Lessons from 2008

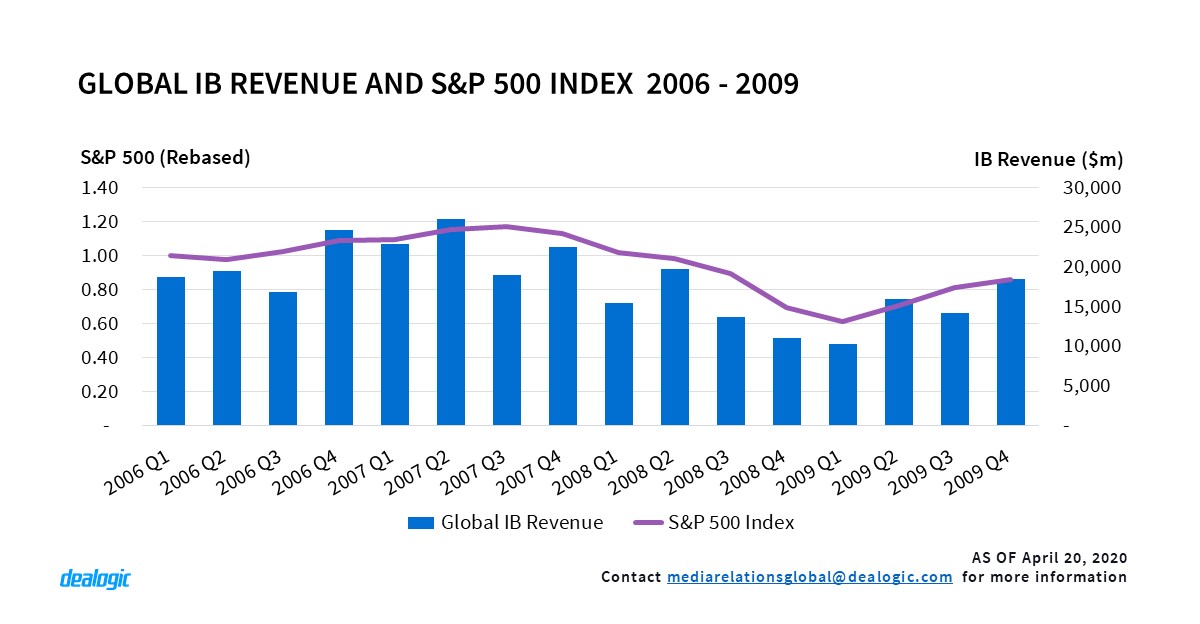

Although characteristics and speed of the current Covid-19 crisis show some distinct differences to the crisis of 2008, a review of developments during the global financial crisis can be a helpful lesson in predicting the possible development of investment banking activity ahead. The S&P 500 Index closed at a record high of 1,565 points on October 9, 2007 (4Q 2007) just to reach a low of 676 on March 9, 2009 (1Q 2009).

Similarly, quarterly investment banking revenues fell from $22.5bn in 4Q 2007 to $10.2bn in 1Q 2009.

A reduction of 57% in the S&P 500 index corresponded to a 55% reduction in investment banking revenues over the same period.

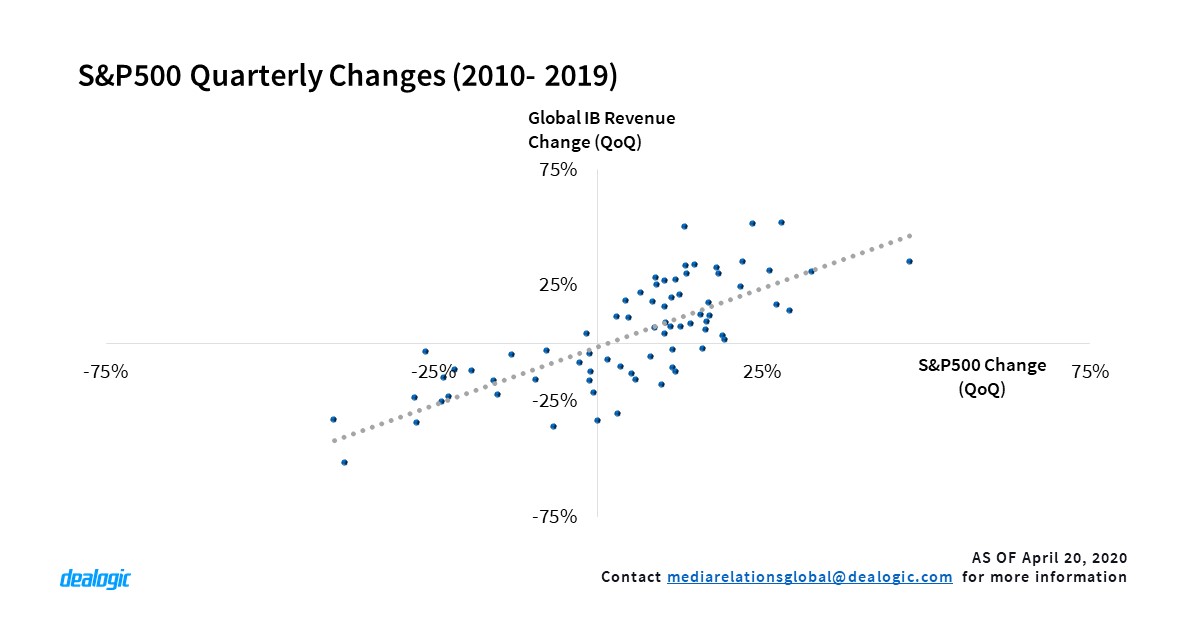

On average, a 1% drop in the S&P 500 historically (2010-2019) corresponded to a 1% decrease in global investment banking revenues.

The S&P 500 closed 21% lower on March 31, 2020 compared to its level at the start of 1Q 2020 on Jan 2, 2020. It dropped by 34% from its peak on February 20, 2020 to its most recent low on March 23, 2020.

Investment banking revenue was down 3% in 1Q 2020 compared to 1Q 2019. However, if we look solely at the Q1 period after the S&P 500 peak of February 20, 2020, revenues from February 20 to March 31 were down 27% compared to those in the same period of 2019, broadly aligning once more with the percentage decrease of the S&P 500.

– Written by Dealogic Fee Research

Data source: Dealogic, as of April 20, 2020

Contact us for the underlying data, or learn more about the powerful Dealogic platform.