Global Volume Rampant

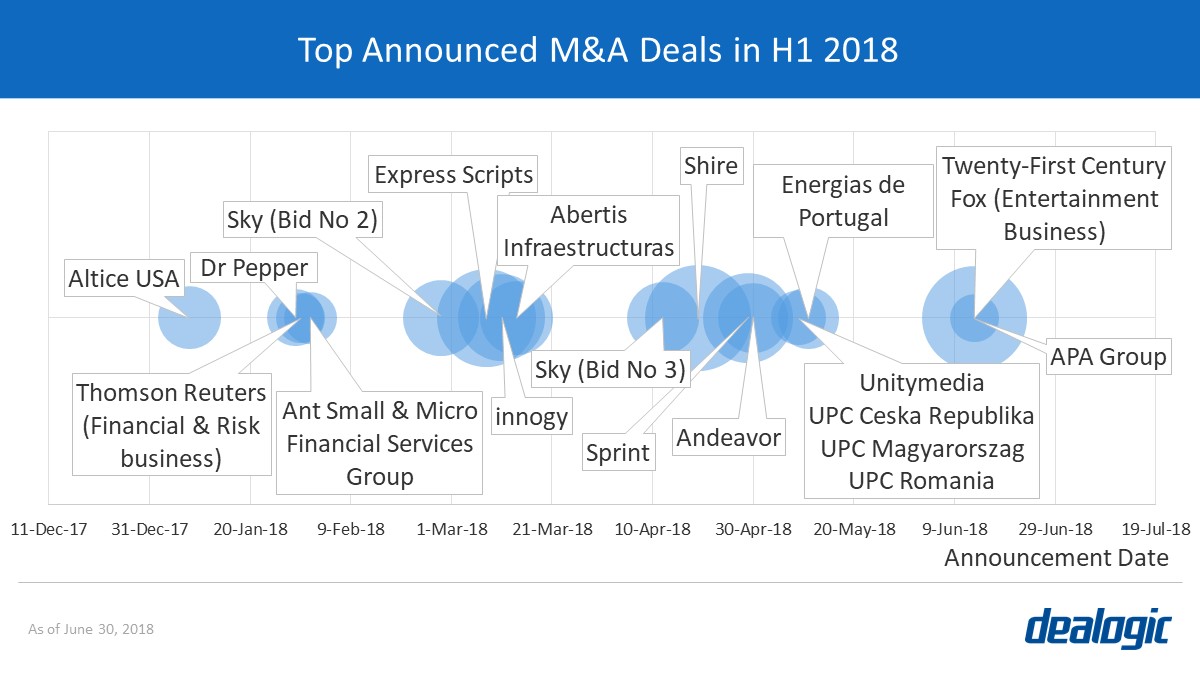

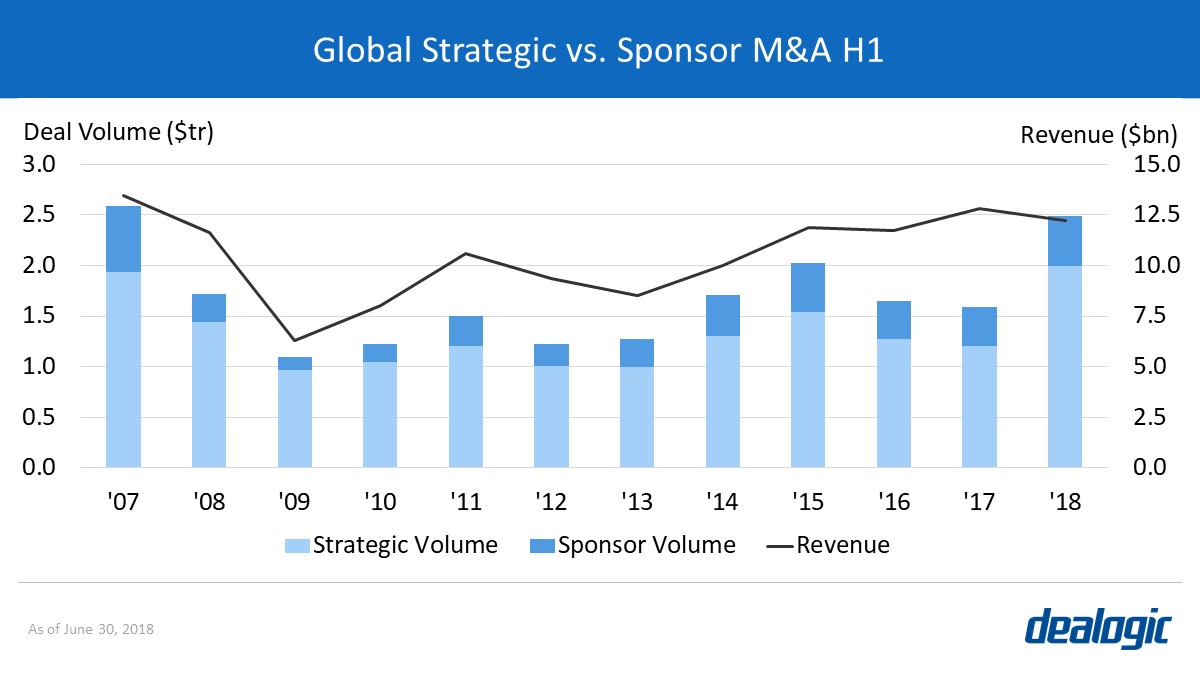

Global M&A during H1 2018 has reached its highest levels since H1 2007, with volume totaling $2.49tr via 17,611 deals. The surge in volume represents an increase of 57% in comparison to the same period of 2017, largely due to a sharp rise in mega deals. Such deals over $10bn have dominated the global M&A landscape this first half, especially in EMEA and the US. 33 mega deals were announced in H1 2018, the biggest of which is Takeda Pharmaceutical’s $81.5bn bid for Shire. Sponsor M&A has also rallied during H1 2018, reaching its highest volume since H1 2007 with $494.5bn via 2,089 deals.

H1 2018 M&A volume should, however, be regarded as rose-tinted. Several high-value bidding wars, hostile offers, and competing offers will inevitably reduce global volume—most notably Comcast and Walt Disney’s bids for Twenty First Century Fox’s assets and Sky, which would account for over $100bn of lost volume alone. For that reason, we can expect drastic changes in the rankings during the second half of the year.

Americas Telecom Boost Market

M&A activity in US-targeted transactions had their strongest start on record in H1 2018, with $1.06tr in volume among 4,425 deals. This is a 74% increase in volume compared to the same period last year ($609.4bn). The number of deals, however, dropped by 17% year-on-year.

Increased activity in the telecommunications sector helped boost the results. Several mega telecom deals drove the trend, such as Sprint’s acquisition by T-Mobile US ($59.9n), and Walt Disney’s revised offer for Twenty-First Century Fox ($84.8bn), announced late 2017 and expected to close soon.

UK Driving EMEA to New Heights

