Driving amid the waves of war

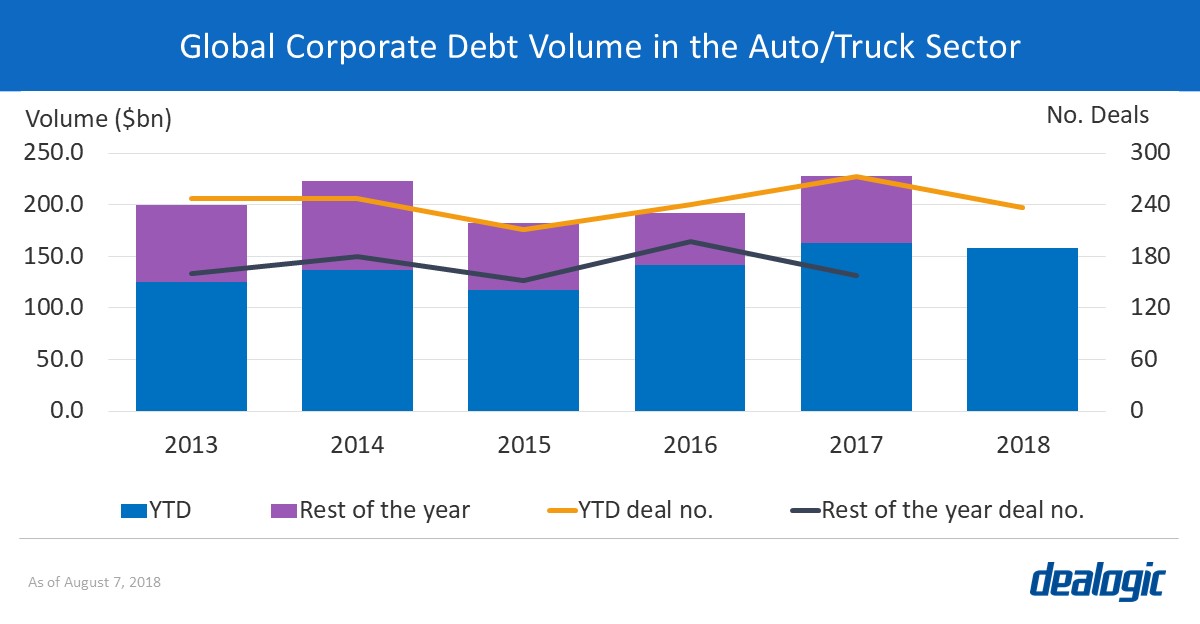

Although H1 2018 marked a 5-year high for corporate debt issuance* in the auto/truck industry ($136.9bn), ongoing talks of potential tariffs on vehicles and imported parts together with proposed countermeasures, are setting up an uncertain time for the sector. Companies that mainly rely on imports could face the challenge of whether to absorb the extra costs or increase prices. The uncertain climate may have affected momentum in the sector, with 2018 YTD volume lagging that of last year. While corporate bonds and leveraged loans volumes have decreased by 30% and 18% respectively, investment grade (IG) loans have gained strength with a 31% increase.

