Getting to the Fortune 500

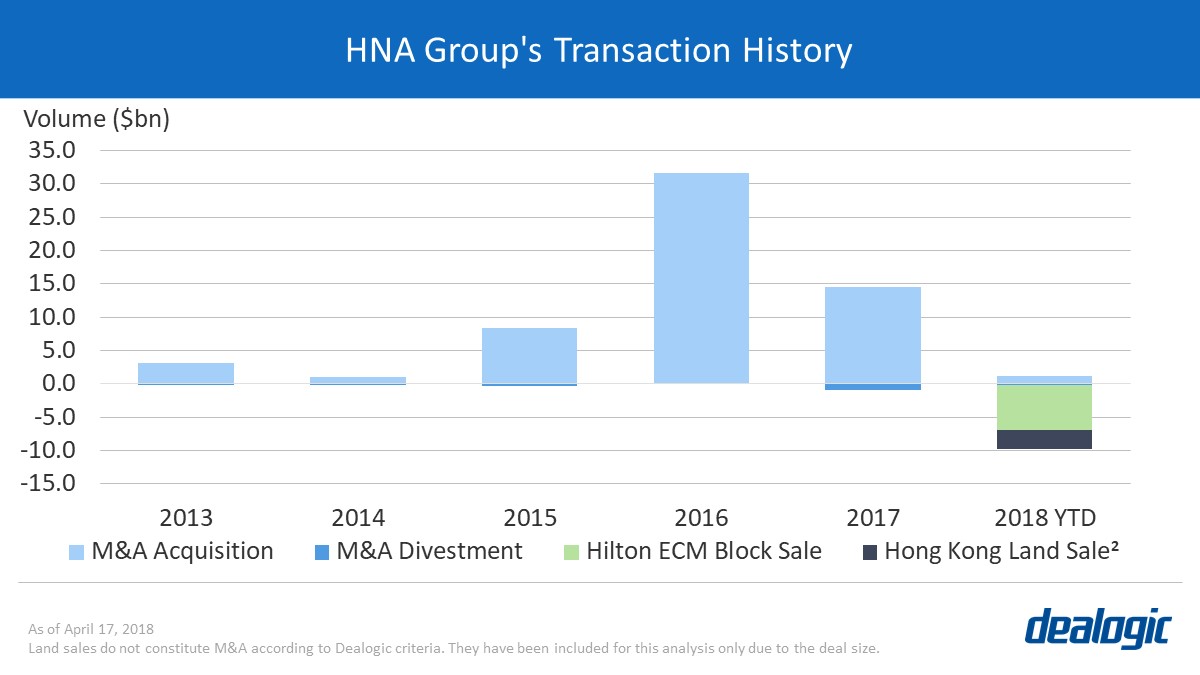

It took less than two decades for HNA to transform from a domestic airline to a Fortune-500 conglomerate, with $147.4bn in assets as of its June 2017 report. With more than 400 entities, it was the most prominent private-sector contributor to China’s outbound M&A wave between 2015 and 2017. Thanks to this aggressive acquisition spree, HNA Group’s businesses cover logistics, hotel, finance, and beyond, with operations around the world.

