EMEA and high yield take the relay to bring new issuance record

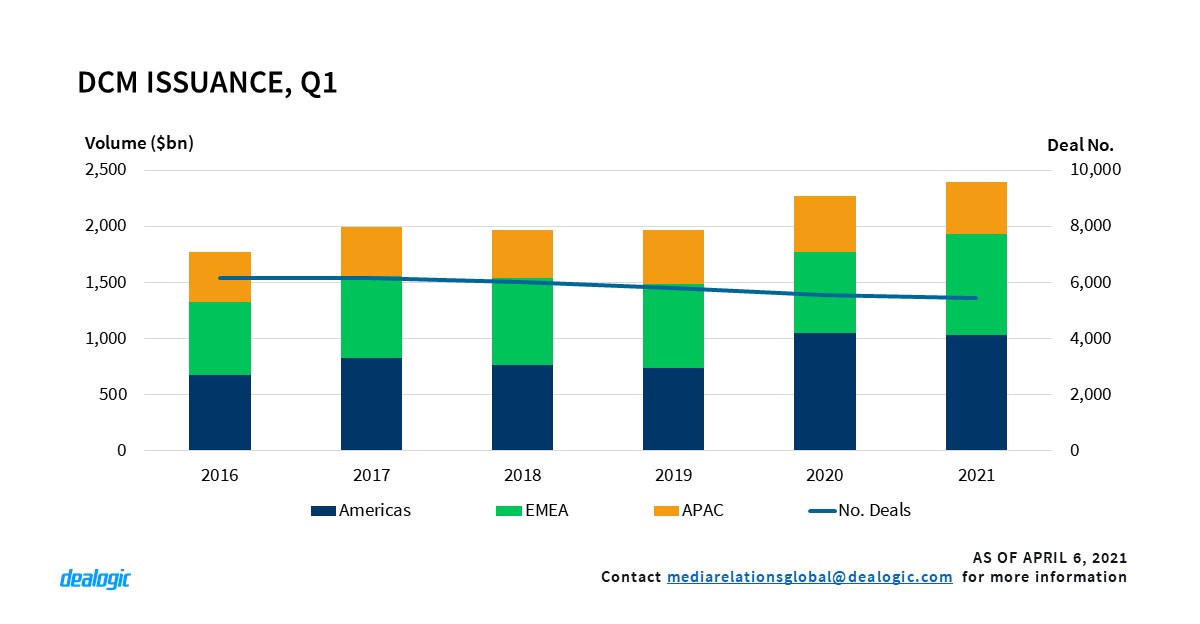

As the world moves into the second year of COVID-19, capital markets – including the bond segment – keep giving market participants great opportunities amidst a landscape full of unsettling uncertainties. In this environment bond sales keep thriving for some asset classes, either as a response to the effects of the ongoing pandemic crisis or from opportunity windows to gain better yields or lower costs in other cases. Thus, DCM issuance has reached a new first quarter historical record in 2021, with $2.40tn issued via 5,433 deals. This time it is the EMEA region pushing issuance to new heights, thanks to a 24% year-on-year growth of volume distributed to investors, totaling $899.2bn in 2021 Q1. Issuance in Americas remains at $1.03tn, 1% lower than the previous first quarter, and in Asia Pacific bond issuance has receded by 7% to $462.4bn.

More topics covered in the report:

- Refinancing activity of junk debt soars to record levels

- Record DCM revenues lose top spots

- US market keeps activity at full pace

- CLOs resume activity and win new heights

- European bond purchase program to accelerate in the second quarter

- Sustainable debt finance expands

- High yield shines

For full access to the Global DCM Highlights and access to Cortex, click here