Jumbo volume soars amid overall drop in levfin loans

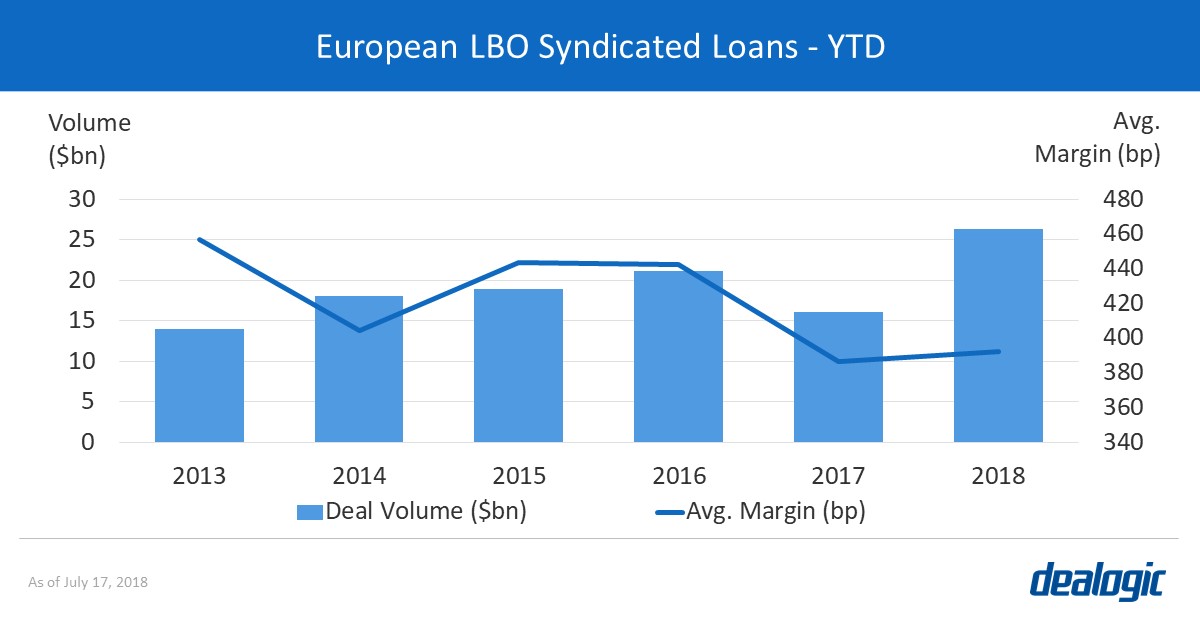

Despite a 30% year-on-year decline in European institutional* leveraged loans volume in 2018 YTD, jumbo LBO deals have climbed to a record-high—reaching $26.3bn so far this year. Jumbo deals have also boosted the average deal size for European LBOs, which have ballooned by 78% year-on-year to $572m, the highest year-to-date average on record.

New LBO-related transactions have unsurprisingly driven European loans revenue, generating $484m in the region, up by 71% compared to the same period in 2017. They also account for 48.1% of leveraged institutional loans revenue in 2018 YTD, up from 34.8% in 2017 YTD.

Bank-led facilities dominate Europe’s leveraged market

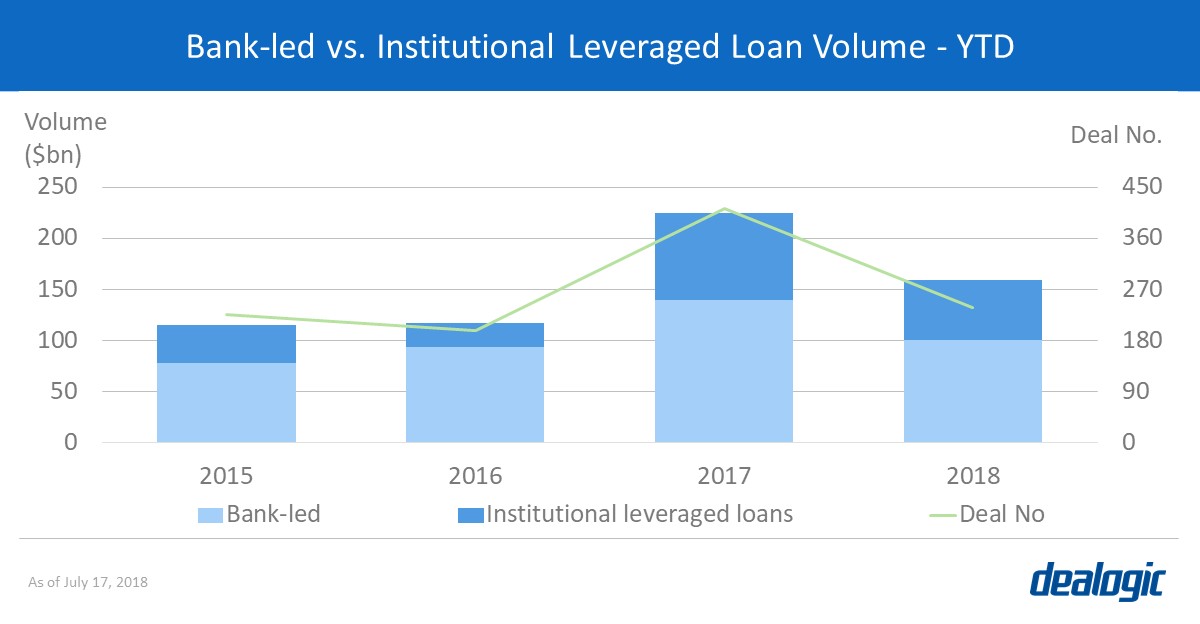

Bank-led leveraged facilities remain dominant in Europe, with a 62.8% share of the market, despite a 28% year-on-year drop in volume to $100.2bn—the lowest YTD level since 2016 ($93.8bn). European institutional leveraged loans* volume of $59.3bn so far this year, accounts for 37.2% of total European leveraged loans (down marginally from 38.0% in 2017 YTD).

European leveraged loans volume has benefitted from the increase in new LBOs, which are up 64% year-on-year to $26.3bn from $16.0bn. However the decline in refinancing has seen overall volume and activity drop to $159.5bn via 238 deals this year, compared to $224.3bn via 412 deals in 2017 YTD.

* Institutional leveraged loans are distributed to at least 75% to investors

– Written by Beata Solti

Data source: Dealogic, as of July 17, 2018

Contact us for the underlying data, or learn more about the powerful Dealogic platform.