Green lights: EMEA takes the lead in going green

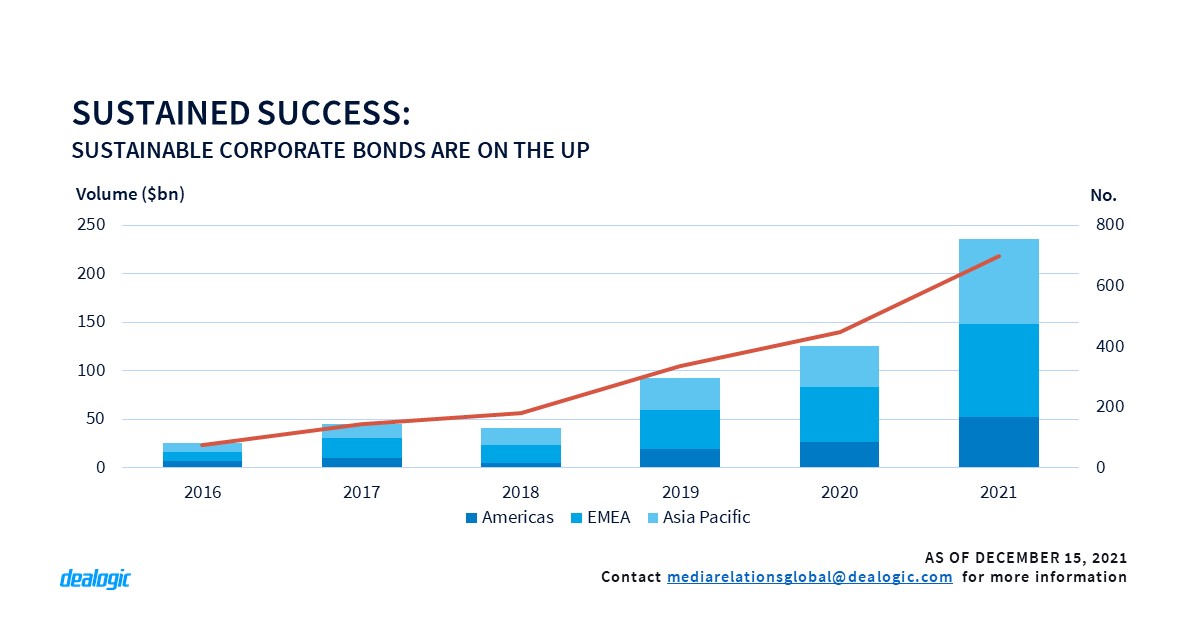

Corporates globally have raised a total of USD 236bn in sustainable (including green) bonds in 2021 YTD, taking a big slice of the total USD 819bn raised across all borrower types including SSAs, financial institutions and asset-backed securities. Corporates in EMEA have been by far the biggest issuers of sustainable bonds, with 227 companies launching bonds totaling USD 96bn, and the UK, Germany and France occupying the top issuer slots. China and Japan are the primary drivers of sustainable loan issuance in Asia-Pacific, where a total of 347 companies delivered USD 87bn. The Americas, perhaps unexpectedly given the corporate emphasis on ESG and consumer preference for renewables products, came last with only 75 companies issuing USD 52bn. Still, sustainable finance is here to stay and will undoubtedly drive more deals in 2022.

More topics covered in the report:

- Global Overview: Winding down, the great debt rush shows early signs of cooling

- Falling due in ’22: Debt walls loom in Asia-Pacific and Americas

For full access to the Global DCM Highlights and access to Cortex, click here

Contact us for the underlying data, or learn more about the powerful Dealogic platform.