Use of Proceeds for Debt Repayment Drops, While Acquisition Finance Rises Year-over-Year

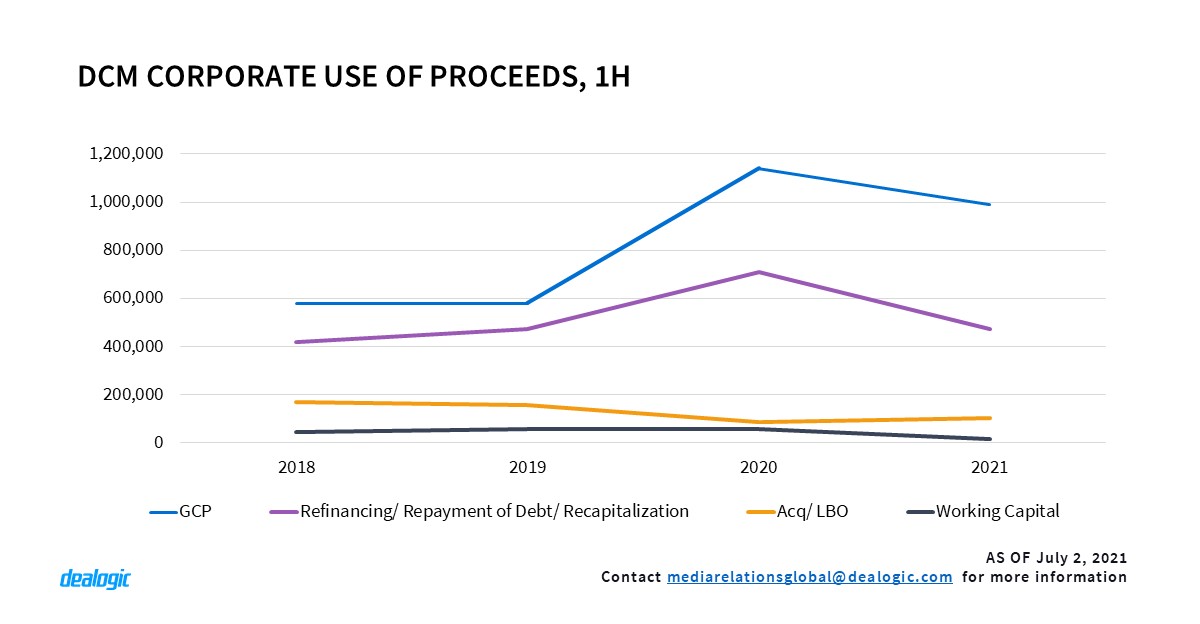

Fewer companies have sought to repay debt, while more have been raising money for M&A albeit still lower than pre-pandemic levels. In 1H21, USD 473bn was borrowed to repay debt, refinance and recapitalise, down 33% from the same period last year, as corporates stabilised balance sheets and hit debt markets for riskier gambles.

More money has been raised for acquisitions, but this is still a far cry from the USD 155bn raised in 1H19 before the pandemic hit and blunted all appetite for deals. A total of USD 105bn was raised for acquisitions, fuelled by cheap debt, up from USD 85bn in 1H20, as companies started to scour the M&A markets.

Use of proceeds for general corporate purposes fell from a record high in 2020 (USD 1.14trn), when corporates hit the market to sustain themselves through the long pandemic, which saw little or no growth. They took the lion’s share of corporate bond issuances (USD $991bn via 2612 deals).

More topics covered in the report:

- CCC Issuers Flock to Market as High-Yield Prices Tighten

- Utility & Energy and Technology Players Rush to Market

- Revenue Data: Less for More?

For full access to the Global DCM Highlights and access to Cortex, click here