DCM issuance slows down in Q2

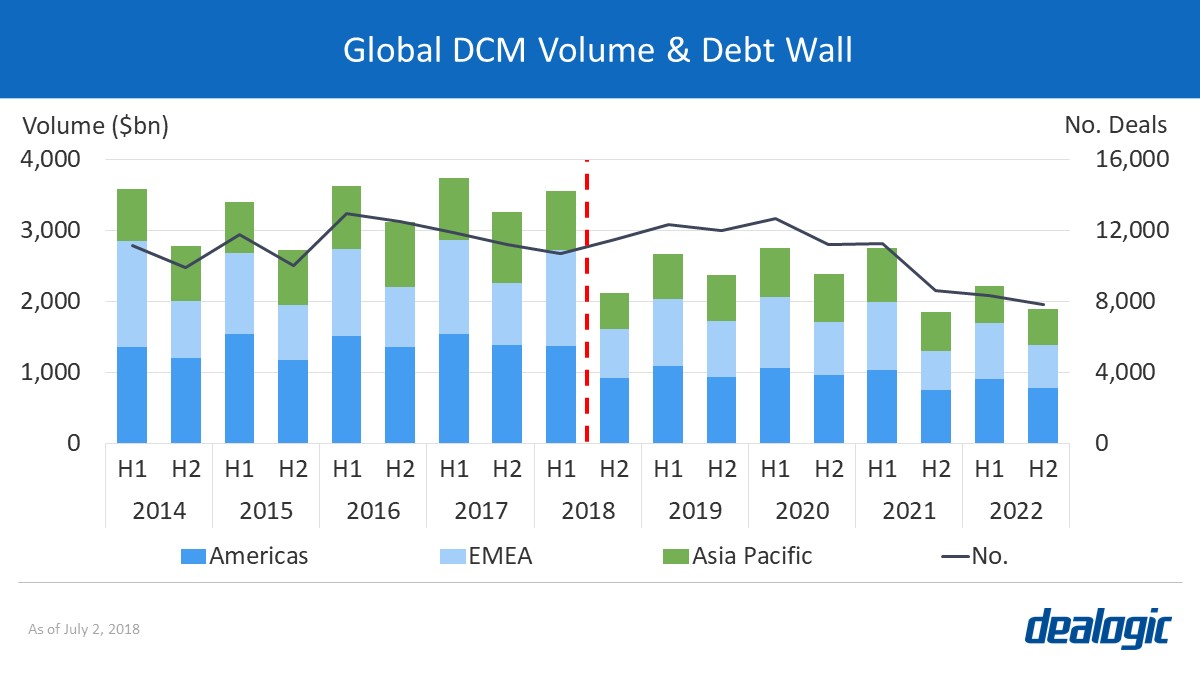

Global bond markets—initially spurred by one of the strongest first quarters on record ($1.95tr of volume issued from January to March 2018)—started to show some signs of exhaustion, with issuance in Q2 totaling $1.68tr from 5,110 transactions. This is the lowest second-quarter volume in the past 3 years, and lowest Q2 number of deals in the past 6. Only thanks to the year’s initial momentum, issuance this first half registers at a hefty $3.64tr of volume sold from 11,005 deals. Nonetheless, these figures are down 3% and 7%, respectively, compared to the same period last year.

Bond activity continues to be affected by news of interest rate hikes and market reaction to the current political environment. All these signals, mixed with instability in other markets, raise questions pointing to the end of the current credit cycle. Deal pricing remains highly changeable, although the data shows a downward trend for the past 3 months. January 2018 holds the largest January volume on record ($771.6bn of paper sold) and the second-largest monthly total after June 2007. In June $490.2bn worth of bonds were issued from 1,373 transactions, the lowest amount of deals issued on this month since 2000.