H1 2018 stood out with the highest volume since H1 2000, reaching $300.1bn, a 195% increase compared to H1 2017. The significant rise is attributed to the fact that almost half of the EMEA-targeted deals valued at $10bn or more are UK-targeted, including the largest global deal so far this year (Takeda’s $81.5bn bid for Shire). Accordingly, the UK is on top of EMEA M&A volume by target nationality.

In addition, the acquisition of consumer healthcare–business Novartis AG by GlaxoSmithKline ($13.0bn) helped the boost seen in the healthcare industry, making it the leading sector for M&A with EMEA nationality for the first time since H1 2010. If all announced deals this year reach completion, these mega deals will have a direct impact on EMEA revenue: 2018 could end up with one of the highest H1 revenues on record.

Continuous growth of APAC software

APAC software-targeted M&A volume has increased drastically over the past 10 years, reaching the record high volume for the first half of 2018 with $107.5bn (via 1,185 deals)—18.9% of total APAC M&A volume. Among all the APAC announced deals in H1 2018, 4 of the top 10 deals are software-targeted. They include the acquisition of Ant Small & Micro Financial Services by Alibaba at $19.8bn and Ant’s subsequent $14.0bn funding round.

China Renaissance led the APAC M&A software revenue ranking, totaling $18.6m over 30 deals with a wallet share of 17.4% this H1. Its revenue nearly doubled the previous period’s total of $9.8m with a wallet share of 8.7%. Meanwhile, Credit Suisse has more than doubled its H1 revenue to $15.4m and 14.4% of the wallet, from its previous H1 revenue of $6.3m and wallet share of 5.5%.

– Written by Dealogic Research

Data source: Dealogic, as of June 30, 2018

Contact us for the underlying data, or learn more about the powerful Dealogic platform.