European leveraged loans have defied market trends this year.

Leveraged loans the star in EMEA

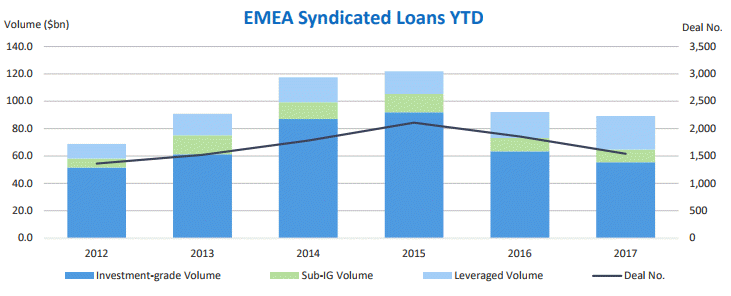

In 2017, the highlight of the EMEA syndicated loans market has been leveraged deals, which stood at $245.1bn in volume this YTD. Not only does this figure eclipse 2016’s YTD volume by an impressive 30%, but it also bucks the overall trend of the EMEA loans market; it saw a year-on-year decline from $920.4bn to $892.2bn, the lowest YTD figure since 2012.

The investment-grade (IG) market has been plagued by political uncertainty across Europe and dragged down the EMEA loans market. With M&A-related IG loans volume falling by 6% since last YTD, overall EMEA IG loans volume stands at $553.9bn, down from $634.6bn in 2016 YTD.

Borrower’s market becomes the norm

Excess demand from investors for leveraged deals, coupled with low pricing, have been manna for sponsors and corporates. For instance, pricing on EMEA institutional loans this year fell from 466bps to 372bps.

The immediate spillover effect has been a frenzy around refinancing and repricing. EMEA loans repricing volume surged 145% year-on-year to $63.6bn in 2017 YTD. Even more impressive, repricing volume by the end of March this year had already surpassed that of full-year 2016.

LBOs and sponsors take center stage

In the European leveraged loans market, deals related to leveraged buyouts (LBOs) also flourished in the low-rate environment. Volume for such deals jumped year-on-year from $61.2bn to $88.6bn this YTD, the highest YTD volume since 2011. Although overall new LBO financing in the region fell marginally by 2% from last YTD, new jumbo LBO-related loans volume increased by 67%. One of the most notable LBOs in the European market so far this year has been Stada’s $3.7bn deal, which was fully marketed in Europe and had the added complexity of bringing a publicly listed company private.

Once more, financial sponsors played a key role in the European leveraged loans market. In addition to driving up volume and activity, sponsors also accounted for a larger share of the wallet—up 12 percentage points from 2016 YTD to reach 88.3% of revenue this YTD from all European leveraged loans.

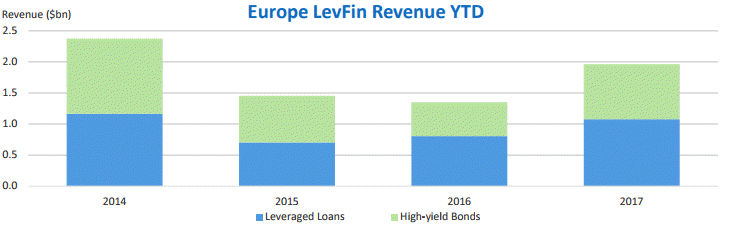

Living in a banker’s paradise

The current borrower’s market has been lucrative for LevFin bankers. European revenue for institutional leveraged loans and high-yield bonds have increased year-on-year from $1.4bn to $2.0bn this YTD. After a dip in 2015, 2017 YTD has set a new revenue benchmark for such deals. Has the market peaked? Can 2018 be even more lucrative? Future pricing level, investor demand, and macro events will have a huge impact on what lies ahead.

Data source: Dealogic, as of December 4, 2017

Contact us for the underlying analysis on European leveraged loans or ask about LevFin Manager on the Dealogic platform.

Related: Dealogic announces partnership with LevFin Insights>>>