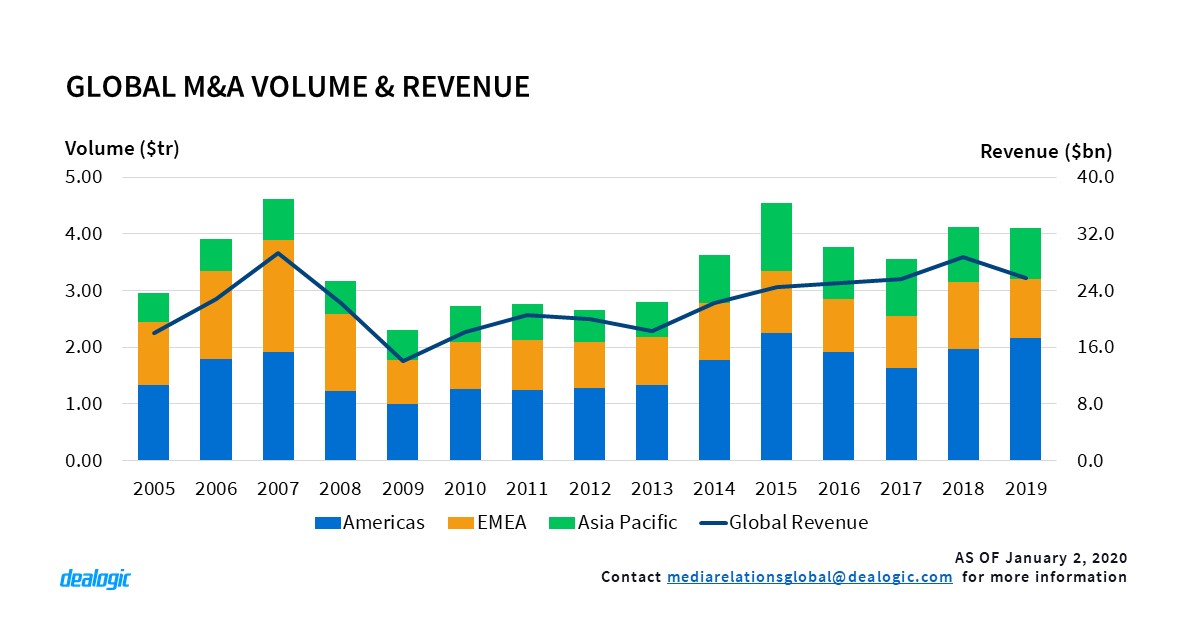

Global M&A volume on a decline

During 2019, global M&A volume has been struggling amid the worldwide economic and political uncertainties. Among all regions, the overall volume saw a small decrease of 0.5% from $4.11tr in 2018 to $4.09tr this year. Despite this, off the back of 34 megadeals1 announced in the US in 2019, such as Bristol-Myers Squibb Co’s $96.8bn acquisition of Celgene Corp, the biggest deal in 2019, the Americas targeted M&A volume remained the only world region that witnessed an increase in volume, reached $2.16tr via 11,511 deals, a small uptick of 9.9% from 2018, just enough to push to the highest level since 2015 ($2.25tr).

Global M&A revenue lost the momentum

Global M&A revenue has lost its momentum after five consecutive years of growth with a 10.3% decline to $25.8bn this year. While all the three world regions saw a decrease in M&A revenue this year, the Americas’ share of global fees rose to 61.7% with revenue of $15.9bn. US fees, although saw a slight 6.6% decrease to $14.2bn in 2019, continued to be the top fee-paying nation and accounting for 55.1% of global M&A revenue.

The year of the mega deals

2019 has been the year for Mega deals with a total of $1.27tr deals being announced above $10bn making up for 31% of the total volume for 2019 which is the highest percentage of mega deals on record. 2019 was a year clearly divided into two. A great start in H1 2019 with volume of mega deals totalling $888.7bn, representing 70% of the mega deals being announced in the 2019. The 2nd part of the year failed to keep up, recording only $380.7bn mega deals.

Revenue and volume in spin offs are slowing down

By the end of 2019, spin and split-offs have shown a bit of a slow-down after the record breaking first 9 Months, with Full year volumes reaching $250.5bn, $12bn shy compared to the 2015’s highest volume this decade of $262.8bn. On the revenue side 2019 Full years amount of $453.75m taking the 3rd place, after 2015 ($628.68m) and 2014 ($559.87m).

Three out of ten in the decade

Looking at the number of deals announced this year, the 41 spin-off transactions fell short by 30.5% when compared to 2018 (59 deals) and by 59% to the current record holder year- (2015 with 100 deals). Despite the low deal count, 2019 saw three of the top 10 largest spin-off deals (Dow Inc – $52.4bn, Prosus NV – $34.5bn and Alcon Inc – $31.4bn), with the Dow Inc transaction coming in at the 2nd position by value in the decade, after the AbbVie deal in 2013 ($64bn).

Sponsor M&A declines year-on-year

Global M&A sponsor volume fell year-on-year from $799.7bn via 2,812 deals during 2018 to just $777bn via 2,637 deals during 2019, representing decreases of 2.8% and 6.2% in volume and deal count respectively. Americas-targeted sponsor transactions was the main driver of sponsor volume during 2019 accounting for 59.1% of all global sponsor volume, the highest market share within the region since 2000. Financial sponsors are currently sitting on record levels of undeployed dry powder, however the fall in volume during 2019 indicates sponsors are still uncertain and hesitant to spend big.

