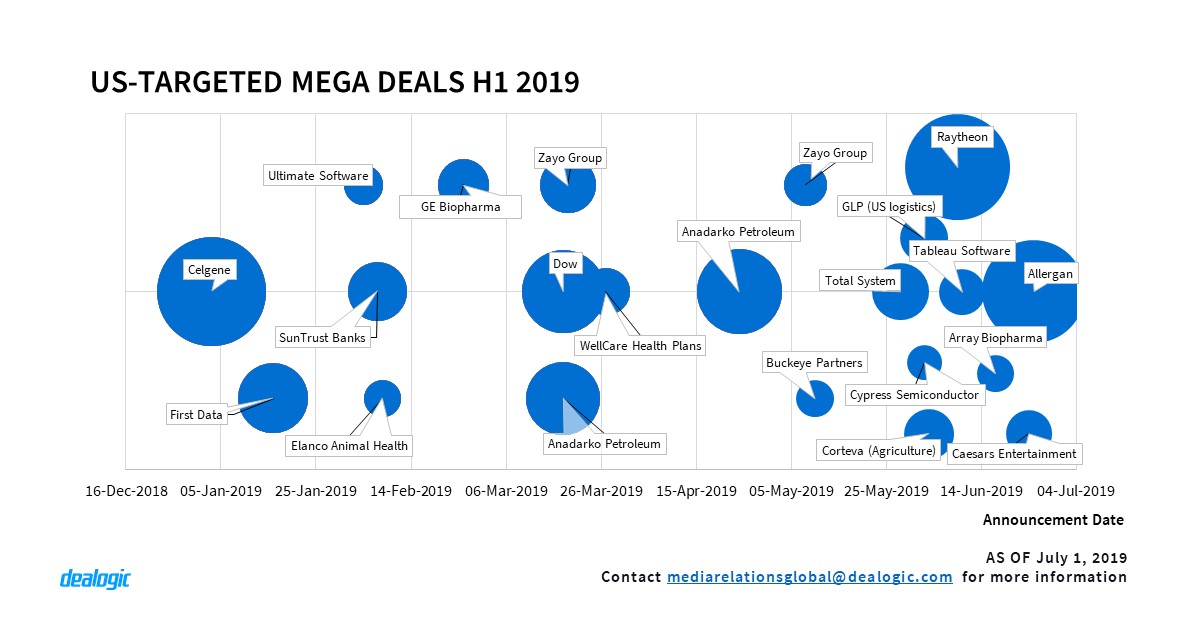

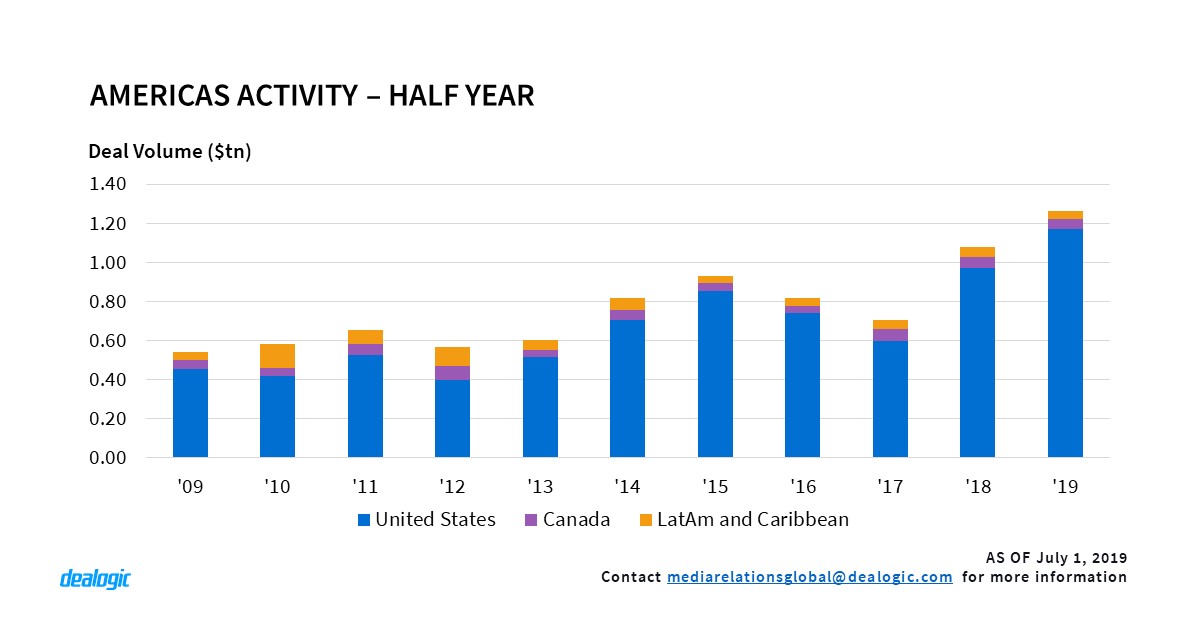

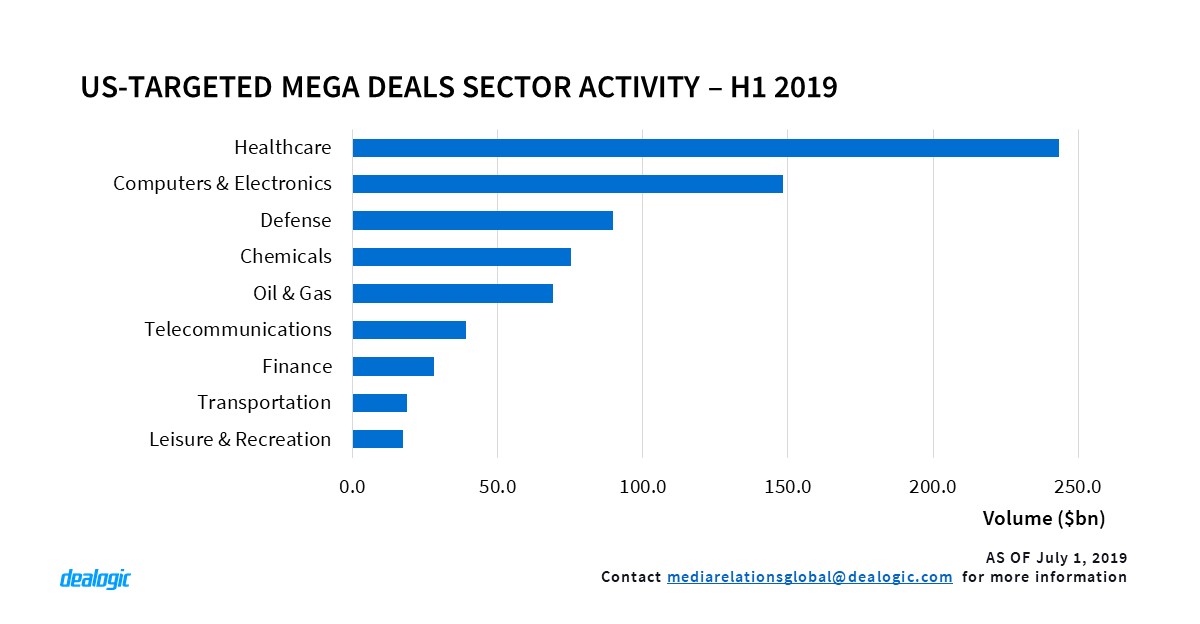

H1 2019 had the highest H1 volume on record for US-targeted transactions with $1.17tn via 4,545 deals, a 20.5% year-on-year increase ($971.5bn in H1 2018). Healthcare was the most targeted US sector during H1 2019, with volume reaching $310.5bn, which was mostly driven by two mega deals, the recently announced $85.0bn offer by Abbvie Inc for Allergan plc, as well as the acquisition of Celgene Corp by Bristol-Myers Squibb Co for $96.8bn. Mega deals, valued at more than $10bn, have formed the backbone of US-targeted M&A during H1 2019 accounting for $729.6bn of all US-targeted volume via 22 deals. Globally there were 28 mega deals accounting for $878.9bn in total volume.

