Global volume—a tale of two cities

A total of 6,984 syndicated loan facilities were completed in the first 9 months of 2018, down 9% on the comparable 2017 period and a 6-year low for deal activity (6,563 loans in the first 9 months of 2012). Global loan volume on the other hand, reached $3.81tr, which was up 9% over the period. Despite overall year-on-year growth, Q3 2018 was a lacklustre quarter with both volume and activity falling by 17% and 27% respectively—the lowest Q3 level since 2012.

The third quarter also saw a continuation of jumbo facilities across the investment-grade and leveraged space, with Saudi United’s $11bn debut syndicated loan, and Blackstone’s $10bn financing for the buyout of Thomson Reuters’ Financial and Risk business.

The technology sector topped all industries in the first 9 months, accounting for a 10.1% share of volume, which was up 0.4 points from the same period last year. Jumbo facilities represented 17.4% of deal activity in that sector and accounted for 67.4% of the volume generated. This mirrors a global trend where 941 jumbo deals were responsible for $2.43tr in volume.

LevFin—is the tide turning?

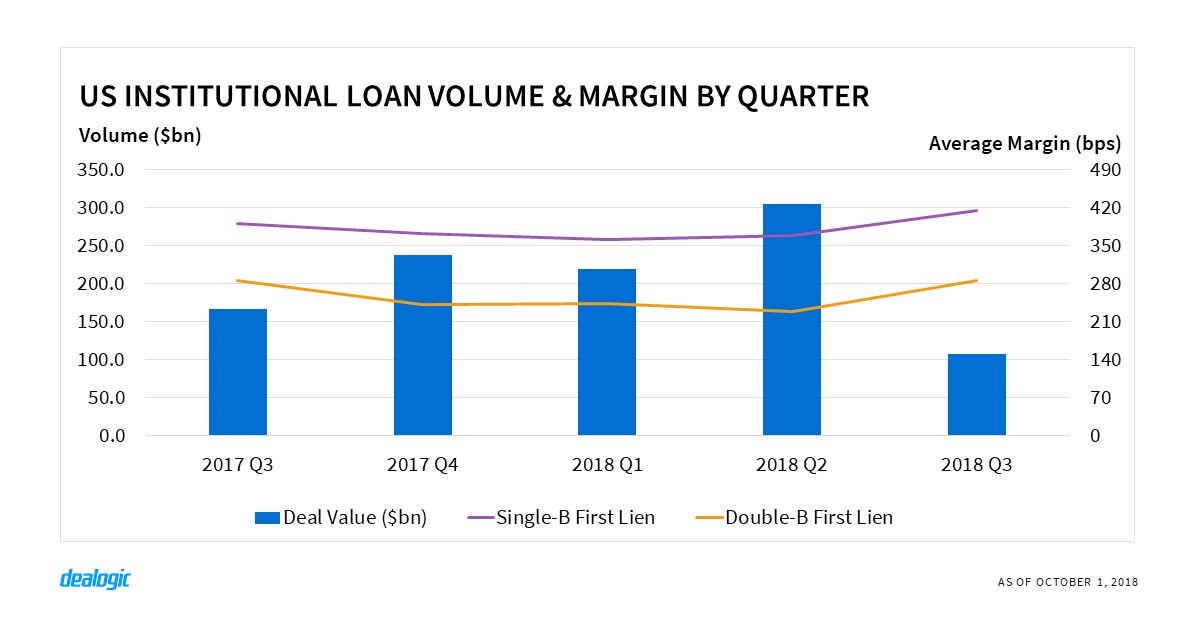

The LevFin market has seen a shift in the balance of power between investors and borrowers over the past month. Looking at US institutional loans, average margins for double-B and single-B first lien facilities moved upwards in the third quarter to 286.5bps and 414.6bps from 229.3bps and 368.6bps in Q2 2018 respectively. Despite rising margins, together with less borrower-friendly market determinants, US institutional loans have remained active with 1,154 deals done in the first 9 months, up by 89 deals year-on-year.