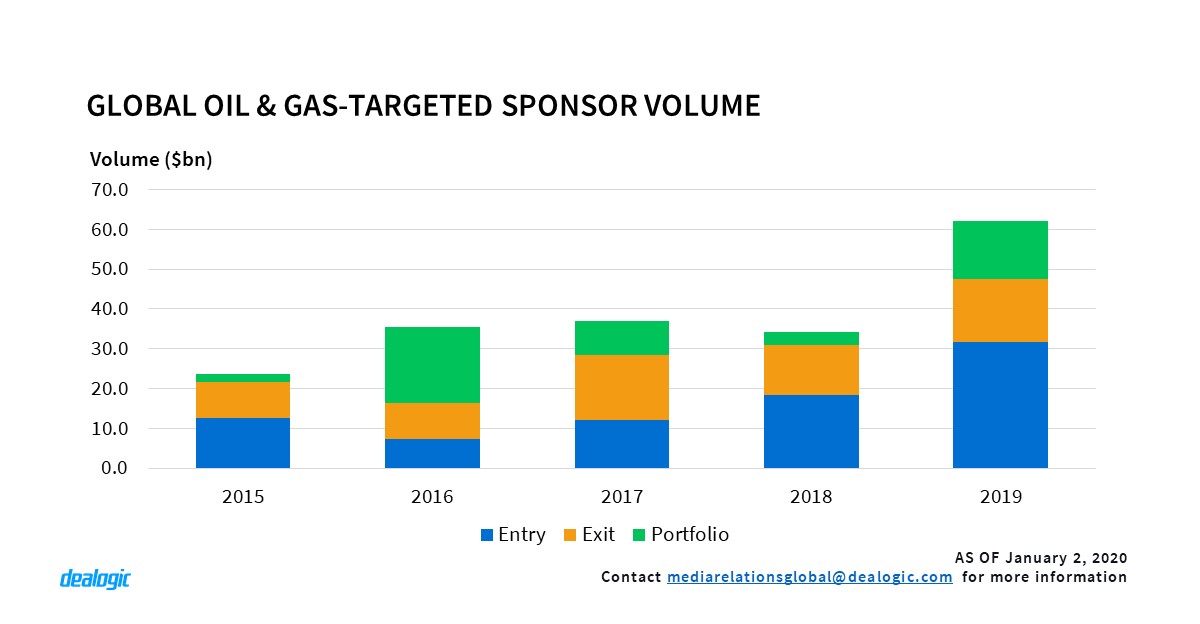

Oil and Gas favored by financial sponsors

Whilst the technology sector remained the most targeted sector for financial sponsor M&A with $209.6bn via 651 deals in 2019, it was the Oil & Gas sector which saw the biggest leap in volume with a record high of $56.2bn via 50 deals, becoming the fourth most targeted industry for financial sponsors during 2019. Sponsor entries into oil & gas companies also reached a record high equating to $31.6bn via 26 deals. The largest sponsor Oil & Gas deal during 2019 was the acquisition of Buckeye Partners by IFM Investors for $11.1bn announced in May 2019.

European M&A volume on the fall

There was a decline in EMEA targeted volume and activity during 2019 with volume reaching $1.03tr via 11,693 deals, representing a 13.3% fall in volume compared to 2018 ($1.18tr), which was mostly due to the decreasing interest in European targeted investments. This trend was visible in European targeted inbound volume which fell heavily year-on-year by 56.28% to $174.2bn during 2019. Ongoing issues across the region such as Brexit and a shortage of mega deals have contributed to the fall in volume. In contrast, European outbound activity increased by 28.1% to $254.3bn with a rising tendency for Canadian ($17.3bn) and Japanese ($12.8bn) targets, the United States was the most started region for European investors. The largest EMEA targeted deal of the year was Saudi Aramco’s $69.1bn acquisition of a 70% stake in Saudi Basic Industries Corp.

LatAm M&A spreads the love

M&A deal volume in Latin America has closed the year with $85bn among 965 deals, an 8.1% increase year on year. Several mega deals drove the surge in deal volume for the top sectors in the region, which were Utility & Energy with $24.5bn in 2019, and the Transportation sector with $14.1bn. Both sectors experienced over $10bn increase in deal volume since 2018, mostly as the result of a few mega deals. Meanwhile, the technology sector accumulated only $5.1bn in deal volume, among 181 deals (124 deals in Brazil alone), the highest activity of any sector in 2019. Softbank’s renewed investments in tech firms throughout the region along with established technology firms finding synergies by acquiring Latin American counterparts explain this surge.

Brazil has the lowest market share since 2010

In a reverse wave from the continent, in 2019 the Brazilian economy had the lowest market share since 2010 with 41.3%, a 20.9% decline from 2018. Considering the amount of assets privatized by the government, it’s clear that there’s a lot work to be done to gain the investors trust on Brazilian economy. Meanwhile in Mexico, the M&A market was surfing above the tide with 17.6% after a drown in 2018 – 4.3%, the lowest percentage since 2010. While in Brazil the order was to sell government owned assets, the Mexican M&A market in 2019 had 12 deals valued over $500m ending the year with 243 deals. Colombia was the fast swimmer of the group, closing their participation in 2019 with 13.8% market participation, an increase of 323% from last year and the highest value since 2010. The internal restructure of Group Casino Guichard, that had Amacenes Exito shares being acquired by Companhia Brasileira de Distribuicao valued at $6.7bn, was one of the top 10 deals for 2019 in LatAm, and the push that brought Colombia to the top 3.

Footnote:

- Dealogic considers transactions with deal value above $10bn as megadeals

– Written by Dealogic M&A Research

Data source: Dealogic, as of January 2, 2020