Manufacturers still rolling ahead

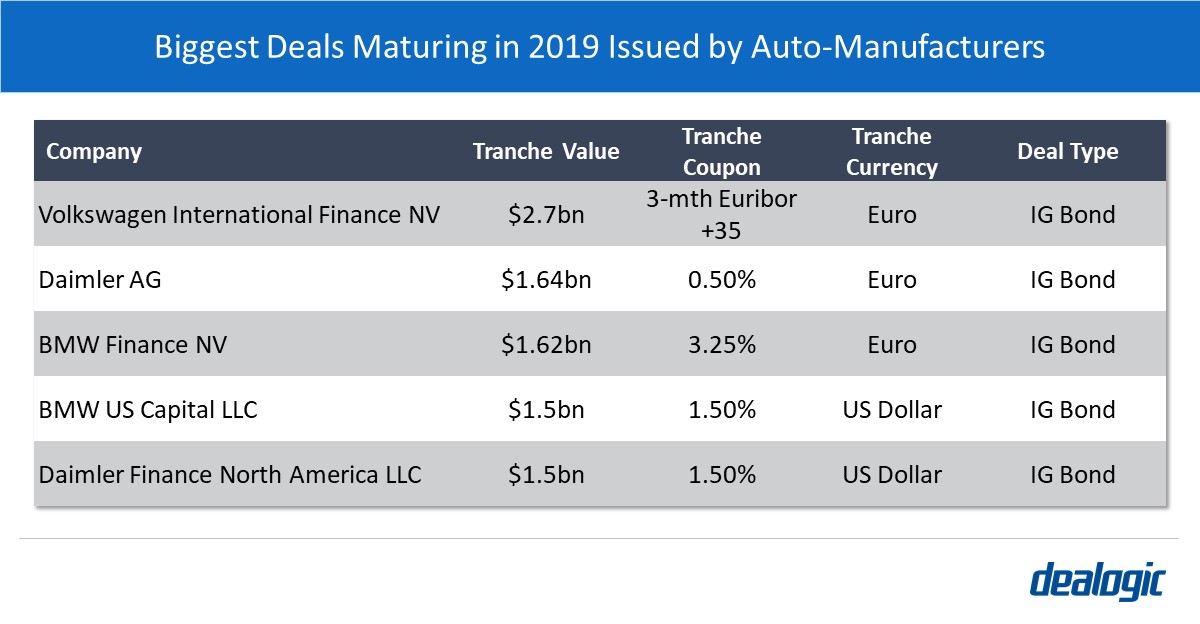

Companies in the car-manufacturing subsector continue to account for the highest share of corporate debt in the industry, with volume of $106.0bn up 14% year-on-year and representing 67.1% of the total. Loans account for 64.9% of car-manufacturing debt, (46.3% investment grade and 18.6% leveraged). Looking ahead, manufacturers own a total of $238.4bn debt due by 2027, that peaks in 2020 with $42.1bn.

A debt wall of dim routes

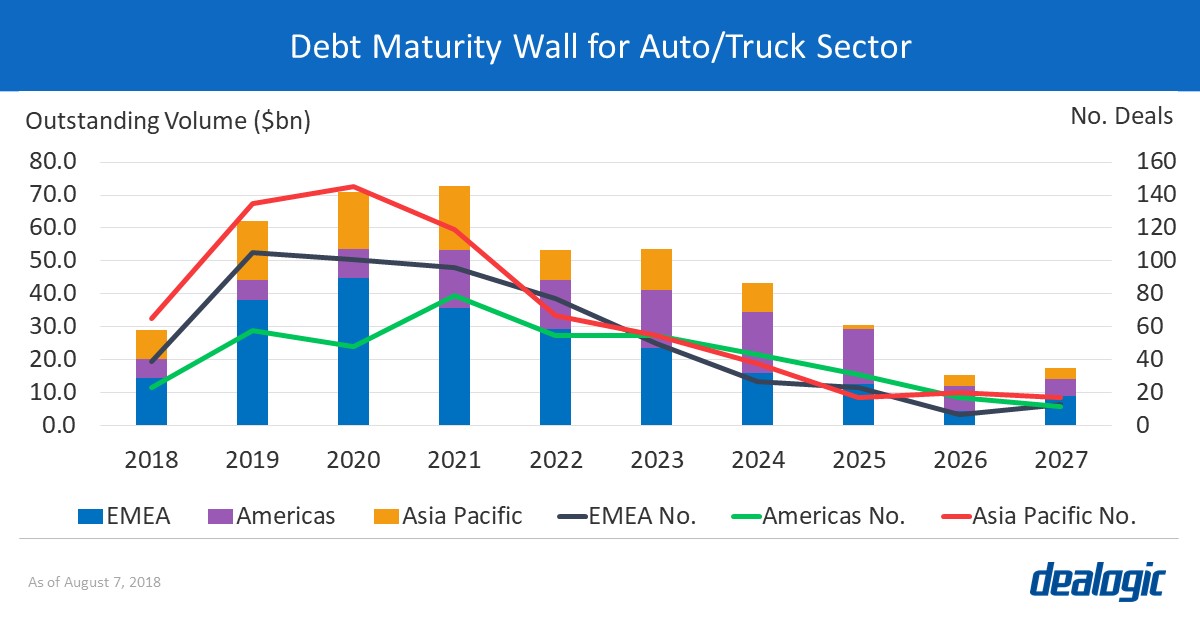

On a global scale, the auto/truck sector owns a total of $448.7bn debt due by 2027. During this period, IG deals dominate the outstanding amount with a 62.3% share, led by IG bonds with 53.7%. The peak will be in 2021, when a total of $72.8bn will come due closely followed by 2020 with $70.9bn.

EMEA leads all world regions with 51.0% of the total outstanding debt due by 2027, ahead of the Americas and Asia Pacific with 26.3% and 22.7% respectively.

– Written by Szilvia Farkas

*Corporate debt comprises high-yield (HY) and investment-grade (IG) bonds, alongside IG and leveraged loans

Data source: Dealogic, as of August 7, 2018

Contact us for the underlying data, or learn more about the powerful Dealogic platform.