Global issuance in Q3 dips to 3-year low

Encompassing the Northern Hemisphere summer months, Q3 is historically not the strongest quarter for ECM issuance, and this year was no exception for most markets. Volume in Q3 2018 totaled $158.4bn from 1,230 deals, down 21% from the same period last year and marked the lowest Q3 level since 2015 ($146.9bn from 1,082 deals).

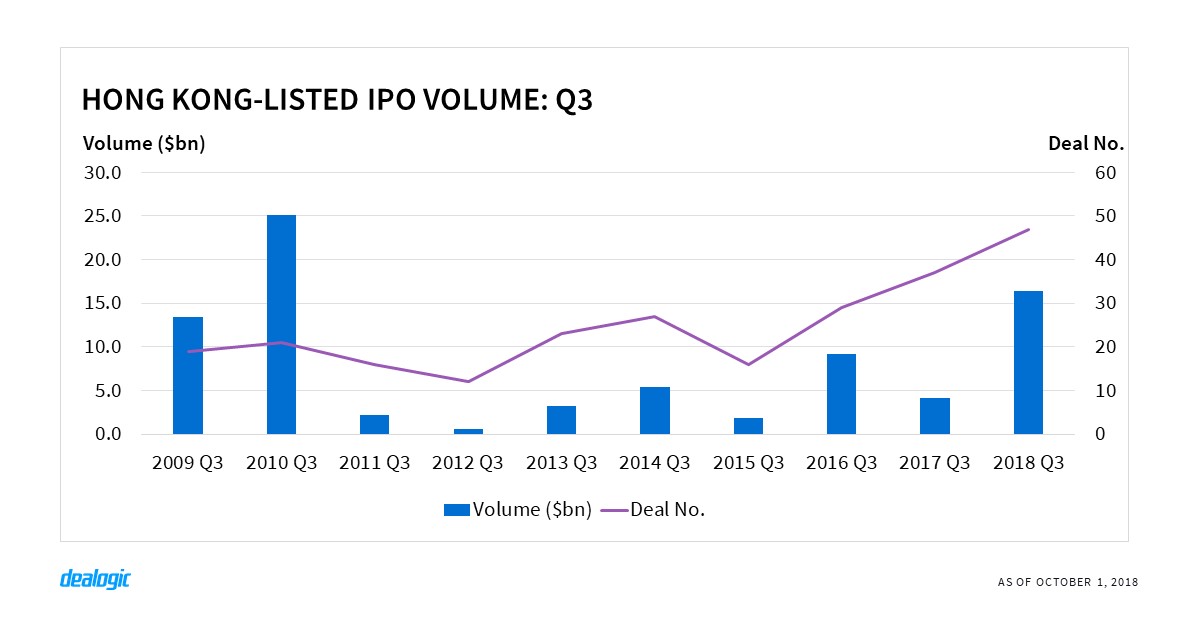

The breakout exchange region in Q3 was Hong Kong, which saw ECM issuance climb to an 8-year third-quarter high of $20.6bn from 90 deals ($49.6bn via 128 deals in Q3 2010). Changes to listing rules saw a Q3 record of 47 companies come to the market with an IPO, raising a total of $16.4bn, and driving record ECM volume.

Technology led all sectors globally, contributing to 21.9% of total quarterly deal volume. The $4.3bn sell-down of Yahoo Japan Corp by Altaba on September 11 was the third quarter’s largest tech transaction in the sector and second-largest ECM deal, as well as the largest ABB of a Japanese company on record.

Morgan Stanley topped the global ECM bookrunner ranking in Q3 with a 9.26% share and was followed by Goldman Sachs (9.25%) and JPMorgan (8.8%).

Hong Kong sets new Q3 record

IPO filings in the Special Administrative Region have surged since new listing rules were implemented in April, which encourages new economy companies to list in Hong Kong. A total of 126 IPOs were filed in Q3 2018 alone, with total draft filings in the first 9 months reaching 340—already up 48% from full year 2017 (230 filings).

The biggest listings of the quarter were from China Tower ($7.5bn) and Meituan Dianping ($4.2bn), which together with Xiaomi in June ($5.4bn) comprise 3 of the top 5 global IPOs in the first 9 months of this year. The multi-billion dollar listings have helped Hong Kong set a new Q3 record for IPO deal activity ($16.4bn via 47 listings) and leads United States’ exchanges in volume ($14.9bn via 62 listings).