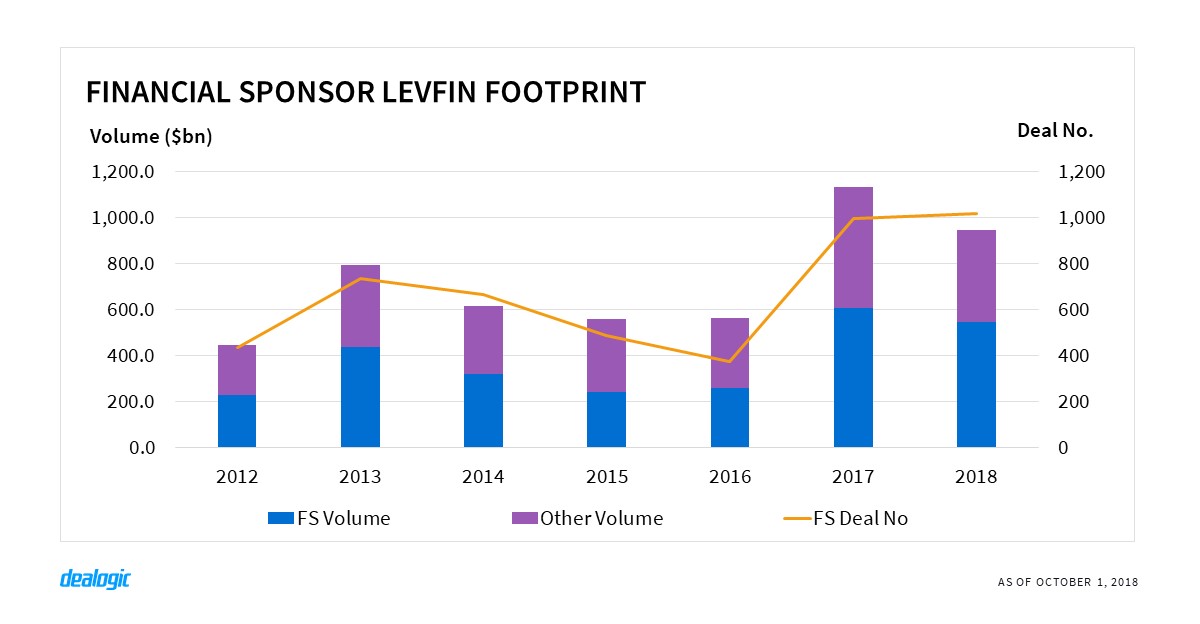

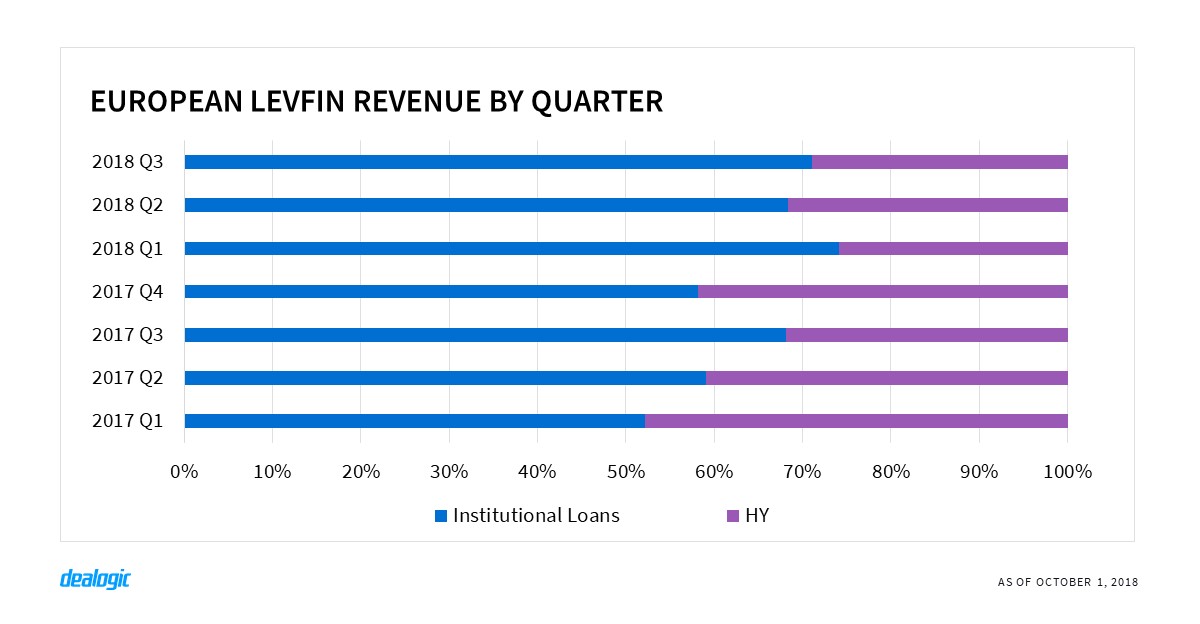

Financial Sponsors have also been more aggressive with portability provisions and weaker investor protection on the high-yield front, accounting for 57.6% of total LevFin volume in Europe and the US in the first 9 months. Such provisions did not hinder investors from oversubscribing to Refinitiv’s $5.5bn high-yield facility that priced in September.

