Business as usual for European corporates

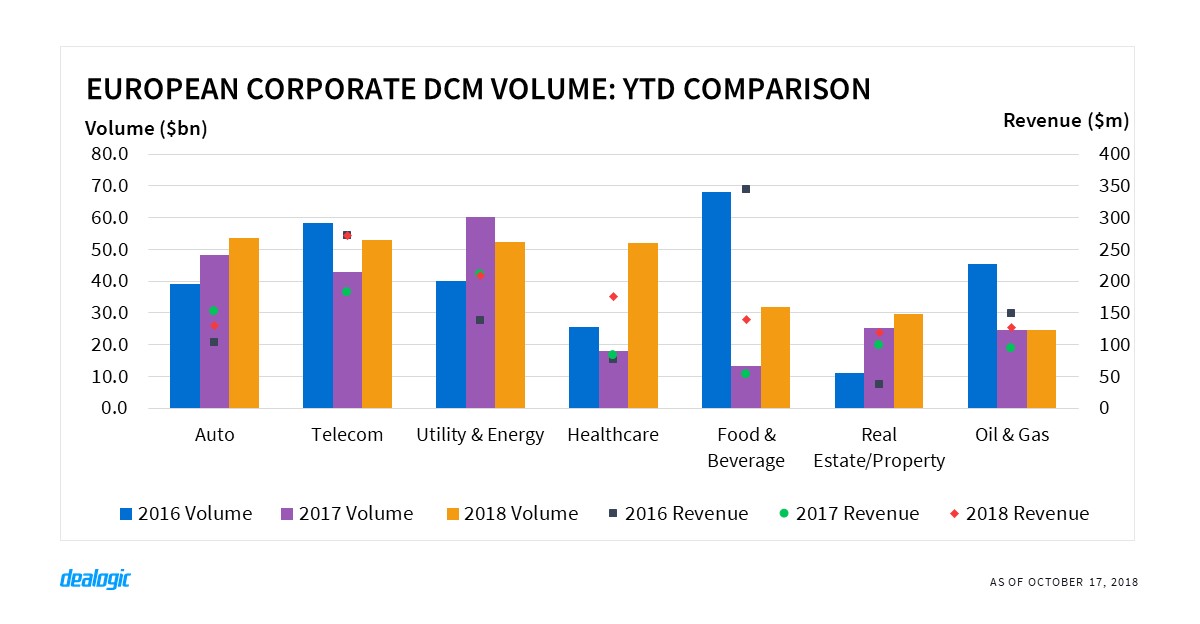

Despite the prospect of tough tariff agreements with the United States and the uncertainty surrounding Brexit, European firms are still actively tapping the bond market. The appetite for international bonds has remained strong with European corporate DCM volume up 5% year-on-year to $439.6bn—the second-highest YTD level on record ($511.3bn in 2009).

Net revenue has held steady in the past 4 years, with the fee pool standing at $1.8bn this year-to-date. The upcoming months will indicate if booming volumes are a result of the final months of the ECB’s QE program or the strength of the corporate sector.

Changing landscape

Traditionally the dominant sector, the auto industry accounts for 12.2% of European corporate DCM volume so far this year, though other sectors are gaining ground. Healthcare companies have issued $51.9bn worth of debt this year, the highest level since full year 2009 and the highest YTD level on record; while the real estate/property sector has continued to gain momentum, with a YTD record 68 deals raising a total of $29.5bn in 2018.

From a revenue perspective, the telecommunications sector has been the most lucrative with a 15.0% market share and generating $271m in revenue so far this year. Utility & energy and the healthcare sectors follow with wallet shares of 11.6% and 10.3% respectively.

Alternatives for the future

Sustainable finance bonds have maintained a steady pace in the region’s corporate sector, totaling $15.6bn in 2018 YTD.

Utility & energy companies are paving the way, with green bonds accounting for 20.4% of the $52.3bn worth of debt issued from the sector this year. Though this proportion matches the 19.9% share seen in 2017 YTD, green bond revenue has in fact climbed to the highest YTD level on record to $45m and is up 11% year-on-year.

– Written by Zita Gombár, Dealogic Research

Data source: Dealogic, as of October 17, 2018

Contact us for the underlying data, or learn more about the powerful Dealogic platform.