Despite record issuance, the aftermarket performance has been mediocre. The stock price of companies listed in Q3 2018 has on average dropped by 16% from their offer price*. Confidence of retail investors has been muted as reflected by IPO subscription levels. Instances of the subscription rate hitting 15 times (the regulatory required level for a deal to claw back) dropped to 30% in Q3 2018, from 77% in Q2 2018.

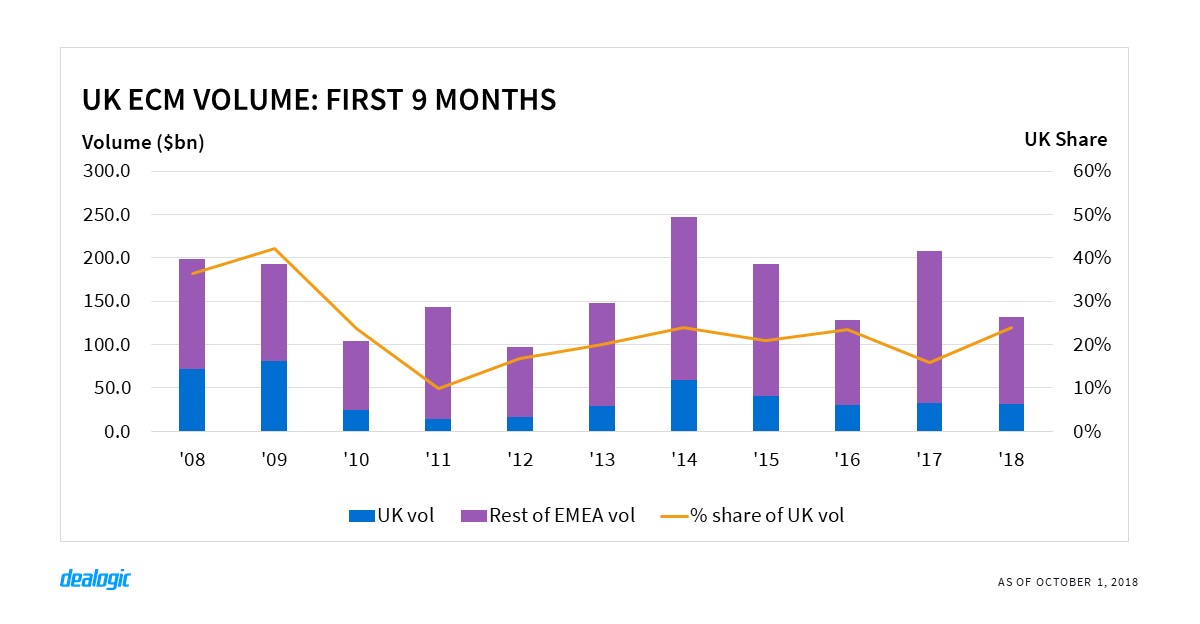

EMEA issuance weakens to 7-year low

ECM volume from issuers in EMEA fell to the lowest Q3 level in 7 years, totaling $26.6bn from 270 transactions, and down 55% in proceeds and 20% in deal activity from Q3 2017. Overall volume and activity for the first 9 months of 2018 stood at a 2-year low of $131.5bn via 1,024 transactions respectively ($128.2bn via 906 deals in the first 9 months of 2016).

With IPO volume of $34.8bn in the first 9 months down 6% from the same period last year, and listing activity of 211 deals also down 14%, there is still concern of a dwindling pipeline, especially in emerging markets. Despite the various privatization measures adopted by many Middle Eastern and GCC governments, Saudi Aramco’s IPO postponement has also extended the regional geopolitical uncertainty.

On another note, investor sentiment has warmed up in Europe, following the pricing of SIG Combibloc Group’s IPO ($1.5bn)—a re-listing on the Swiss stock exchange after 11 years and the third-largest EMEA IPO of the first 9 months of 2018—as well as Aston Martin’s expected flotation on the LSE, Knorr-Bremse’s in Frankfurt and CEPSA’s in Madrid.

UK continues to hold the reins

The UK continued to lead all EMEA nations for both ECM proceeds and number of transactions in the first 9 months of the year ($31.4bn via 374 deals), contributing 24.0% to regional volume and 37.0% to deal activity.