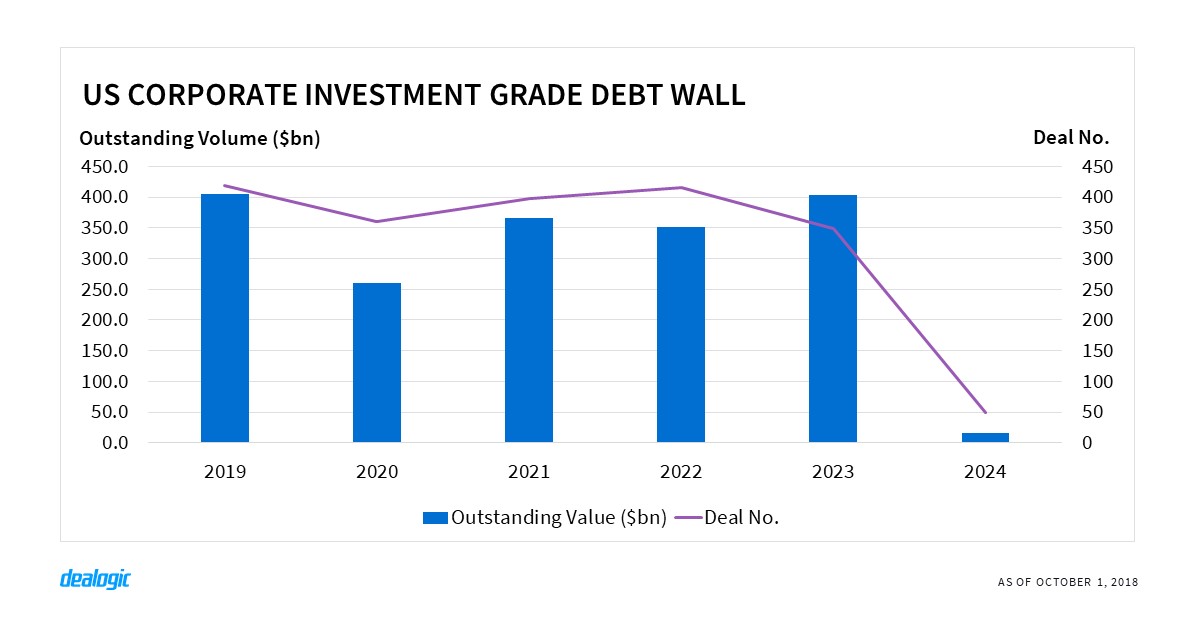

US corporate IG expanding debt wall

In the first 9 months, the Americas accounted for 61.7% and 47.5% of global syndicated loans volume and activity respectively. Unsurprisingly, the Americas increased its market share of global volume and deal flow by 1.1 and 2.0 percentage points year-on-year respectively and has been the key driver behind global growth.

