Green and ESG linked loans growing popularity

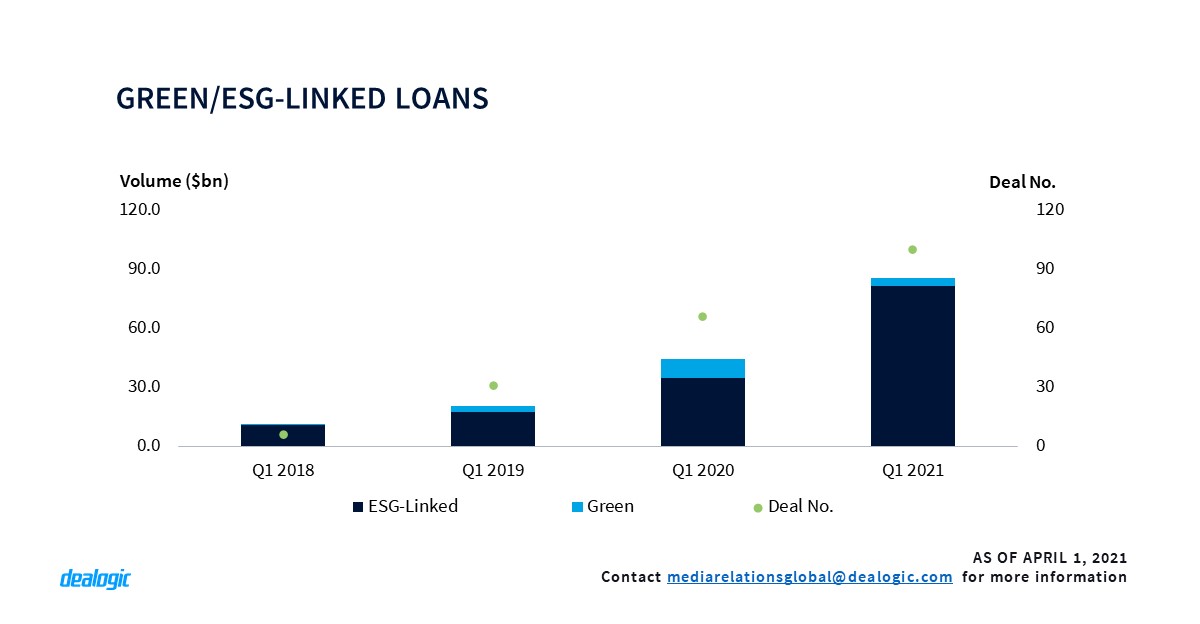

Green and ESG linked loans have shown resilience and growth throughout the pandemic. In the first three months of 2021, $85.5bn of ESG facilities were arranged, up by 93.3% from Q1 2020. ESG-linked loans which are not constrained by a green use of proceeds are by far the most popular facilities.

ENEL signed a €10bn revolving credit facility on 5th March 2021, the largest sustainability-linked loan signed on record. The most active sector in Q1 2021 has been utility & energy, food & beverage and finance with a 23.6%, 13.0% and 8.7% share, respectively.

More topics covered in the report:

- Booming US leveraged loans market the key driver

- Sustained shift in borrowing pattern

- Refinancing the main engine for growth

For full access to the Global Loans Highlights and access to Cortex, click here