HNA’s sand castle

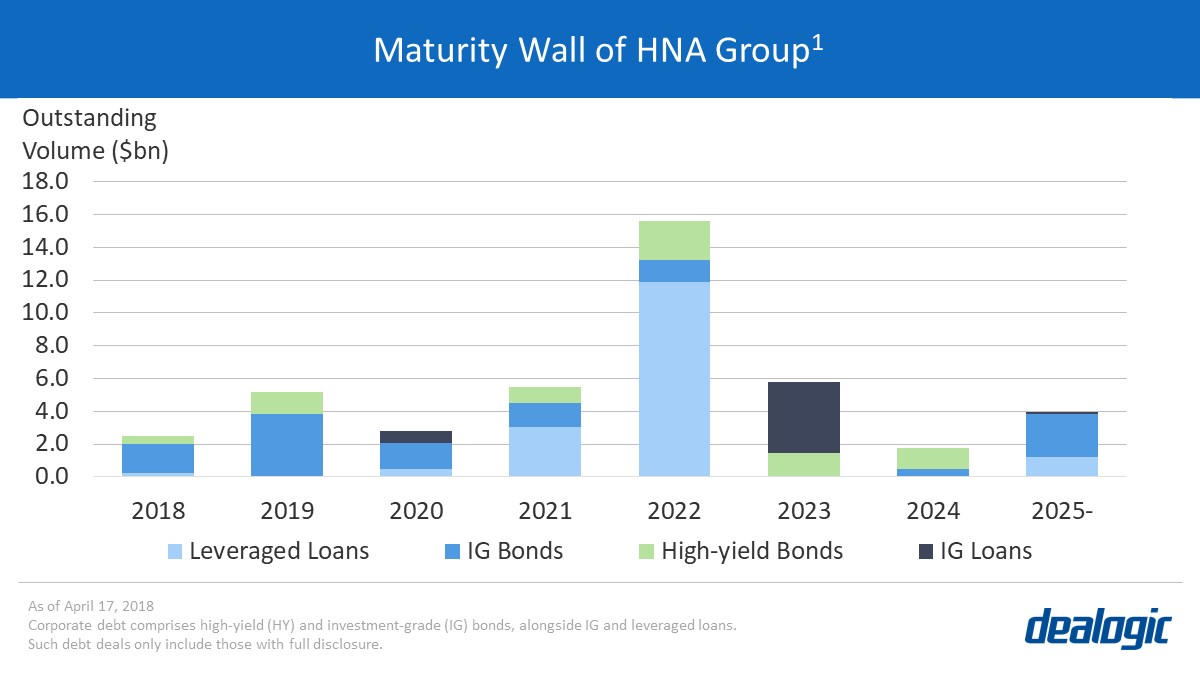

2016 marked the peak of HNA’s ambitions, when its overseas acquisitions reached 12.7% of total China outbound M&A volume that year. However, much of this spree was fueled by debt. Between 2015 and 2017, it borrowed a total of $45.7bn, mainly through leveraged loans.1

Soon after HNA accumulated a 10% stake in Deutsche Bank in May 2017, it also came under regulatory scrutiny over its funding and ownership structure. The curb of capital outflow by the Chinese government in late 2016 put additional limits on the number and size of its overseas M&A targets.

Crumbling foundations

Though HNA’s business was profitable overall, it had made many of its acquisitions at a high premium. Trouble appeared in January 2018 with reports of HNA facing difficulties in repaying its debt: a total of $319m with a maturity date in Q1 2018. With its heavy debt burden—one of its subsidiaries, CWT International (formerly HNA Holding Group), has a debt-to-equity ratio of 4.63—the group faced increasing censure from the Chinese government. As a result, they began to unload many of their overseas investments.