The rest of the Americas runs low

Latin America and Caribbean targeted M&A volume on the other hand declined by 19.2% year-on-year, with only $40.7bn recorded in H1 2019. 49.9% of the deal volume in the region was Brazil-targeted, reaching $20.3bn. However, this was still a 37.9% decline compared with the $32.7bn recorded during H1 2018, even despite the $8.6bn sale of Transportadora Associada de Gas by Petrobras to ENGIE and CSPQ. This decline in market activity is largely due to the delay in the Brazilian Pension Reform. Conversely, Mexico-targeted transactions saw the strongest H1 since 2015, with $4.5bn in announced deal volume.

Canada-targeted M&A volume also had a weak H1 with only $51.6bn in volume recorded, a 7.3% decline compared with the $55.7bn recorded in H1 2018. Canada deal count fell to 428 deals compared with 615 during the same period of 2018, representing a decrease of 30.4%. Even medical cannabis activity declined year-on-year with only $1.7bn in activity during H1 2019, down from $3.6bn in H1 2018. US-targeted companies, however, saw an 860.3% year-on-year increase in medical cannabis activity, with $4.5bn registered this half, the highest on record.

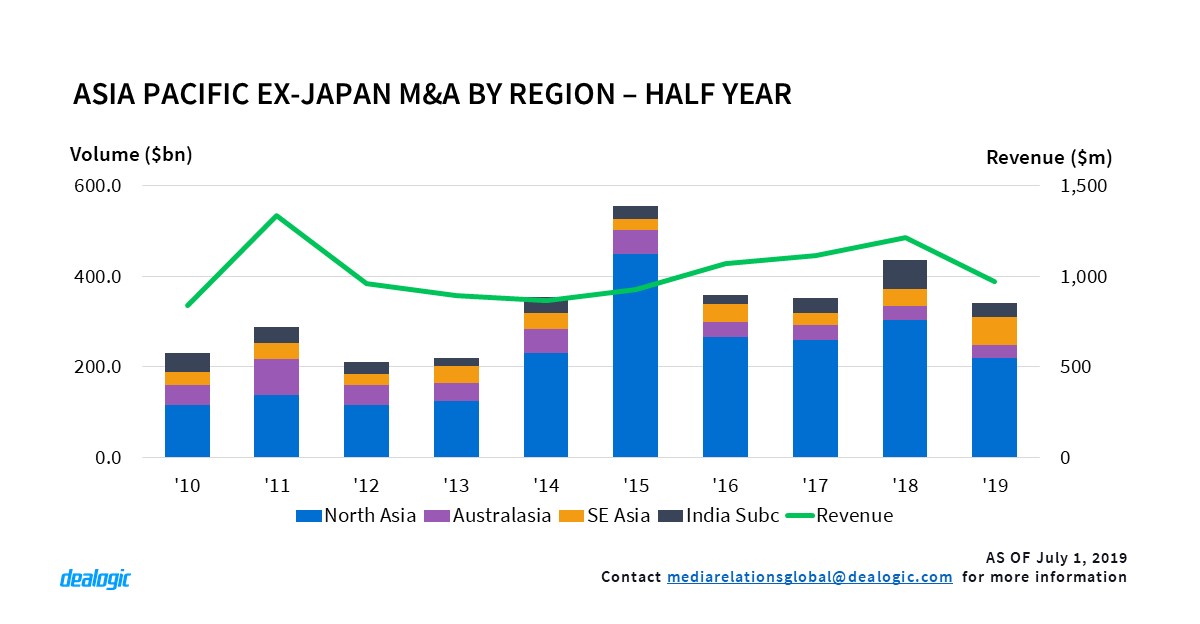

Asia Pacific ex Japan M&A declines

APAC (ex-Japan) targeted M&A activity in H1 2019 saw a 21.8% year-on-year decrease in volume to $341.3bn via 4,095 deals, the lowest level since H1 2013. Significant contributors to this decline are China and India, where drastic 31.0% and 52.1% year-on-year falls in volume have been seen to $175.6bn and $31.2bn, respectively. Since 2017, the challenging economic environment in China has dented China outbound M&A transactions, a trend which has continued in H1 2019 with volume reaching only $20.4bn, down 31.3% from H1 2018, and the lowest since H1 2012.

