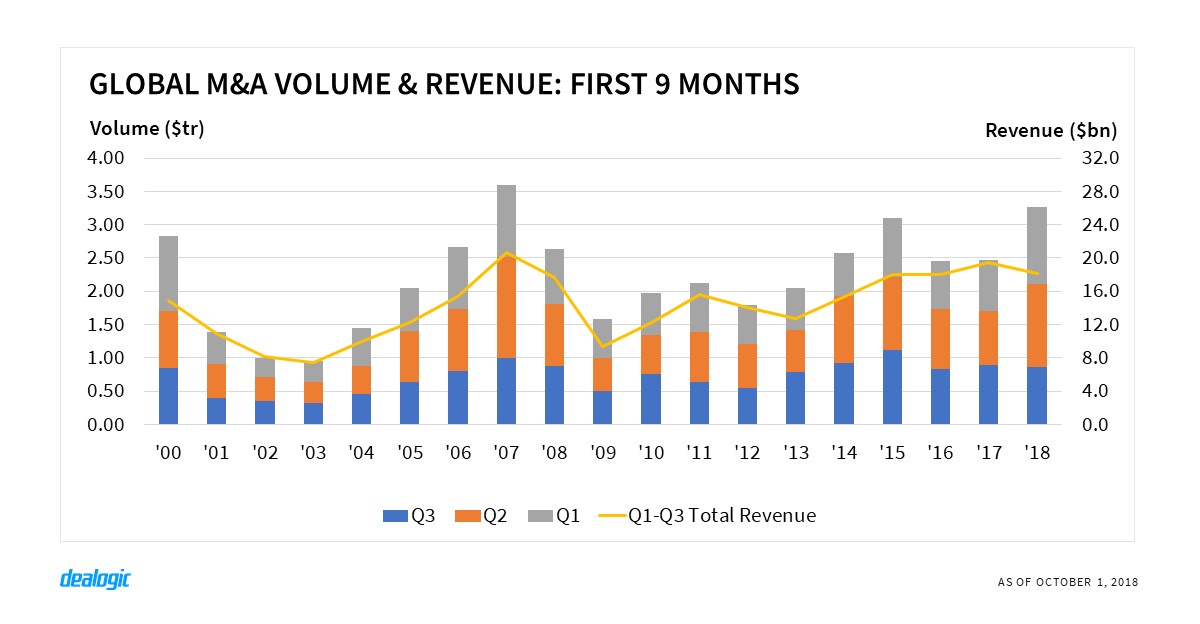

Global volume still ahead despite Q3 slowdown

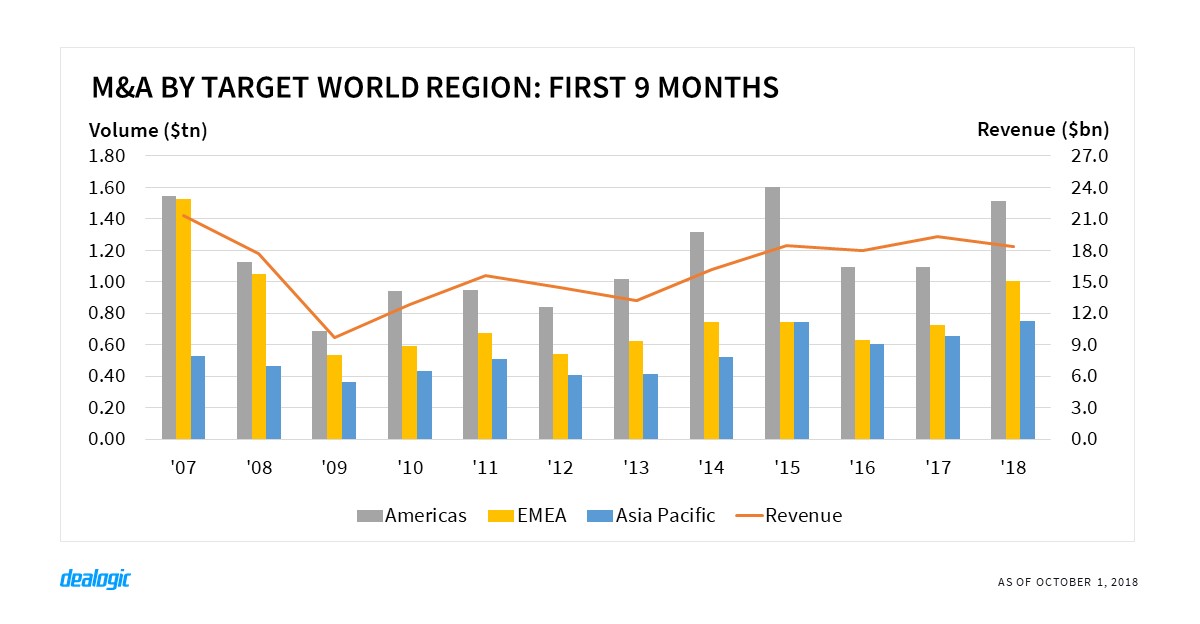

After a strong first-half to the year which saw M&A volume hit an 11-year high, the third quarter has seen a pullback with global volume in Q3 down 5% year-on-year to $855.6bn, the lowest Q3 level since 2016 ($837.5bn). The weaker quarter was driven by a downturn in volumes across EMEA-targeted and Asia Pacific-targeted deals, which were down 15% and 18% from Q3 2017, respectively.

Despite the slow quarter, total volume for the first 9 months of $3.27tr was still up 32% year-on-year, off the back of mega deals such as Takeda Pharmaceutical’s $81.5bn bid for Shire—the biggest deal this year—and has reached the highest first-9-months level since 2007 ($3.60tr).

