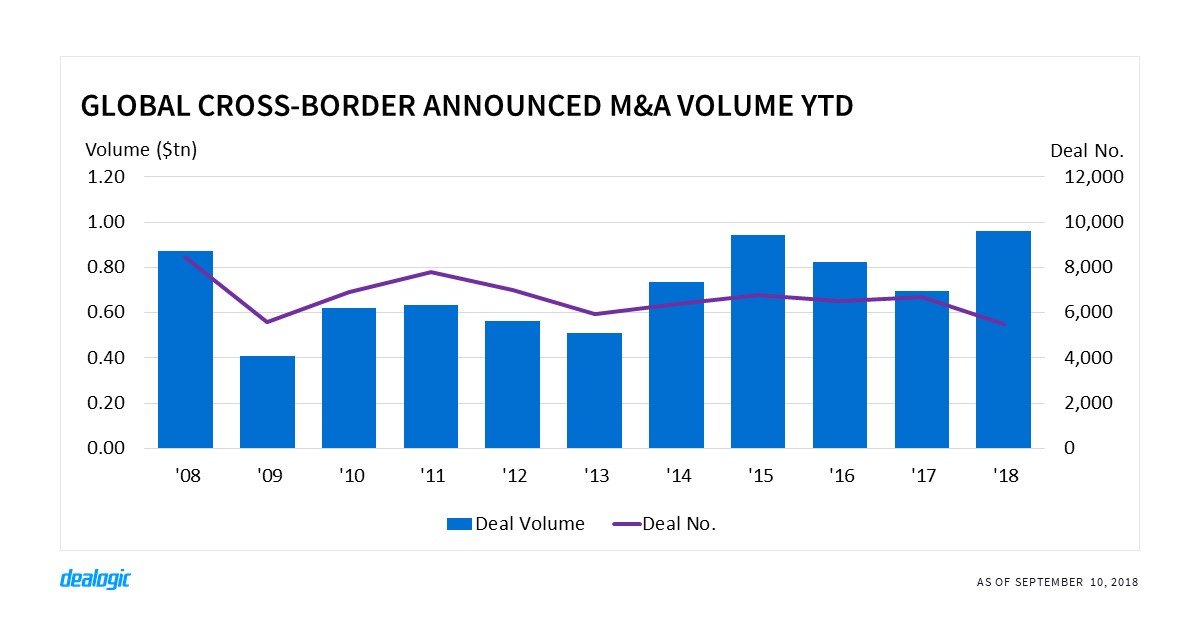

Volume growth for cross-border M&A

So far this year, a record $962.6bn worth of cross-border deals have been announced via 5,498 transactions. This represents a 38% increase in volume year-on-year ($696.1bn in 2017 YTD), despite deal activity having dropped 18% over the same period (6,680 deals in 2017 YTD).

