Record issuance on US convertibles

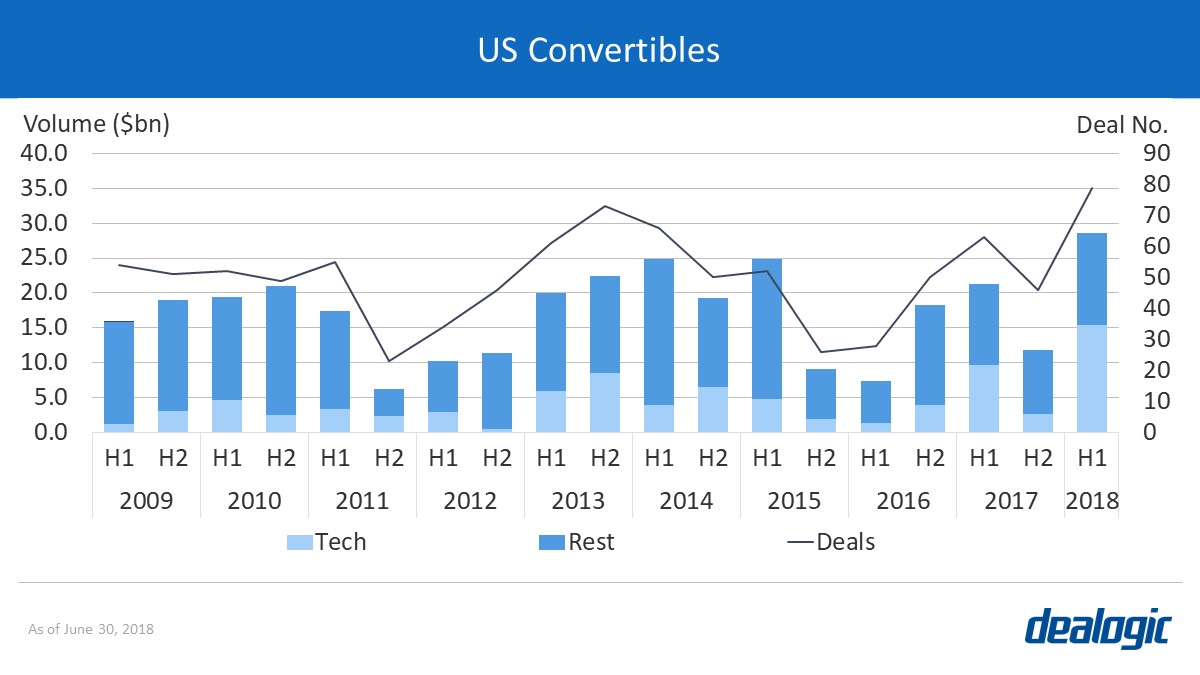

One of the highlights for global ECM in H1 2018 is the rapid expansion of US convertible bonds. In the first half, US companies issued a total of $28.6bn via 79 such deals—the highest half-year volume since H1 2008 ($51.5bn via 75 deals). This increase in issuance validated the expected ending of lower interest rates, and the credit cycle is ready to move on to the next stage. Companies are trying to lock in a lower coupon before the raising of interest rates.

Out of all the industries, technology companies took the biggest advantage in issuing convertible bonds. In H1 2018, US tech convertible issuance stood at a record $15.4bn via 31 deals. It marked the highest half-year volume ever, surpassing even the dot-com bubble (in H1 2000, with $13.1bn via 31 deals).

Changing regulations in Asia

Q2 2018 saw the proposal and implementation of new listing regulations in several stock exchanges in Asia. Hong Kong and Singapore finished consultations of the weighed voting rights structure (WVR structure) in April. So far, 3 companies had applied to list under the WVR structure in Hong Kong (Xiaomi, Meituan Dianping, and Zhaogang.com), with Xiaomi scheduled to list this month after raising $4.7bn on 29 June. The new rules in Hong Kong also allow pre-profit biotech companies and innovative companies with a weighed voting structure that are currently listed overseas to apply for a secondary listing. Meanwhile in China, CSRC completed the consultation of Chinese Depositary Receipts (CDR) listing in early June. All these new proposals could mean more Asia-based companies, especially those from China, may reconsider their listing location.

Among the 255 new listings in US with a WVR structure priced between 2009 and H1 2018, China led by nationality with 55 deals and raised $16.4bn, contributing to 47.0% of the total amount raised by all foreign companies in the period. With the new listing regulations, Chinese companies that are currently listed in the US could look for secondary listings via CDR in China or a dual-class offer in Hong Kong/Singapore if they prefer to keep their existing share structure.

The return of Southeast Asia

Southeast Asia has recovered from its slump in the past few years and recorded the highest half-year volume and activity since H1 2013. The increase was led by issuance in Vietnam—with the then-record $923m IPO of Techcombank followed by the current record IPO from Vinhomes IEO for $1.3bn priced 9 days after. Whether this trend will continue is questionable though, as both companies recorded a negative return on debut (Techcombank plummeted 20.0% while Vinhomes had a 3.7% drop).

Meanwhile, Singapore saw the return of Real Estate Investment Trust capital raisings in the equity market, with 7 issuers raising a total of $1.3bn through accelerated placements and preferential offerings in Q2 2018. DBS and Citi were appointed as joint bookrunners in all of these accelerated placements. The 10 deals (raising $1.7bn) from the sector between January and June had the highest first-half volume and activity since 2013.