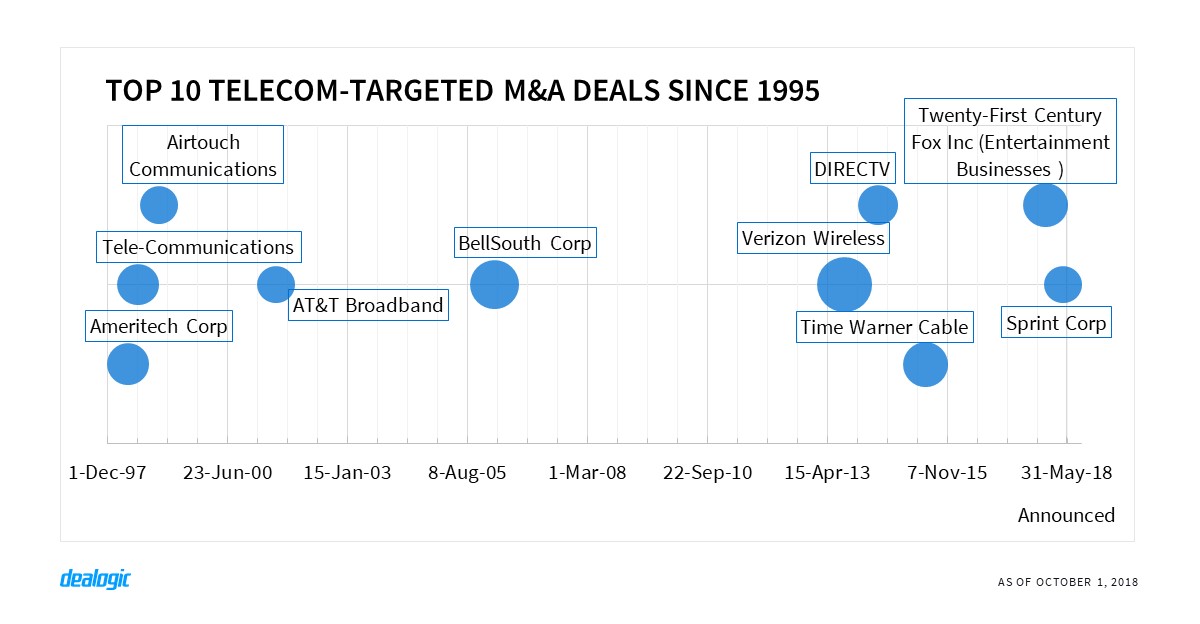

Telecom attracts global investment

Digitalization and technological innovation in the telecommunications industry has seen increasing interest from investors worldwide. Global telecom-targeted M&A volume reached $277.9bn in the first 9 months of the year, the highest level for the period since 2013 ($302.8bn) and was up 53% compared to the same period in 2017.

Competing bids for the acquisition of Sky by Comcast Corp ($53.3bn), plus the $59.0bn tie-up between T-Mobile US and Sprint Corp, have contributed to the year-on-year spike. Targets in EMEA ($134.2bn) and