Global volume takes off amid fall in activity

Global syndicated loans volume grew by 11% year-on-year and stand at $2.75tr for the first half of 2018, even with a crumbling activity level (down by 575 deals year-on-year). While refinancing and amendments, which account for 58.4% of H1 volume, are unsurprisingly dominant, the growth of new M&A-related deals from 19.3% in H1 2017 to 25.4% this H1 has undeniably helped to boost volume. Main contributors to such M&A deals have been financial sponsors, who saw LBO volume increase by $38.6bn year-on-year, and jumbo IG acquisitions like Walt Disney, Takeda, Cigna, and Hochtief.

Financial sponsors growing LevFin footprint

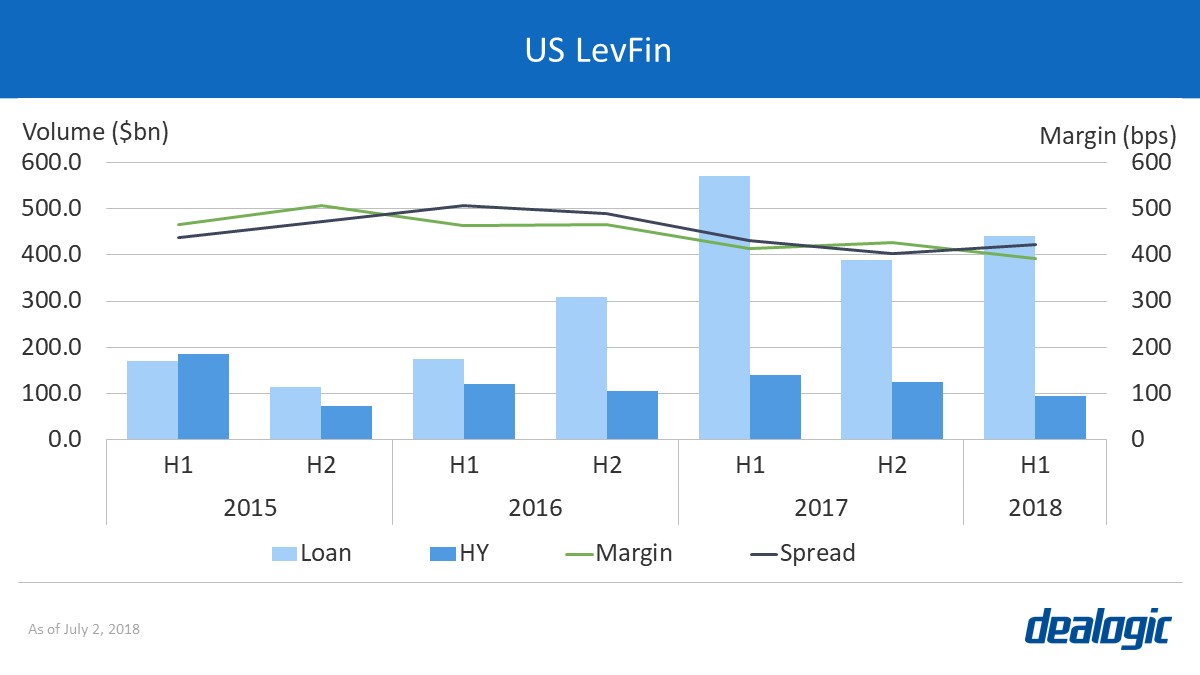

Leveraged finance (institutional loans and high-yield bonds) generated $6.8bn in revenue across the US and Europe this first half, down by 8% from H1 2017, which was a record half due to the high level of activity. Financial sponsors, the key driver for revenue, have increased their wallet share from 52.5% in H1 2017 to 59.1% in H1 2018.

In the US, the LevFin wallet fell to $5.5bn, which has been a result of lower HY fees. Revenue from HY fell more dramatically than volume to $1.3bn—down by 25% since H2 last year. On the other hand, fees from US LevFin loans increased, but only by 18% to $4.1bn compared to H2 2017. Lower HY volume and revenue came amid a decrease in institutional loans pricing by 35bps (averaging 392bps in H1 2018) and an increase in HY spreads by 20bps (averaging 422bps) compared to H2 2017.

Revenue for deals marketed in Europe on the other hand increased by 24% compared to H1 2017. It received a boost from the sharp rise in new LBOs’ wallet share in the region, which grew by 16 percentage points year-on-year.

IG revival boosts US volumes

Americas loans volume stands at $1.71tr for H1 2018, up by $220.9bn from the same period last year. Meanwhile, activity levels have fallen by 81 deals to 2,296, continuing the decrease since the start of 2017.

2018 reached a record-breaking H1 for syndicated loans in the US; volume stands at $1.57tr this first half, an increase of 11% from H1 2017. With a jump of 51% to $397.5bn, new M&A-related US loans are also at record H1 levels. IG lending spurred on this increase, accounting for 51.2% of new M&A-related volume signed—up from 28.5% last H1.

The driving force behind the US market was the revival of IG deals this H1, up in both volume and share by 48% and 12 percentage points, respectively. Contrasting this is leveraged lending, which saw a decrease from $917.9bn to $839.6bn year-on-year, driven by decreases in refinancing by 9% whilst new M&A-related lending was up 3%.

Refinancing and M&A fuel EMEA volume

EMEA loans volume for the first half of 2018 totaled $635.7bn, up from H1 2017 by 14%. The increase in deal size from $526m to $783m is hiding a more significant fall in activity from 1,061 to 811. Western Europe, the usual driver of EMEA volume, accounted for 73.3% and reached $466.3bn in H1 2018—witnessing a 14% year-on-year increase.