Adyen priced but withdrawn IPOs hit a new record in EMEA

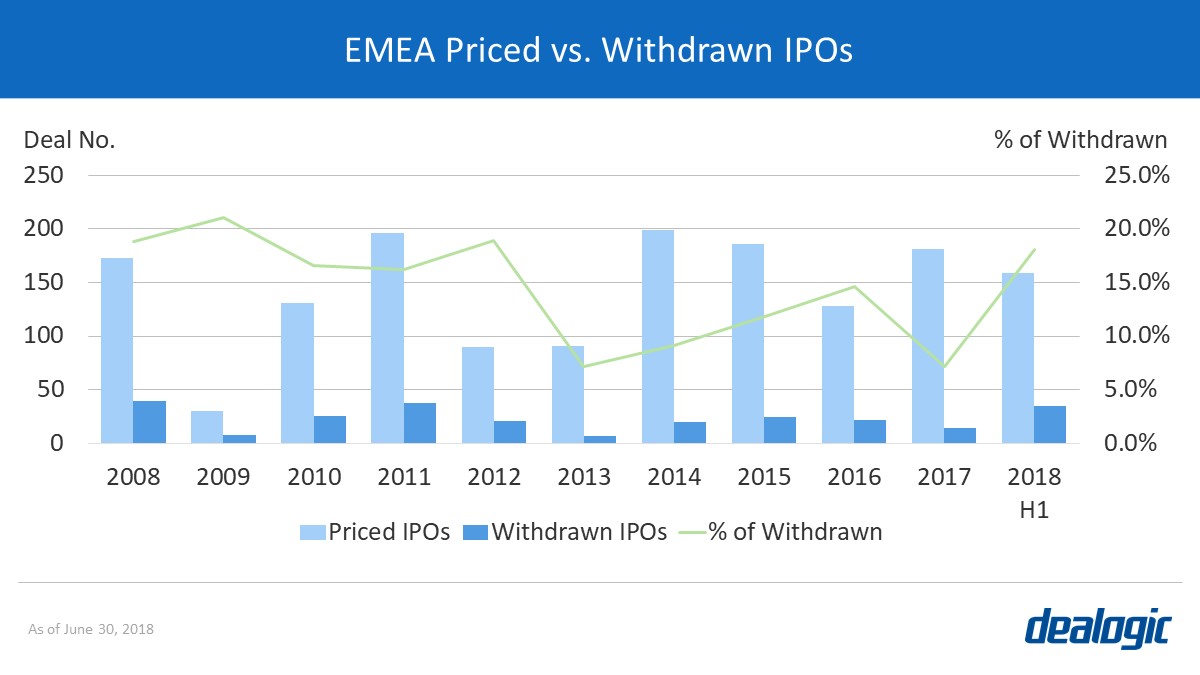

Despite a 12% decrease in EMEA’s IPO activity compared to H1 2017 (181 IPOs), regional IPO volume stood at $28.4bn—the highest H1 volume since 2015 ($39.2bn via 186 IPOs). Q2 2018 priced Adyen BV ($1.1bn), the third-largest EMEA IPO of H1 and the fourth-largest EMEA fintech IPO ever. Adyen closed on its first day of trading at 89.6% above its offer price. This was the largest first-day increase from the offer price for a $50m+ IPO in Europe since ARC International in 2000, which closed 103.8% above its offer price.

However, a strong dollar, primarily due to monetary tightening by the US Federal Reserve, along with other macroeconomic and political factors, had a notable impact on EMEA IPOs. The pipeline saw 18.0% of its IPOs withdrawn in the first 6 months of 2018, the highest H1 proportion since 2012 (18.9%). 159 IPOs have been priced in EMEA in H1 2018 compared to 35 withdrawn, of which 26 were pulled in Q2 2018.

Turkey and France have been the most affected countries, pulling 5 IPOs each in H1 2018 compared to 6 and 8 priced, respectively. These withdrawn deals spoiled what was supposed to be a bumper year for Turkey’s equity market. Nonetheless, Turkey hit the third-highest H1 in IPO proceeds this year ($1.3bn). The country ranked third along with France for number of withdrawn IPOs by nationality, following Brazil. Italy and the UK shared the fourth position globally, pulling 4 IPOs each.

Bayer’s RI largest Q2 ECM deal & EMEA ABBs see tighter discounts

With the completion of Bayer AG’s $7.0bn rights issue, initially announced in 2016, EMEA saw the largest ECM deal of Q2 globally and the second-largest in the first half. The UK government’s $3.3bn sell down in RBS was the fifth-largest deal of Q2 globally and the largest EMEA ABB since AIG’s sell down in AerCap Holdings in June 2015 ($3.5bn). The RBS transaction was priced with a premium discount of -3.62%.

Q2 2018 has seen the average discount on EMEA secondary ABBs falling to -4.50%. This is the lowest average for a quarter since Q2 2017 (-4.15%). The average discount of -5.02% seen in April, falling to -4.34% in May, was the lowest monthly average since last August (-3.45%), while the average discount in June was -4.54%. All EMEA secondary-share ABBs in Q2 this year accounted for 41.9% and 20.4% of EMEA’s follow-on volume ($37.2bn) and activity (294 deals), respectively. In comparison, primary-share ABBs contributed 15.3% to EMEA’s follow-on proceeds and 24.8% of its activity.

– Written by Dealogic Research

Data source: Dealogic, as of June 30, 2018

Contact us for the underlying data, or learn more about the powerful Dealogic platform.