Revenues reflect higher competition

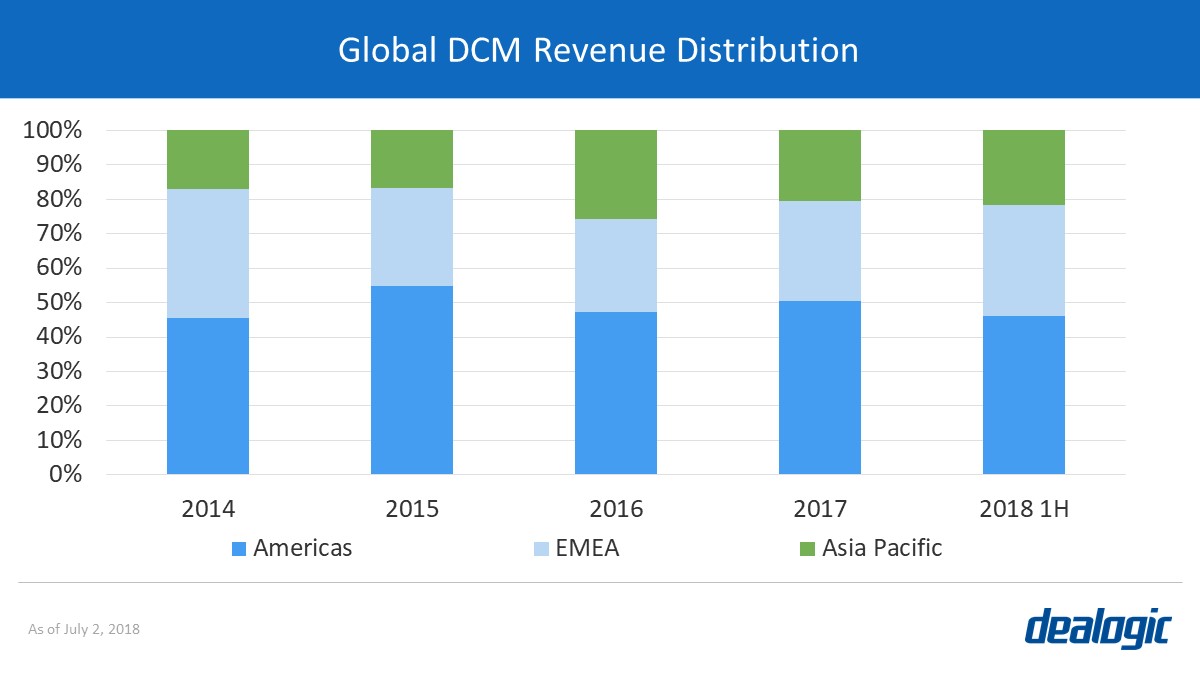

By region, EMEA was the only one increasing the volume issued year-on-year: a 4% increase to $1.38tr issued in H1 2018, despite a 5% decrease in number of deals. Americas volume decreased 9% to $1.41tr and Asia Pacific went down 2% to $850.6bn. When looking at H1 revenue paid to underwriters, the trends show a 3% increase in EMEA (from $3.4bn paid in 2017 compared to $3.5bn this year), a 15% decrease in Americas ($5.1bn paid in 2018), and a slight 3% fall in Asia Pacific (to $2.3bn of revenue paid by Asian clients). Volume variations compared to revenue paid by issuers show fee compression and highlight the fierce competition in bond markets these days.

From all deal types, non–investment grade bonds are the asset class bearing the most significant relative decrease in fees paid by issuers: $2.5bn in H1 2018, down 25% year-on-year, whereas volume went down 20% to $251.3bn. The trend is more accentuated for high-yield deals included in the leverage finance market: a 23% decrease in volume to $148.3bn, whereas revenues declined 30% to $1.7bn. This comes amid a time when the average HY spread is going up in Q2, in both the US (449.29bps) and Europe (466.35bps), and covenant terms on these deals remain highly disputed between investors and issuers. In this environment, borrowers show preference for the loans market, which currently offers lower yields.

So where do bond proceeds flow into these days? Available data show general purposes decreased 11% year-on-year to $1.84tr in H1 2018. Meanwhile, refinancing grew 5% to $462.6bn, and permanent financing for acquisition purposes grew 57% to $169.8bn this first half. Walmart and Bayer priced $16.0bn and $15.0bn transactions in June for their respective acquisitions of Flipkart and Monsanto. Vodafone also issued an M&A-related bond for $11.5bn to finance its purchase of Liberty Global’s European assets. Together with acquisition-related bonds, only sovereigns were able to keep pace on mega deals: Qatar ($12.0bn) and Saudi Arabia ($11.0bn) both came to market in April, although more emerging governments kept pace with smaller deals. In addition, Spain has sold so far this year $20.3bn equivalent in bonds.

EMEA first half on par with 2017

The only region to increase bond sales this first half of 2018 was EMEA. The 4% increase to $1.38tr in H1 2018 was not matched by an increase of deal activity, and average deal size grew from $389m to $427m. The bulk of this increase can be explained by higher activity from financial firms. FIG volume was up 15% to $452.7bn this first half from $394.0bn in the same period last year—making this the highest H1 volume since 2014 ($498.0bn).

