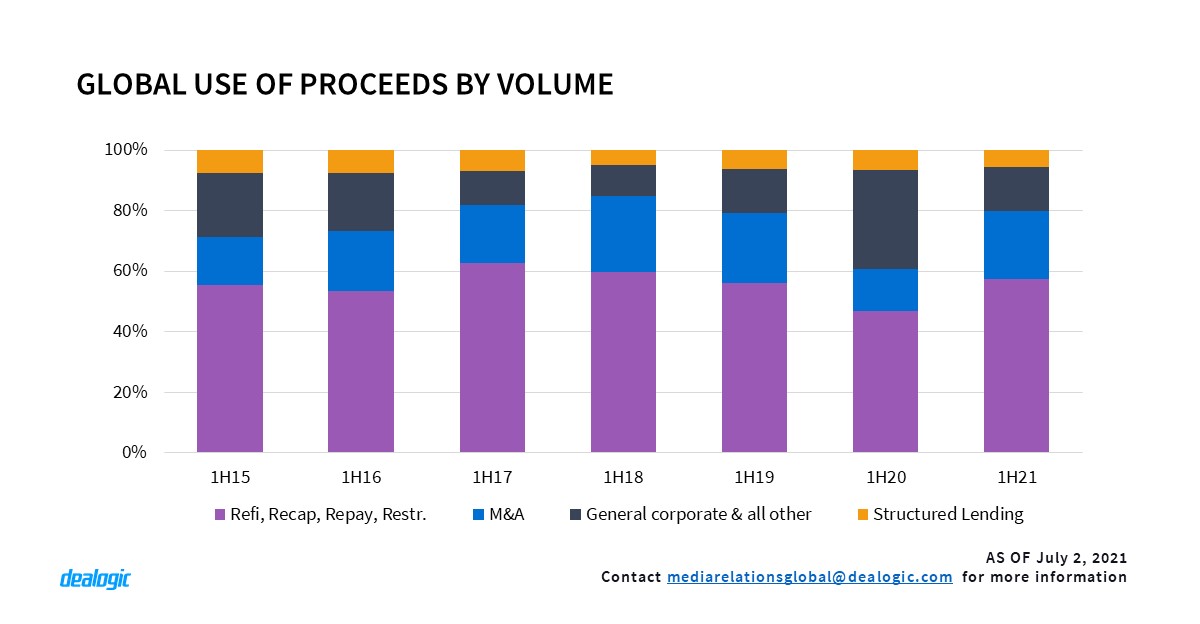

Refinancings Seize Lion’s Share of Global Proceeds

Financial uncertainty caused by the global pandemic has manifest in a changing economic climate, and this, in turn, has seen a shift in the use of proceeds since last year. Refinancing volumes snared an impressive 51% of global proceeds, soaring to USD 1.39trn in 1H21 from USD 879bn in 1H20, as issuers rushed to take advantage of cheaper financings and push out tenors.

Acquisition finance took the second place, with USD 371bn or 14% of total proceeds, up from USD 193bn and 9% in the previous year, as risk appetite returned to the market and executives targeted growing inorganically. Despite the rise from last year, the use of proceeds for acquisitions was lower than in pre-pandemic years in 1H19 and 1H18, when USD 408bn and USD 586bn were raised, respectively. In 1H20, after refinancing, proceeds for general corporate purposes held the second spot, as companies sought to combat the impact of COVID-19.

More topics covered in the report:

- Technology Raise Highest Volume of Loans

- ESG and Green Loans Continue to Bloom

For full access to the Global Loans Highlights and access to Cortex, click here