US corporate investment grade volume in Q3 2018 stood at $215.3bn, up by $19.2bn from Q3 2017, but activity plunged to 152 deals from 190 over the same period. While refinancing and amendments accounted for the lion’s share of use of proceeds with a 65.7% share in the first 9 months, new acquisitions nearly doubled to $229.6bn from the $122.8bn reported in the same period last year. The significant year-on-year volume increase to $843.5bn in the first 9 months of the year ($572.5bn in the first 9 months of 2017) paves the way for future refinancing opportunities. By the year 2023, there will be a total of $1.79tr worth of US corporate investment grade debt outstanding.

EMEA—Jumbo deals mask falling activity

For the first time since 2014, less than 1,500 facilities were completed in EMEA in the first 9 months of the year. Western Europe saw volume climb to $629.7bn, while the rest of EMEA was more subdued with a decrease in both volume and activity.

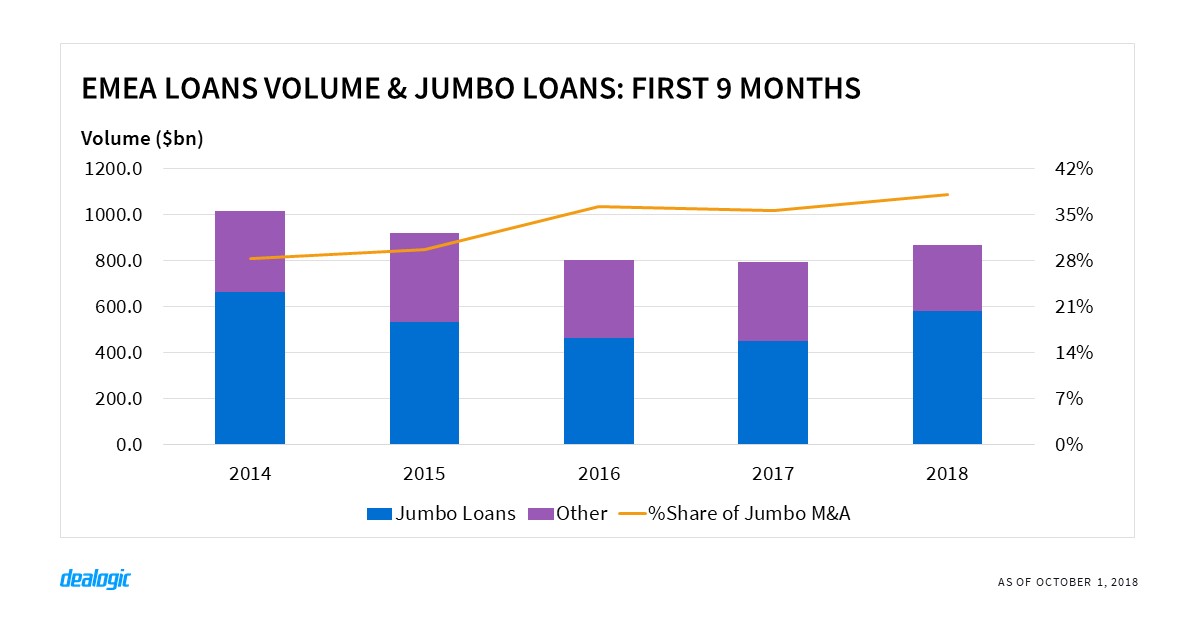

EMEA loans volume jumped to $865.3bn in the first 9 months and was inflated by jumbo* loans which accounted for 67.1% of volume, up by 10.2 percentage points year-on-year. New M&A-related deals accounted for 37.9% of jumbo facilities in the region with only 63 deals so far this year. It is important to note that 45.4% of jumbo new M&A facilities in EMEA were cross-border, such as the Sivantos/Widex $3.4bn financing.

