Global Overview: 2Q numbers boost stellar six months

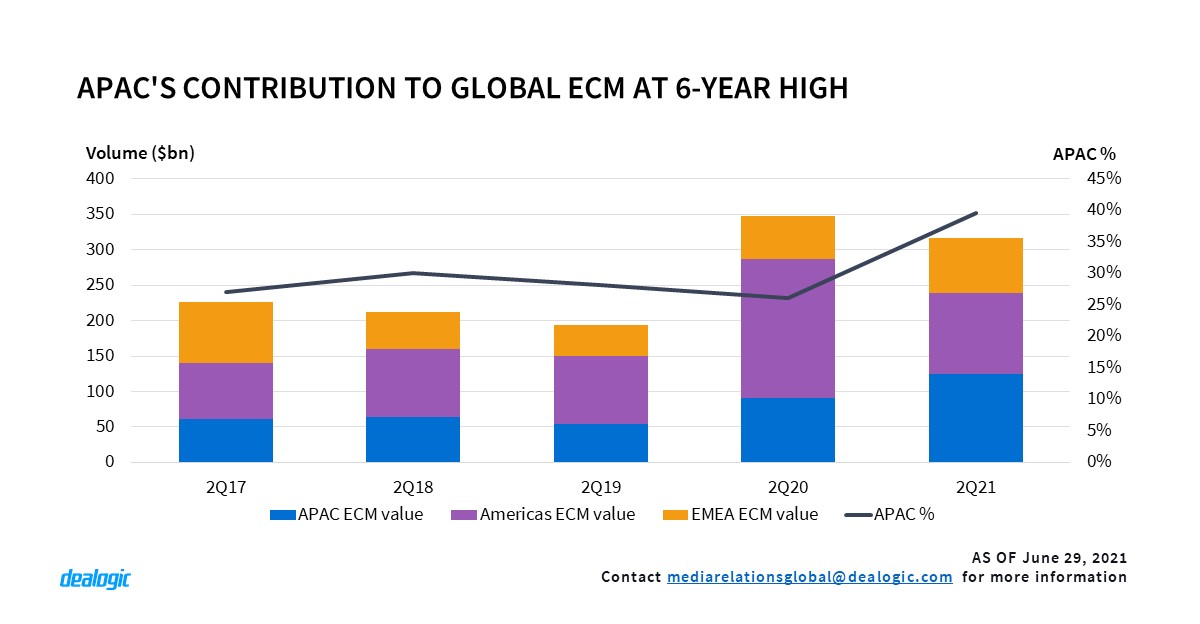

Though 2Q21 paused for breath by comparison with a stellar opening quarter, 1H21 global ECM issuance still came in at USD 785bn – up a staggering 62% year-on-year. That 2Q tally is no slouch, either. At USD 316bn, 2Q21 may be down 8% against the backdrop of last year’s opportunistic balance sheet buffering, but it nonetheless remains the fifth most active quarter by proceeds raised in a series dating back to 2017.

The mix of issuance in the quarter tells a story of regional variation, some normalisation and sector specific focus.

More topics covered in the report:

- Americas: US sees busiest ECM market in 20 years

- Americas: SPACs, technology drive new issuance

- Americas: Convertible debt deals still working

- EMEA: Dash for cash lights fuse under Europe’s IPO market

- EMEA: Technology remains talk of the town

- EMEA: The year of the SPAC

- Asia-Pacific: Fantastic first-half but softer Hong Kong IPOs a concern

- APAC: A closer examination

- APAC: South Korea an India shine despite pandemic, tech IPOs lead

For full access to the Global ECM Highlights and access to Cortex, click here