New M&A financing volume is on the rise compared to H2 2017 with $222.2bn this H1. Year-on-year volume is up by 40% and deal activity reached 171, bettering H1 2017, which recorded only 159 deals. From an investment-grade perspective, refinancing saw a 23% increase year-on-year to $212.6bn, and has been the primary reason for borrowers to come to the market. With $619.3bn due to mature by 2022, refinancing will continue to be the dominant element.

„In EMEA overall IG loan volumes in H1 2018 are up compared to the same period in 2017 and this has been driven by an increase in both refinancing and M&A financing activities. Volumes have largely been driven by borrowers seeking to refinance their core bank facilities ahead of time to take advantage of the liquidity and favourable terms available in the bank market.

Aside from the traditional one year Turkish bank loans, activity in the emerging markets has been somewhat muted although South Africa has provided some welcome deal flow for international banks as a number of corporates have followed their Western European peers by refinancing their core banks facilities ahead of time against the backdrop of a more stable political environment as well as the buoyant market conditions.

David Pepper

Head of EMEA Loan Capital Markets, BAML

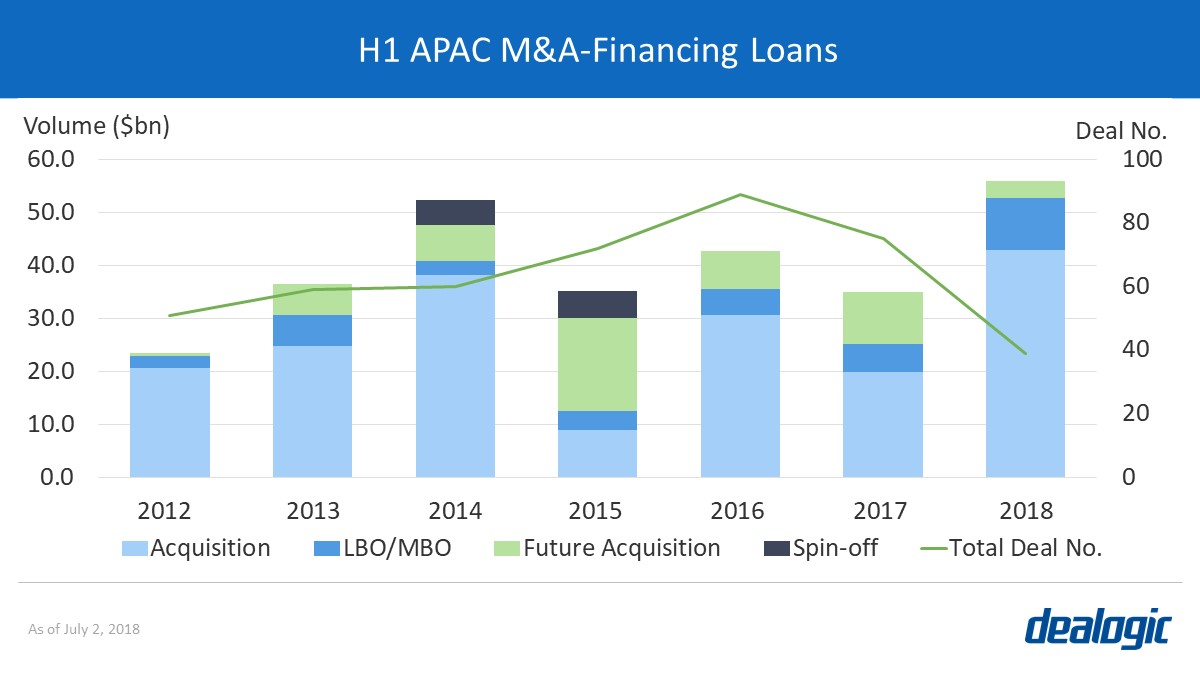

APAC’s new M&A illusion

Overall APAC (ex-Japan) loans volume fell 10% to $229.1bn in H1 2018, while Japan was boosted by acquisition volume and grew 35% to $161.5bn. The jumbo-acquisition wave has swept across APAC and fueled H1 loans volume, reaching $55.9bn, the highest H1 since 2007. Takeda Pharmaceutical’s $30.8bn bridge facility for Shire, the Bain-led $17.9bn buyout fundraising of Toshiba Memory, and ASE Industrial Holding’s $3.0bn merger explain the swing in volume. Those three deals accounted for 92.5% of total new M&A-related loans volume in the region. Coupled with declining activity, this depicts a more subdued M&A-related loans market. In fact, such deals in APAC (ex-Japan) only reached $15.5bn this H1, down by 32% year-on-year.

Refinancing has once more dominated the market, reaching heights of $86.3bn and taking 37.7% of market share in the first half—up by 10 percentage points from H1 2017 as Asian borrowers focused on taking advantage of better interest rates. With $668.0bn in outstanding loans (excluding project finance) due for APAC (ex-Japan) borrowers by 2022, refinancing is likely to be the dominant reason for borrowers to come to the market in the near future.

„Whilst overall volumes were down in the APAC loan market in 1H 2018, the market was boosted by an increase in event driven loan volumes on the back of a handful of jumbo M&A financings. The outlook for the second half remains encouraging with requirements across M&A, PF, capex and refinancing expected to support activity.”

Amit Lakhwani,

Head of Loan Syndicate & Distribution, Asia – Standard Chartered

– Written by Dealogic Research

Data source: Dealogic, as of July 2, 2018

Contact us for the underlying data, or learn more about the powerful Dealogic platform.