Moving towards non-Japanese borrowers and markets

Japanese banks are lending more to non-Japanese companies, both inside and outside of their home market. In the Japan market, non-Japanese borrower volume was up 78% year-on-year; remarkably, volume in the oil & gas sector almost tripled over the same time.

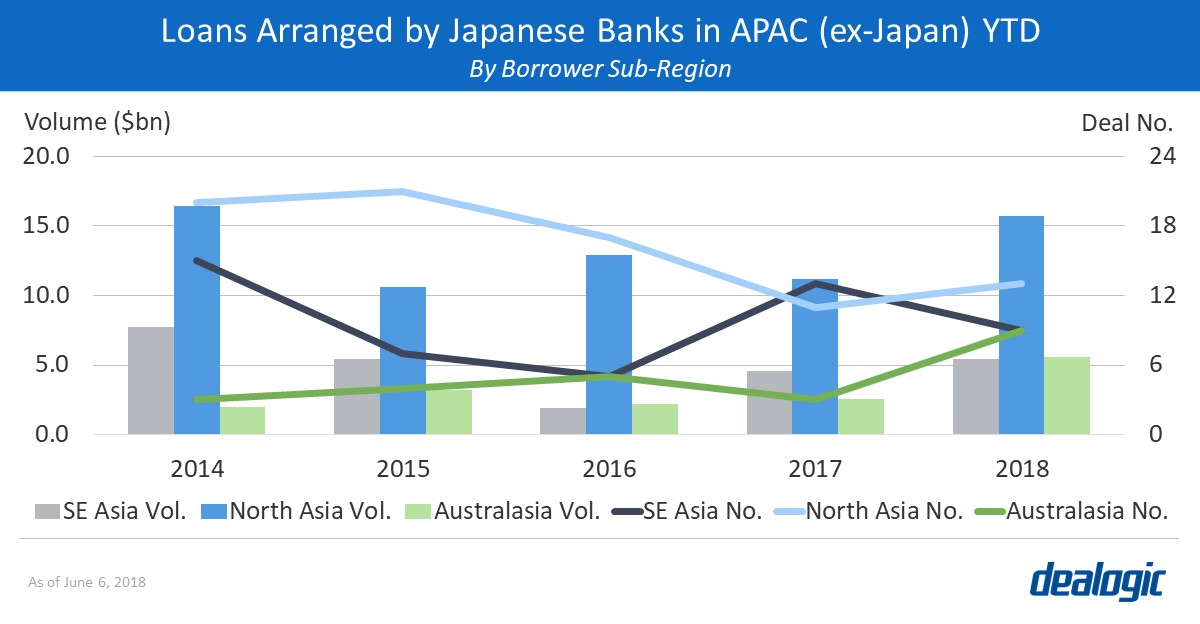

These banks’ market share in the rest of the world also grew by 2.0 percentage points year-on-year to 6.7% in 2018 YTD. Though they have struggled to move beyond the 8% threshold globally (ex-Japan) in the past 5 years, a key growth area is their home region.

Despite the overall Asia market trend of a 19% decrease in volume since last YTD, Japanese banks were able to increase their market volume to $5.1bn (up 4%) since last YTD.

ANZ is the new target

2018 YTD Japanese banks’ market volume in ANZ is the highest in the last 5 YTD periods, and up 102% since last YTD. Despite overall ANZ activity falling year-on-year, Japanese banks in 2018 have already arranged 7 loans in the region, which is more than double the activity from last YTD. Accordingly, these banks’ share of the ANZ market grew by 2.3 percentage points since last YTD.

Within the ANZ market, Japanese banks have arranged the highest number of loans in the healthcare and construction/building sectors, with 2 deals each so far this year. They include financing arranged by SMFG for the LBO of I-Med Radiology Network.

More revenue-generating deals outside Japan

Japanese banks are actively arranging M&A-related deals outside of Japan; global (ex-Japan) volume on which Japanese banks were bookrunners was up 9% year-on-year. Remarkably in the Asia market, Japanese banks increased their market share of M&A-related loans volume by 1.5 percentage points year-on-year. This increase reflects the overall volume of their M&A-related Asia deals, which grew 429% year-on-year.

As Japanese banks seek more revenue-generating loans, they have expanded beyond traditional areas and are increasing their presence in the greater region.

– Written by Azusa Hashimoto

Data source: Dealogic, as of June 6, 2018

Contact us for the underlying data, or learn more about the powerful Dealogic platform.