Japan pharmaceuticals leap

Japan-targeted M&A volume has fared far better than China and India, yet has still been struggling, with volume only reaching $55.5bn, a slight decline of 2.1% year-on-year. This volume was buoyed by two large deals in the region, AstraZeneca’s $6.9bn acquisition of pharmaceutical rights from Daichi Sankyo, as well as Novartis’ $5.3bn acquisition of pharmaceuticals rights from Takeda Pharmaceutical. These two healthcare deals have not only pushed H1 Japanese inbound M&A activity to $13.6bn – the highest H1 volume since 2008 – they have also boosted healthcare M&A volume in Japan to the highest H1 level on record, generating $15.1bn, and enabled healthcare to become the second most targeted sector within the region for M&A in H1 2019, following consumer and electronics, that lead the activity with $15.4bn.

France reaches the top of outbound activity

EMEA-targeted deals recorded a 33.3% year-on-year decrease in H1 2019, reaching only $510.4bn in volume. Inbound activity also declined significantly, from $245.8bn in H1 2018 to $90.9bn this year. EMEA outbound volume, on the other hand, has fared far better with only a moderate rise of 15.1% year-on-year to $104.2bn in H1 2019. Outbound activity in Europe has France leading for the second time since 2006, with $32.2bn in volume. French outbound M&A has been boosted this H1 by the $8.6bn acquisition of Brazilian oil and gas company Transportadora Associada de Gas SA – TAG by French energy giant ENGIE SA. Trending technology and healthcare consolidations have also played a part in boosting French activity, via the ongoing acquisition of US-based clinical research software provider Medidata Solutions Inc by French software developer Dassault Systemes SE for $6.1bn, as well as French Ipsen SA’s acquisition of Canadian Clementa Pharmaceuticals ($1.09bn).