The sale is on

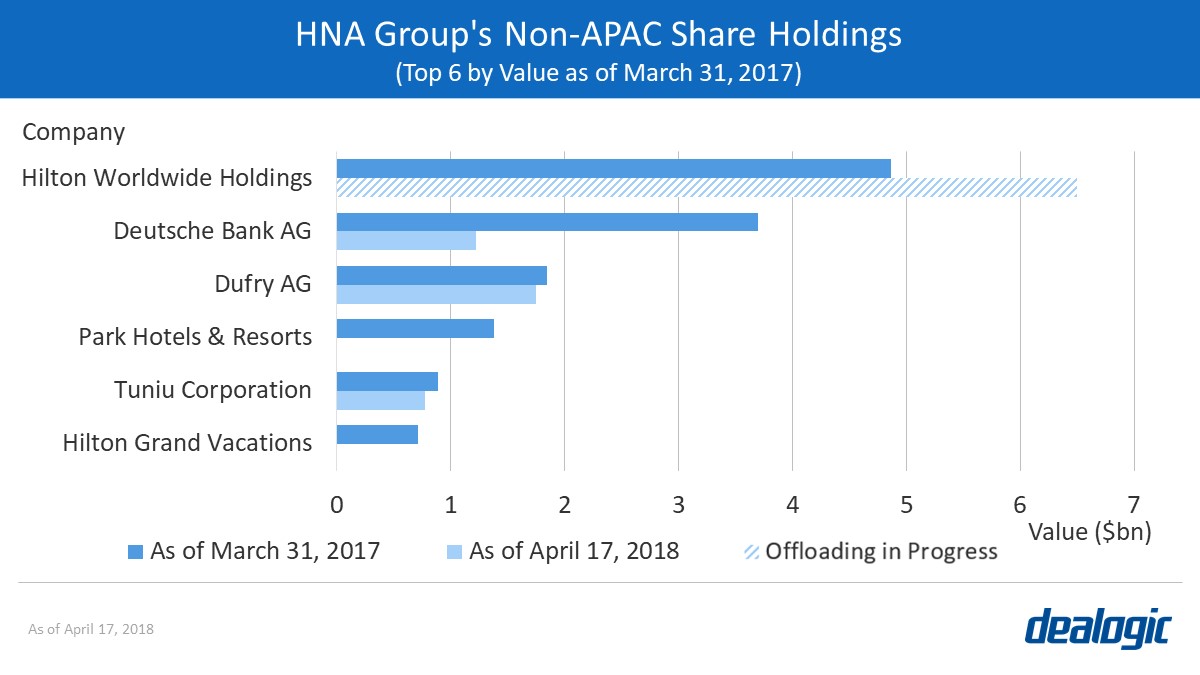

The combination of government pressure and a need for cash put HNA into sales mode. So far this year, it has divested all of its stake in Hilton’s listed entities via three accelerated bookbuild (ABB) deals: Hilton Worldwide Holding’s $6.0bn ABB, Hilton Grand Vacations’ $1.1bn ABB, and Park Hotels & Resorts’ $1.4bn ABB. HNA made a total of $2.0bn, or a 30% profit from these three sales. It has also sold a small part of its stake in Deutsche Bank, and land plots in Hong Kong. Between all these deals, HNA Group has raised more than $10bn.

HNA continues to drive fees

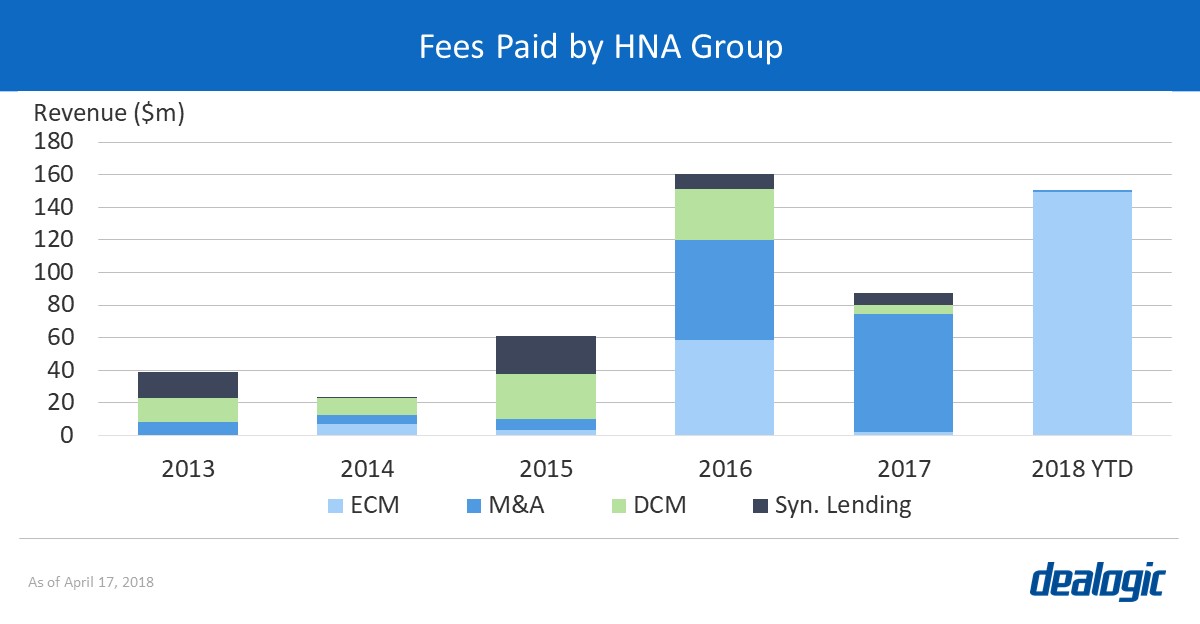

During its 2016 golden period, HNA Group paid $161m in fees, with M&A transactions accounting for 38.4% of total full-year revenue. Though revenue fell in 2017, M&A’s share grew to 82.8%.

In its current sales mode, HNA continues to be a source of revenue. The group has already paid $151m in fees so far this year, with almost the entire amount driven by Hilton’s ECM deals—an overwhelming 99.0% of revenue.

What’s next?

With $7.7bn in outstanding debt maturing by next year, HNA was looking to sell Swissport and Gategroup via IPO. However, both these planned IPOs were withdrawn this month due to adverse market conditions. Instead, there have also been talks that Temasek is interested in acquiring the two companies from HNA. The group plans to raise further funds by transferring its airline, duty-free store, and hotel business to its listed subsidiaries through share swaps.

Overall, HNA Group is looking to hold on to certain core domestic businesses and limit their scope of expansion overseas. This is evidenced by subsidiary Tianjin Tianhai’s acquisition of domestic online-retail platform, Dangdang.com, in April this year—another step towards completing its transformation into an online and electronics business-supply-chain company.

1. Corporate debt comprises high-yield (HY) and investment-grade (IG) bonds, alongside IG and leveraged loans. Such debt deals only include those with full disclosure.

2. Land sales do not constitute M&A according to Dealogic criteria. They have been included for this analysis only due to the deal size.

– Written by Dealogic Research

Data source: Dealogic, as of April 17, 2018