The LSE’s Main Market topped the region’s exchange rankings for ECM volume, and increased its market share by 7.7 percentage points to 23.9%, compared to the first 9 months of 2017, raising a total of $30.4bn from 157 deals. It also saw the third and fourth-largest EMEA deals of Q3 2018—rights offerings from DS Smith ($1.4bn) and Phoenix Group Holdings ($1.3bn). Similarly, AIM increased its market share by 1.9 percentage points over the same period, raising $6.1bn and leading all EMEA exchanges in deal activity with 302 transactions from companies listed on its board.

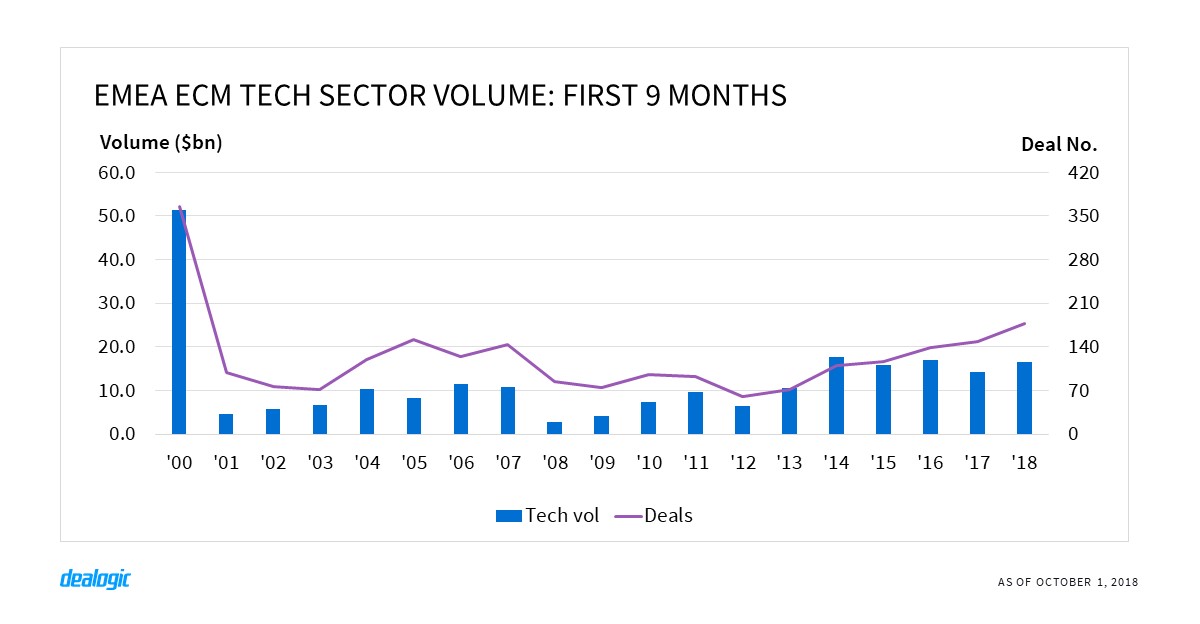

Adyen a bright spot for EMEA’s tech sector

On September 13, a group of shareholders of Dutch payment firm Adyen raised $1.9bn by selling 8.3% of the company, making it EMEA’s largest deal of the quarter and the world’s third-largest largest technology sector ABB in the first 9 months, following Altaba’s sell-down in Yahoo Japan 2 days prior. After its successful $1.1bn IPO in June 2018, Adyen has provided a boost to EMEA’s technology sector which led all industries in Q3 2018 ($5.2bn from 51 deals), and has seen first-9-months tech volume climb to a 2-year high of $16.5bn ($17.1bn in F9M 2016) and activity of 178 deals at an 18-year high (366 deals in F9M 2000).

Cross-Border Chinese IPOs still strong in the US

US-listed ECM volume totaled $67.3bn in Q3 2018, up 18% from Q3 2017, and helped boost overall issuance for the first 9 months to a 4-year high of $224.3bn via 852 deals ($254.4bn via 932 deals in the first 9 months of 2014).

A Q3 highlight of the US-listed ECM market was the level of cross-border IPOs from China, which totaled $3.5bn from 12 deals. If Alibaba’s mammoth $25bn IPO in 2014 is excluded, Q3 2018 would be a record Q3 for Chinese cross-border IPO volume on US exchanges, in addition to the biggest first 9 months ($7.6bn via 26 deals). China accounted for the lion’s share of overall cross-border IPO volume in the US in Q3 2018, which totaled $5.7bn from 21 deals and was more than four-times the level seen in Q2 ($1.4bn via 10 deals).

