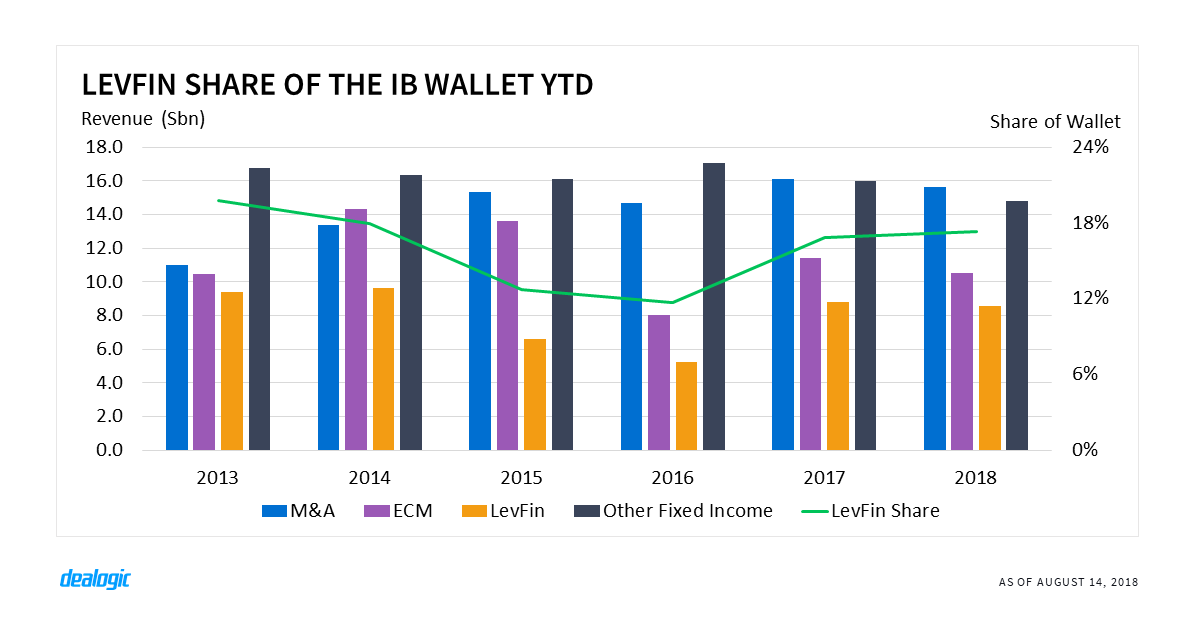

Growing LevFin wallet

Global investment banking (IB) revenue has reached $49.5bn in 2018 YTD, down by 5% from 2017 YTD. While a busy M&A market has generated a steady source of return for banks so far this year, though down slightly to $15.6bn from $16.1bn, the leveraged finance (LevFin) market accounts for 17.3% the total IB wallet, its highest YTD share since 2014. LevFin has generated $8.6bn in revenue this YTD, and represents 36.7% of total revenue generated by fixed income transactions.

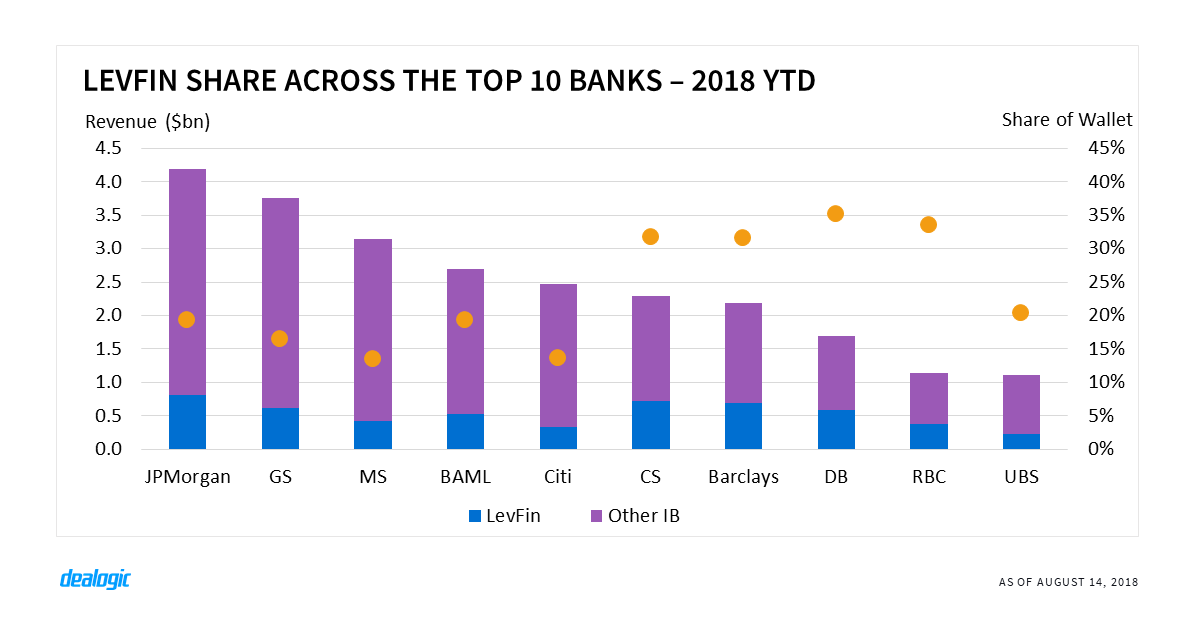

LevFin fuels European bank revenue

The share of LevFin revenue across 70% of the top 10 investment banks so far this year, stands above the average share of 17.3%. It is worth noting that for European banks in the top 10, LevFin revenue averages 30.7% of their total wallet, with Deutsche Bank generating 35.1% of its revenue from LevFin. The increasing share of European banks’ LevFin footprint coincides with their growing presence in the US market. So far this year, Deutsche Bank and UBS have increased their share of the US LevFin wallet to 5.8% and 2.3%, from 4.8% and 1.9% in 2017 YTD, respectively.

– Written by Roody Muneean

Data source: Dealogic, as of August 14, 2018

Contact us for the underlying data, or learn more about the powerful Dealogic platform.