The increase came from all segments except subordinated debt. Notably, senior resolution debt (non-preferred and holdco) increased 42% year-on-year to $103.3bn. Sovereign, Supranational, and Agency (SSA) volume continued taking the lion’s share of DCM volume in the region with $506.9bn from 976 deals. Nonetheless, this volume represented a 6% drop from $541.3bn issued in H1 2017 via 1,079 transactions. Corporates kept pace with $345.4bn issued in H1 2018, although their increase (1%) is not as significant as their enlarged average deal size, from $412m in H1 2017 to $487m this H1.

The announcement by the ECB confirming the end of quantitative easing at the end of the year seems too recent to affect market behavior. Issuance in the second quarter followed the yearly cycle and went down compared to Q1, but the volume issued ($596.1bn) still shows similar levels of activity compared to past years. Euro-denominated average spread over benchmark in the corporate sector was 187.7bps in H1 2018, very close to 188.6bps in H1 2017. FIG spreads were down 17% to 94.2 bps from 105.1 bps. On the other hand, SSA spreads widened 13% to 65.6 bps from 58.3 bps. All sector spreads decreased from the previous semester in 2017. Amid this environment, euro-denominated volume went up from $521.5bn in H1 2017 to $876.2bn this year, of which $771.5bn were sold by EMEA issuers. US issuers sold $59.2bn of such deals, 27% more than the same period last year—ranking fourth behind German, French, and Spanish borrowers. Meanwhile, issuance in British sterling totaled $111.6bn this first half and performed slightly better than the two semesters of 2017.

Asian markets slow down amid China concerns

After a busy 2017, when issuance peaked in different segments, Asian markets showed a slight downward trend this year. This is illustrated by APAC international G3 bond sales in H1 2018: $232.68bn from 445 transactions. Volume and activity were higher than all historical years, except for both halves of 2017. Despite a remarkable first quarter ($130.7bn), issuance steadily dried to a low $21.2bn issued in June, giving the second quarter an issuance of $101.8bn via 205 transactions.

Chinese issuers remained the most active on the G3 market despite decreasing activity ($49.9bn and $44.3bn sold in Q1 and Q2, respectively). In contrast, their issuance in the local currency went upwards in the past 3 months (26% up from Q1 to $174.3bn in RMB this Q2). Nonetheless, there are mounting concerns on the increasing number of defaults that Chinese bonds are falling into. Bankers in the region are reportedly emphasizing to Chinese firms the importance of rating the debt in order to ensure investor commitment on the deals.

Outside of continental Asia, Japan experienced an increase of bond issuance in the second quarter of this year with $75.1bn distributed amongst investors. However, this figure was not enough to get the half-year activity ($142.1bn from 508 deals) past the issuance registered in the two halves of 2017. The Australia domestic market also saw a slight drop after a booming 2017, down year-on-year by 7% in volume to $64.3bn this H1. The dip is attributed to local borrowers, since kangaroo issuance by non-resident issuers recovered in H1 2018 with $14.3bn, registering a 21% increase year-on-year.

US-marketed CLOs are back

Similar to the regional trend (Americas down in H1 by 9% to $1.41tr), US-marketed issuance decreased 5% year-on-year to $1.62tr. Deals done went also down 11% to 3,942. This is the lowest H1 volume and number of deals in the past 6 years. This performance reflects a stagnation of corporate, FIG, and SSA debt: down 11%, 9%, and 14% year-on-year to $538.0bn, $329.3bn, and $325.5bn, respectively. Economic policy pursued by the Fed seems to have gradually affected bond markets, whilst fears of a recession continue to spread.

Only securitizations achieved a remarkable performance in 2018: $426.2bn issued from 775 deals, the highest volume in the past 6 years. These figures could be considered positive; however, they need to be read with caution: Collateralized Loan Obligations (CLOs) increased their volume by 51% year-on-year to $107.3bn sold in 2018. The remarkable pace at which these deals are growing is raising concerns. Banks repackage leveraged loans (i.e. non–investment grade loans to corporates) and sell them in the bond markets via CLO transactions. With this transfer of risk, they are able to remove hazardous assets from their balance sheets. The boom in leverage loans and their effect on debt markets are mounting speculation about another bubble that could bring serious consequences to financial markets.

– Written by Dealogic Research

Data source: Dealogic, as of July 2, 2018

Contact us for the underlying data, or learn more about the powerful Dealogic platform.