The two largest US-listed IPOs in the third quarter were both from China—led by e-commerce firm Pinduoduo which listed on Nasdaq and raised $1.7bn, to become the largest cross-border IPO from China since Alibaba Group Holdings. Electric vehicle manufacturer NIO was the second-largest listing for the quarter, raising $1.0bn via the NYSE, and marked the largest Chinese auto sector cross-border IPO on record.

US companies contributed 36.1% ($57.2bn) to global Q3 volume, compared to 25.6% in Q3 2017, and continued to lead all countries to account for the greatest share of global ECM issuance in Q3 2018—the highest quarterly share since Q2 2012 (45.1%).

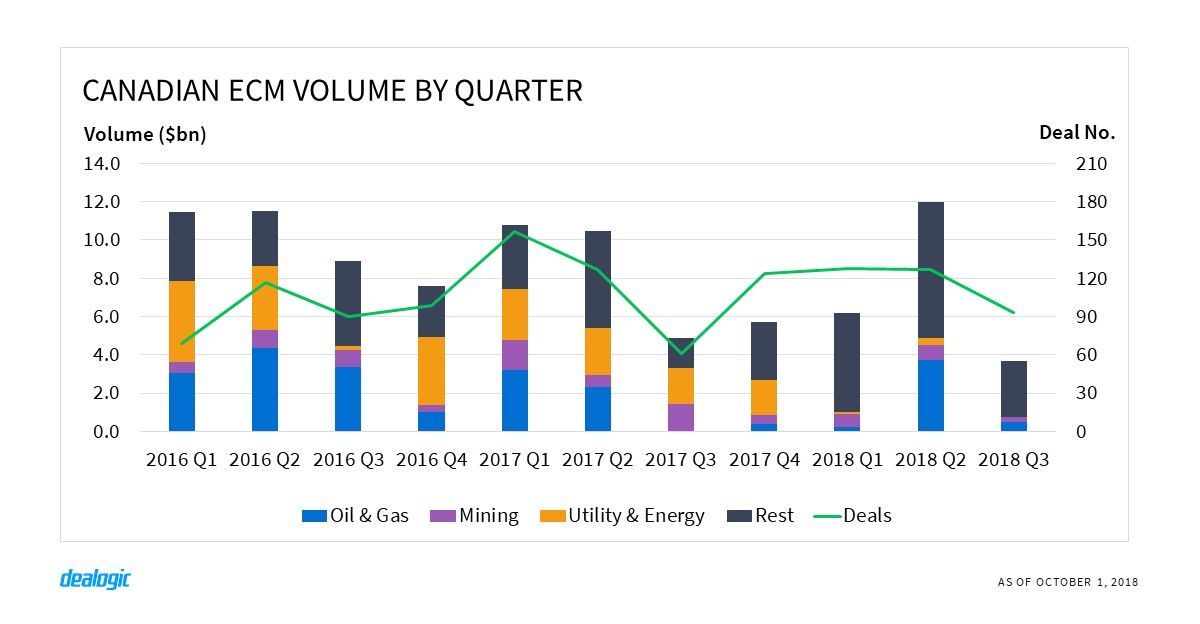

Canadian ECM continues to weaken

The slowdown in ECM volume from Canadian issuers continued into the third-quarter, following a 5-year low in H1 2018 volume. Q3 2018 volume fell to $3.7bn via 93 deals—the lowest quarterly level seen since the financial crisis ($861m via 87 deals in Q3 2008).

Oil & gas, mining, and utility & energy continued to lead all sectors, though there was a significant decline across all three in the first 9 months of the year. Oil & gas issuance dropped 21% year-on-year to $4.4bn via 22 deals, mining saw a 51% decline to $1.7bn via 74 deals, and utility & energy fell 94% to $448m via 4 deals. Collectively, the three sectors saw volume plummet to a 15-year low ($5.4bn via 212 deals in the first 9 months of 2003).

While the traditional leading sectors have slowed down this year, the legalization of marijuana in Canada has brought new investment to the Canadian healthcare sector. Healthcare ECM reached $3.2bn via 61 deals for the first 9 months this year, the highest level for the period on record.

*Based on offerings larger than $100m in size

– Written by Dealogic ECM Research

Data source: Dealogic, as of October 1, 2018

Contact us for the underlying data, or learn more about the powerful Dealogic platform.