North America ($115.7bn) continued to lead sector volume, while in China telecom was the most targeted industry in the first 9 months ($116.9bn).

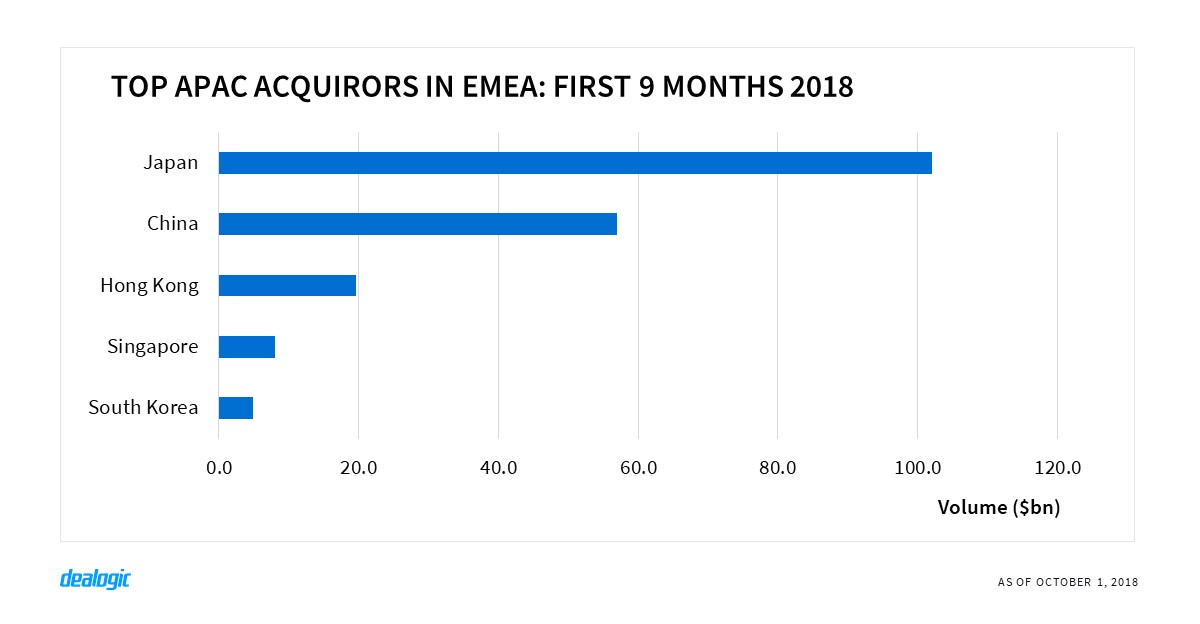

APAC momentum into EMEA continues

Despite the general drop in global M&A activity in the first 9 months, transactions involving an Asia Pacific-based company totaled $1.07tn via 10,749 deals—the highest first-9-months level on record. Asia Pacific companies and investors continued to target EMEA-based businesses, with cross-border volume also setting a record of $202.8bn and was up 162% compared to the same period in 2017.