APAC (ex-Japan)—M&A and Project Finance stall

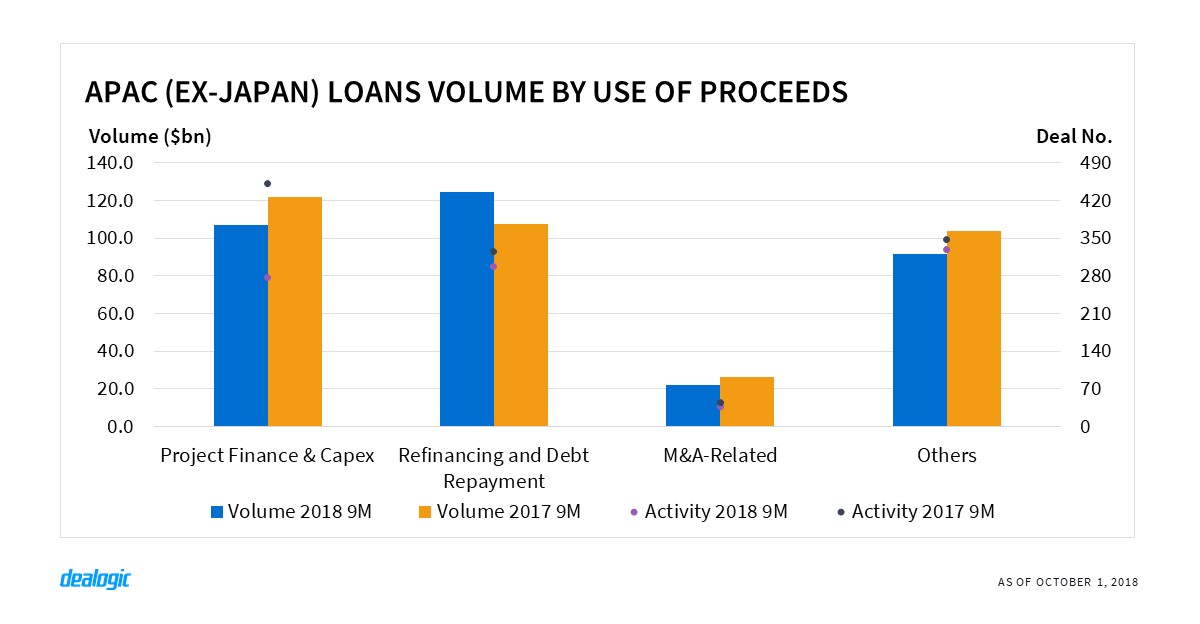

APAC (ex-Japan) marketed volume and activity saw year-on-year declines of $14.1bn and 229 deals respectively for the first 9 months of 2018. The 4% decline in the region brought volume down to $345.4bn. Much of the decline can be attributed to a relatively slow Project Finance and capex market which fell by $14.9bn compared to the first 9 months of 2017. While China volume ($116.9bn) was more or less on par with the same period last year ($119.1bn) despite the ongoing trade war with the US, the decline in Project Finance has largely affected India where volume plummeted to $21.9bn from $41.6bn. The bad loans crisis in India will not help to boost falling volume.

Refinancing, amendments, and debt repayment accounted for the majority share of the market with 35.6% of volume. New M&A-related loans have stalled compared to last year with volume declining to $4.3bn in the first 9 months—highlighting dwindling new money hitting the market.

*Jumbo loans are facilities greater or equal to $1bn

– Written by Dealogic Loans Research

Data source: Dealogic, as of October 1, 2018

Contact us for the underlying data, or learn more about the powerful Dealogic platform.