Q1 record with a week to go

With more than a week to go until the end of quarter, global carve-out IPO volume has already hit a record Q1 level. Carve-out volume totaled $8.5bn this YTD, aided in large part by the $4.5bn IPO of Siemens Healthineers and the $2.6bn IPO of PagSeguro Digital.

A further 5 carve-out IPOs are set to price before the end the quarter, expecting to raise $6.4bn and potentially bringing Q1 2018 volume to $14.9bn. This would be double the previous Q1 record of $7.4bn set in 2002 and the fourth-highest quarterly carve-out volume on record.

Carve-outs a major driver of IPO volume

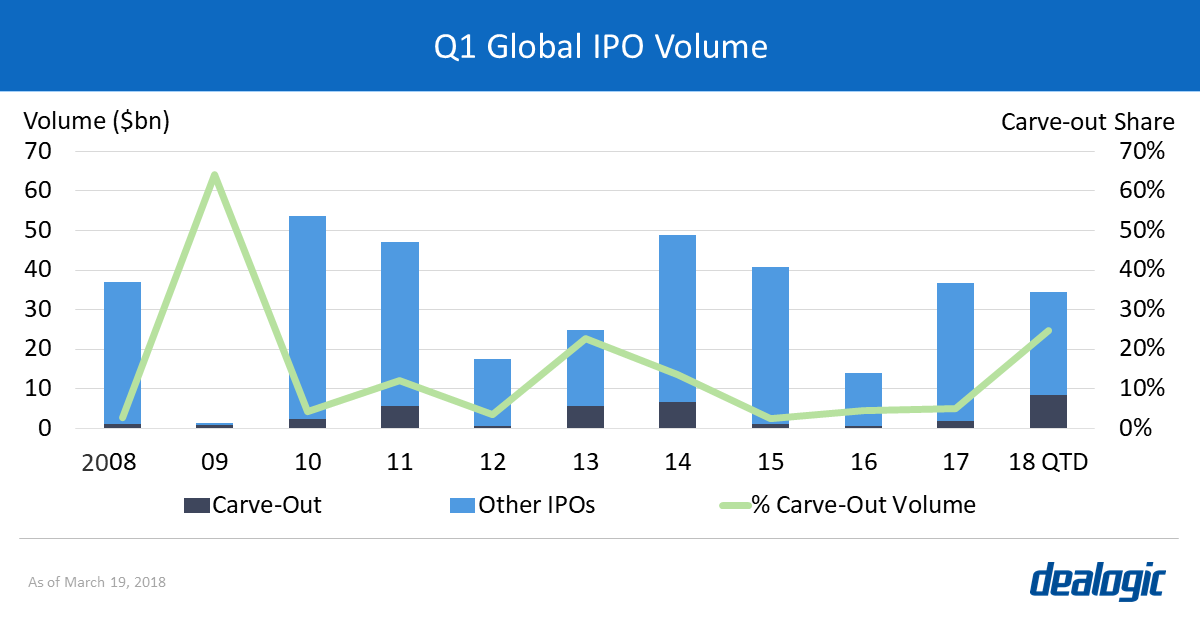

Global IPO volume this YTD stood at $34.5bn, with carve-outs accounting for 24.7%. However, volume for Q1 2018 is projected to reach $50.2bn, which would be the highest Q1 IPO volume since 2010 when $53.7bn was raised. Carve-out volume would account for 29.6% of that, more than double the average Q1 level of 13.5% from the past 10 years.

It would also be the highest Q1 proportion since 2009, when Bristol-Myers Squibb carved out Mead Johnson Nutrition, raising $828m in an otherwise moribund IPO market. Q1 2009 saw just $1.3bn raised from 56 IPOs as the stock market fell to its lowest level following the October 2008 crash.

Billion-dollar deals in the pipeline

Chinese companies listing their subsidiaries account for the majority of expected carve-out volume in the rest of Q1. Baidu will list its video-streaming unit iQIYI on Nasdaq, expected to raise $2.25bn in what would be the largest carve-out IPO this quarter.

In Europe, Elkem—currently a unit of China National Bluestar—is expected to raise $955m in its Oslo IPO, while HNA Group will carve out gategroup Holding in a $1.5bn Swiss IPO. In addition, after the massive Frankfurt IPO of Siemens Healthineers, Deutsche Bank is set to list its asset management arm, DWS Group, in a long-awaited IPO set to raise $1.6bn.

– Written by Andrew Gorton, Dealogic Research

Data source: Dealogic, as of March 19, 2018