Though the largest APAC acquisition into EMEA this year was Takeda Pharmaceutical’s $81.5bn bid for Shire in May, the momentum has continued with a notable increase in the number of deals more than $5bn in size in Q3. There were three $5bn+ deals announced in Q3 2018, which made it the most active quarter on record alongside Q4 2006 for such deals. CK Hutchison announced a $16.3bn bid for a 50% stake in Italy’s Wind Tre in July which was the biggest deal in EMEA’s telecommunication sector in the third quarter. Boosted by inbound deals from APAC, overall EMEA-targeted M&A volume reached $1.00tn, the highest first-9-months level in a decade ($1.05tn in 2008).

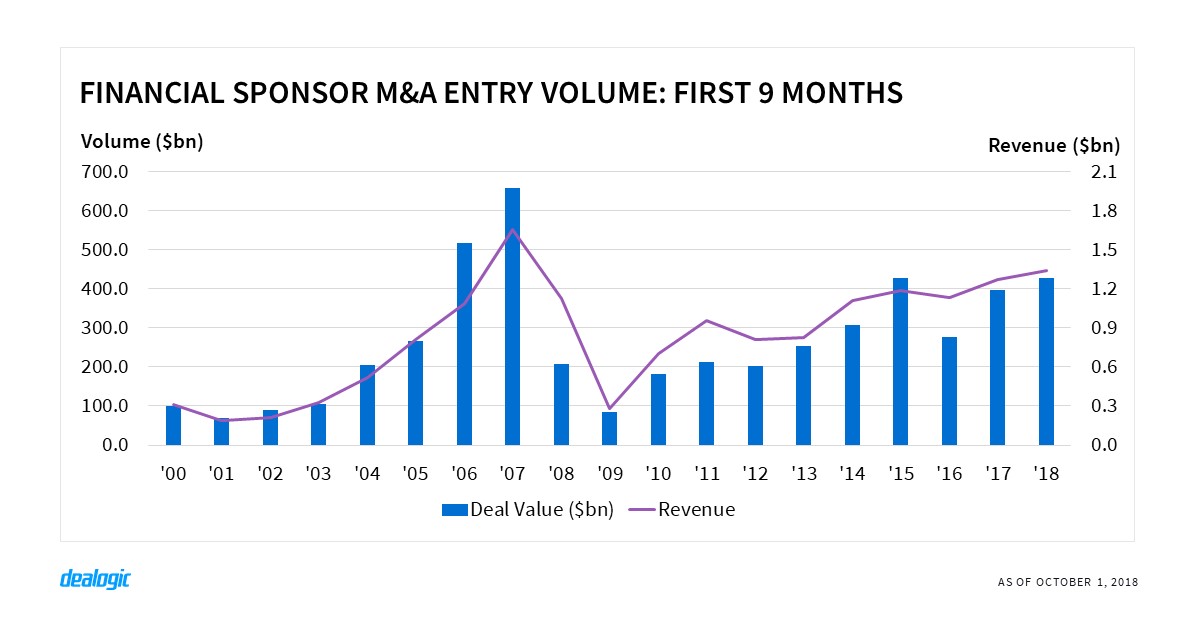

Sponsor entries continue to rise

Financial sponsor entry volume has climbed steadily this year, totaling $427.9bn via 2,199 deals—the highest first-9-months level since 2007 ($657.8bn via 3,338 deals). This also represented a year-on-year 8% increase in volume and an 11% decline in deal activity.

One region that has seen a substantial uptick in financial sponsor activity this year is India. Financial sponsor entries into India-based companies surged to the highest first-9-months volume on record with $20.9bn via 49 deals. The most targeted sector by activity was the technology sector with $2.2bn via 14 deals, indicating that sponsors continued to favor India’s lively software industry.

– Written by Dealogic M&A Research

Data source: Dealogic, as of October 1, 2018

Contact us for the underlying data, or learn more about the powerful Dealogic platform.