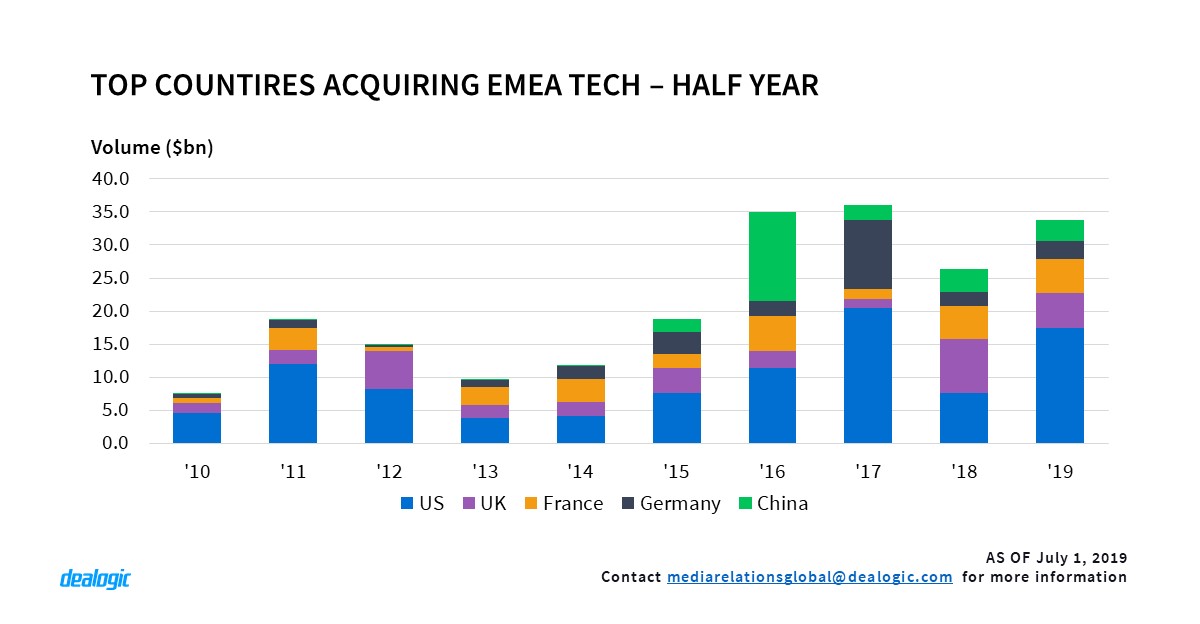

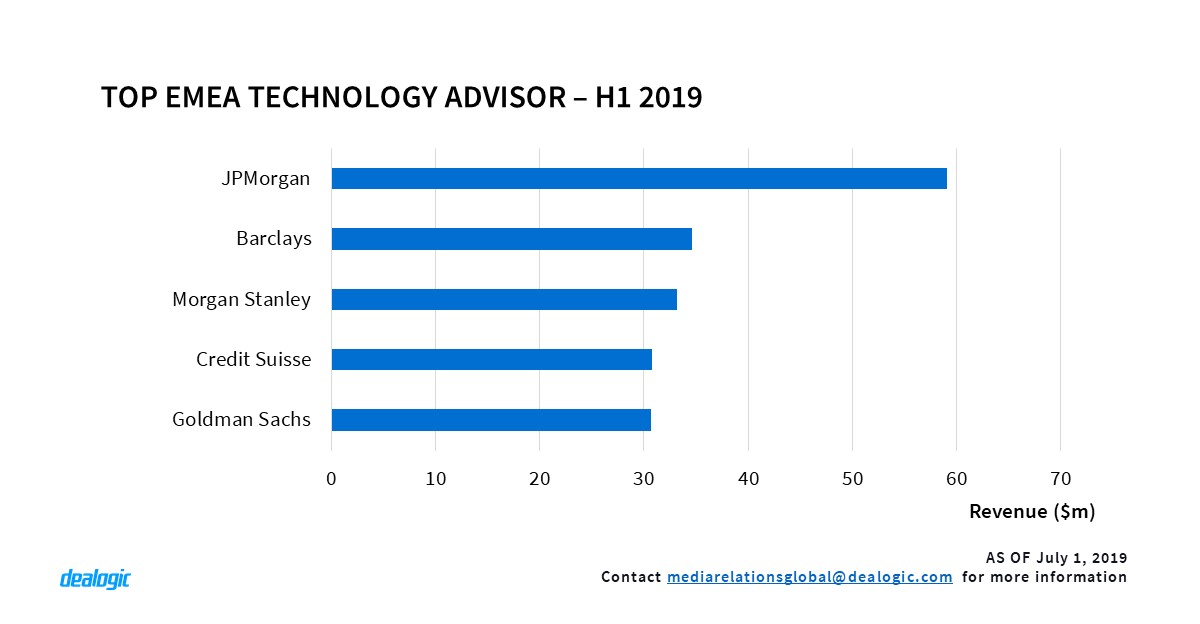

Slowed EMEA activity backed up by Technology

Chemicals continues to be the most active M&A sector within EMEA, largely due to the $69.1bn mega deal acquisition of Saudi Basic Industries Corp (Sabic) by Saudi Aramco. The technology sector is in a distant second place in H1 2019 with $52.9bn generated. The technology boom is being driven by consolidations in the sector and the desire of companies to improve their tech capabilities. Sizable deals over the past six months have included the acquisition of Mellanox Technologies by NVIDIA Corp for $6.8bn, and fleet tracking software provider TomTom Telematics BV’s acquisition by Bridgestone Corp for $1.0bn. The rise of technology also boosted the EMEA-targeted cybersecurity volume, which recorded $143m in H1 2019 – the highest H1 volume on record for the sub-sector.

Footnote

- Mega deals are deals with deal value above $10.0bn

– Written by Dealogic M&A Research

Data source: Dealogic, as of July 1, 2019