Private equity: A meteoric rise

Global PE activity accounted for 27% of worldwide M&A activity by value and 9% by deal count in 2021, setting a new record for the total share of sponsor-led dealmaking. Buoyed by low interest rates and high volumes of dry powder, the PE space saw USD 1.5tn change hands across 2,869 deals.

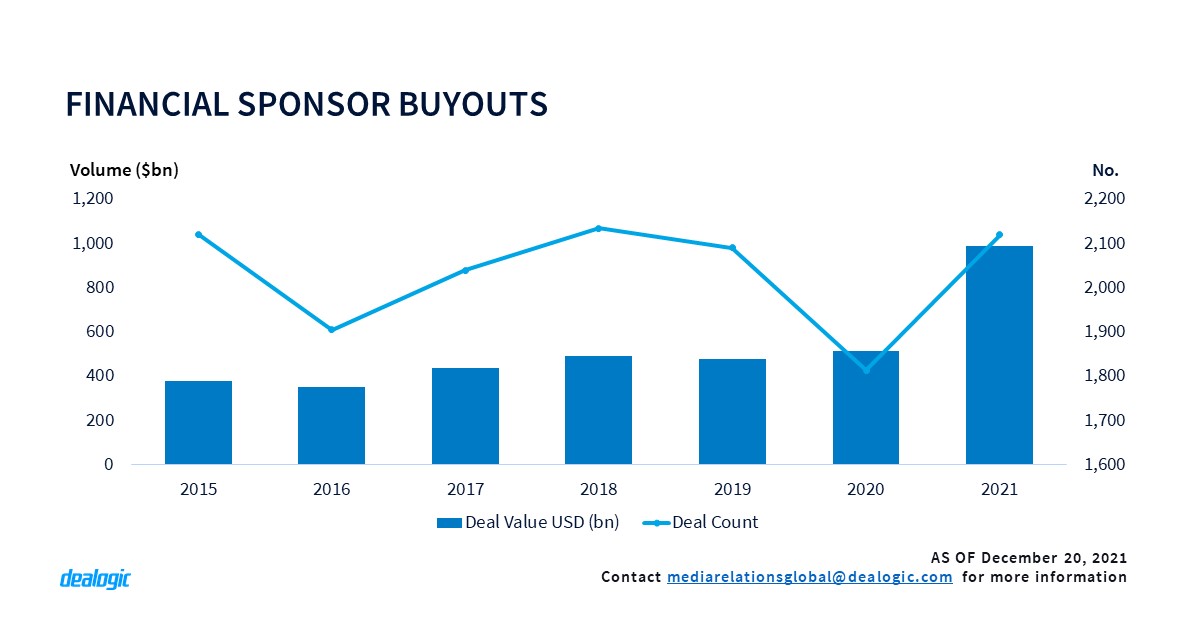

A total of 2,120 buyouts worth USD 990.8bn were recorded in 2021. Technology continues to fuel investor appetite with 470 deals worth USD 225.7bn. The telecom and real estate sectors have also attracted high levels of interest with USD 69.6bn and USD 37bn invested respectively in those two sectors. The largest buyout deal of 2021 so far is the USD 40.1bn acquisition of Telecom Italia by KKR in November. Buyout activity is expected to grow further in 2022 with PE firms in the early stages of tapping into new markets such as the insurance and retail investor spaces. Indeed, a SEC advisory group recently recommended increasing retail investor’s access to private capital vehicles, as per a WSJ report.

Exit valuations have reached new highs and sponsor exits have almost doubled compared to last year with 1,245 exits worth USD 800.1bn recorded in 2021.

More topics covered in the report:

- World Record: Global M&A hits all-time high despite fourth quarter slowdown

- Can the run continue?

- Private equity: meteoric rise

- North America: US and Canada record blockbuster year

- Tech and healthcare lead the way

- The LBO and SPAC bonanza

- EMEA: Mega deals push M&A to its highest point since 2007

- Record-breaking sponsor activity drives dealmaking

- Tech dominates EMEA M&A

- Asia Pacific: China stays flat but Australia helps region to record high

- Beijing in the driver’s seat

- Tech magnestism

For full access to the Global M&A Highlights and access to Cortex, click here

Contact us for the underlying data, or learn more about the powerful Dealogic platform.