Sponsor-driven M&A in the fast lane

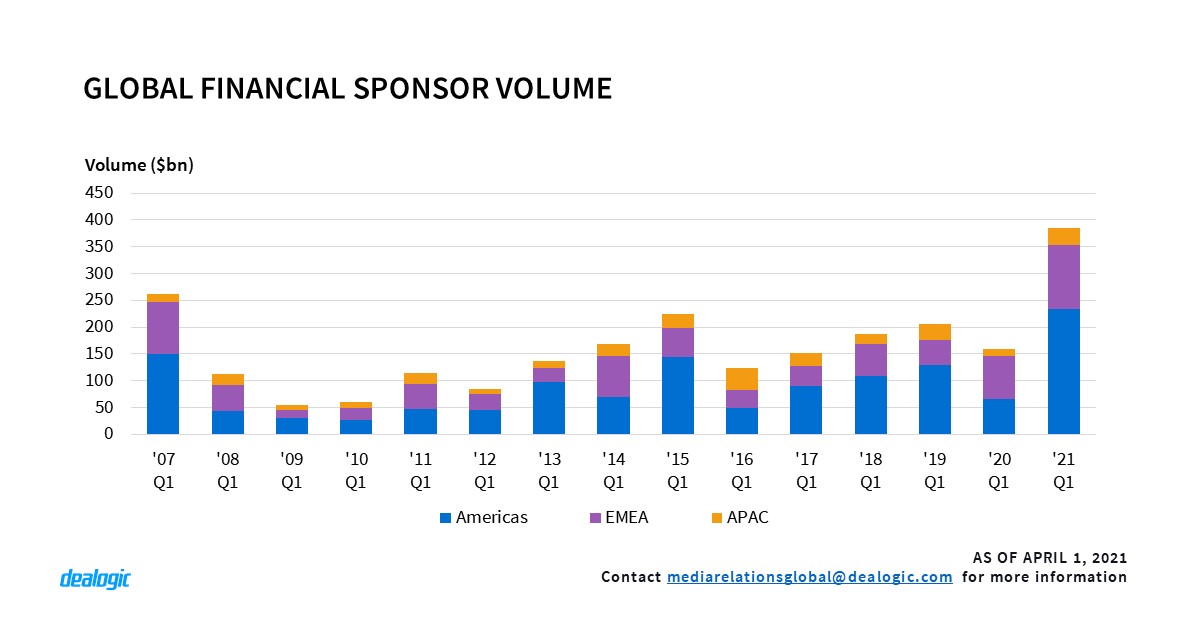

Financial sponsor M&A has taken off this year, reaching its highest Q1 volume on record with $385.8bn via 779 deals, an increase of 142.9% compared with the same period in 2020. Financial sponsor entries also grew in volume by 85.8% year on year, the same with exits with a year-on-year increase of 119.4%. The high volume has been driven by a plethora of mega deals, such as Ardian and Global Infrastructure Management’s acquisition of the Water and Recycling business of Suez for $18.8bn the largest financial sponsor deal announced in 2021 so far. In total, there were 19 mega deals valued at $5bn or more announced during Q1 2021 representing total volume of $161.4bn.

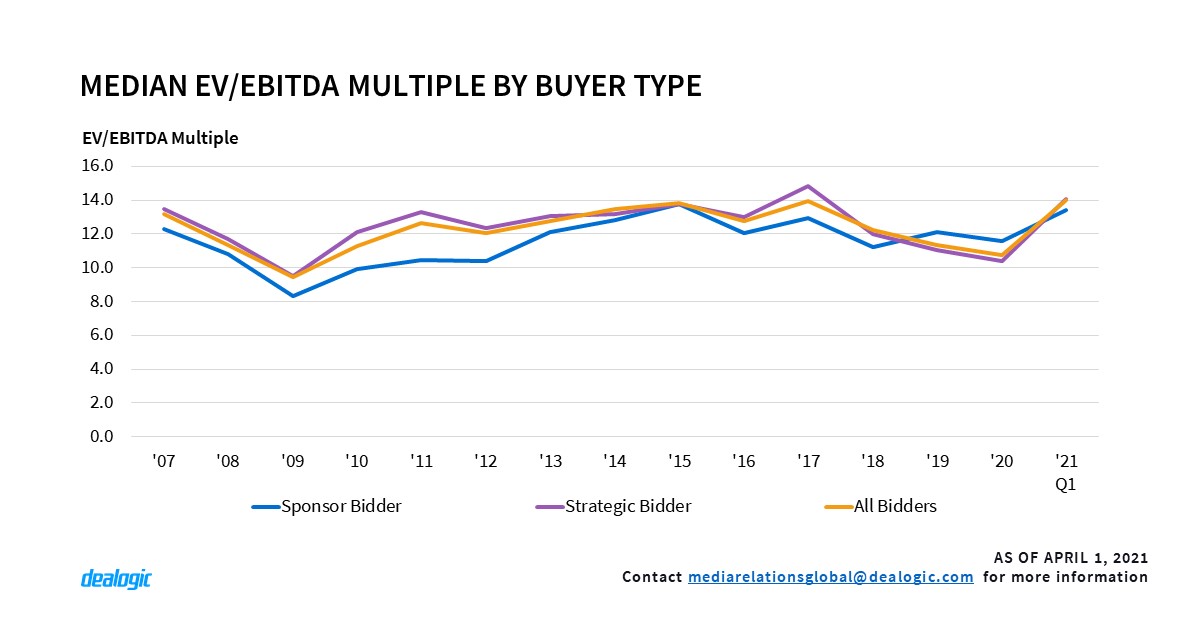

Other factors behind the rise in financial sponsor volume could be the low company valuations. According to Dealogic data, the median EV/EBITDA multiple paid by bidders in transactions resulting in a change of a majority stake reached 10.72x during 2020, the lowest it has been since 2009 where the median EV/EBITDA multiple stood at just 9.45x. The impact of COVID-19 last year has caused company valuations to fall, hence this could also be one of the driving factors in the recent burst of sponsor activity, companies are cheaper to purchase.

More topics covered in the report:

- Global M&A volume on the rise; financial sponsor M&A booms

- Global M&A volume rises once again

- US M&A Dominated by SPACs

- SPAC’s Target Tech

- EMEA Top Sectors Record Achievement

- Strong start for Asia Pacific M&A

- Cross-border M&A in Asia rebound

For full access to the Global M&A Highlights and access to Cortex, click here