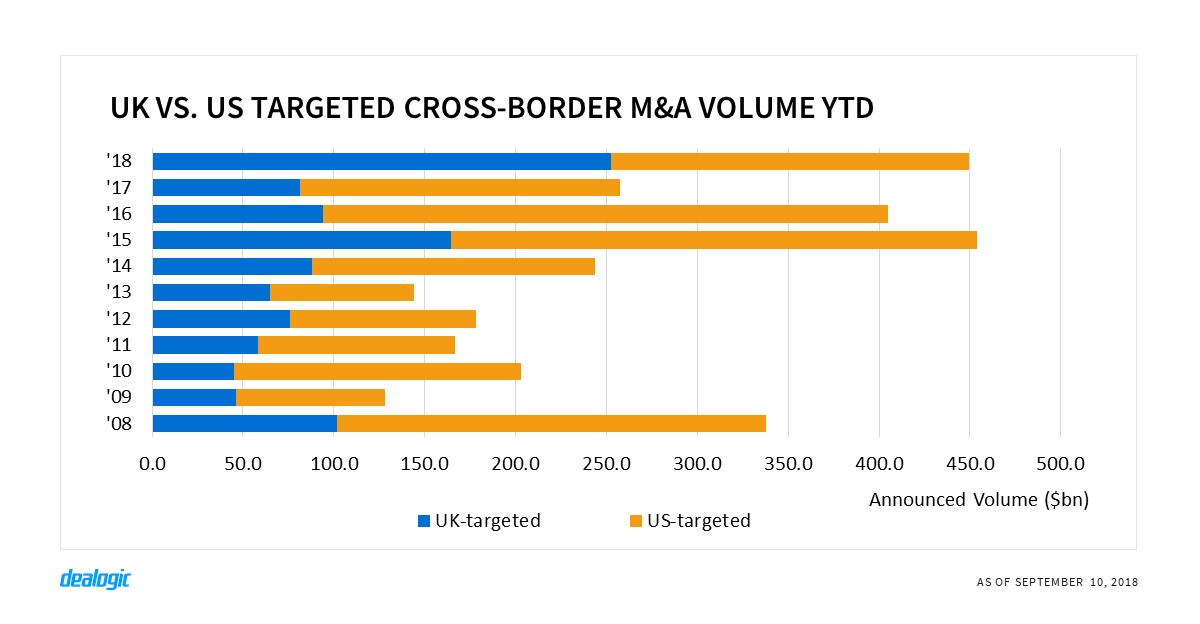

UK targets remain popular

Since 2011, the US and UK have been the top target countries for cross-border deals, with the UK taking the lead this YTD and significantly increasing its share of volume to 26.2% from 11.2% in 2017 YTD. Despite the lack of clarity over the UK’s future on economic and trade relations, companies are still attractive to foreign buyers given their experience and proximity to European markets. Takeda Pharmaceutical’s $81.5bn acquisition of Shire announced in April, has been a primary driver of UK volume.

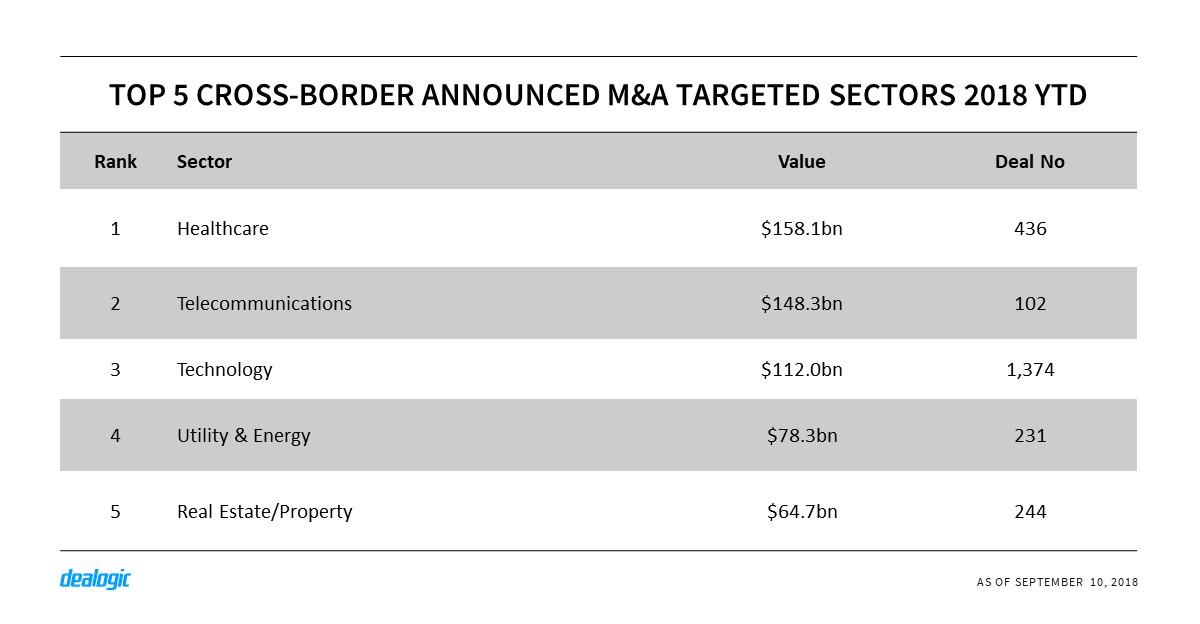

Telecom closing in on healthcare

Though healthcare remains the most targeted sector for cross-border transactions, the telecommunications sector has provided a boost to global cross-border volume this year. A total of 102 cross-border deals involving telecom targets worth $148.3bn have been announced in 2018 YTD, accounting for 15.4% of the market—the highest share for the sector in 5 years (15.6% in 2013 YTD).

– Written by Attila Muze

Data source: Dealogic, as of September 10, 2018

Contact us for the underlying data, or learn more about the powerful Dealogic platform.