Boutiques keep pressure on investment banks

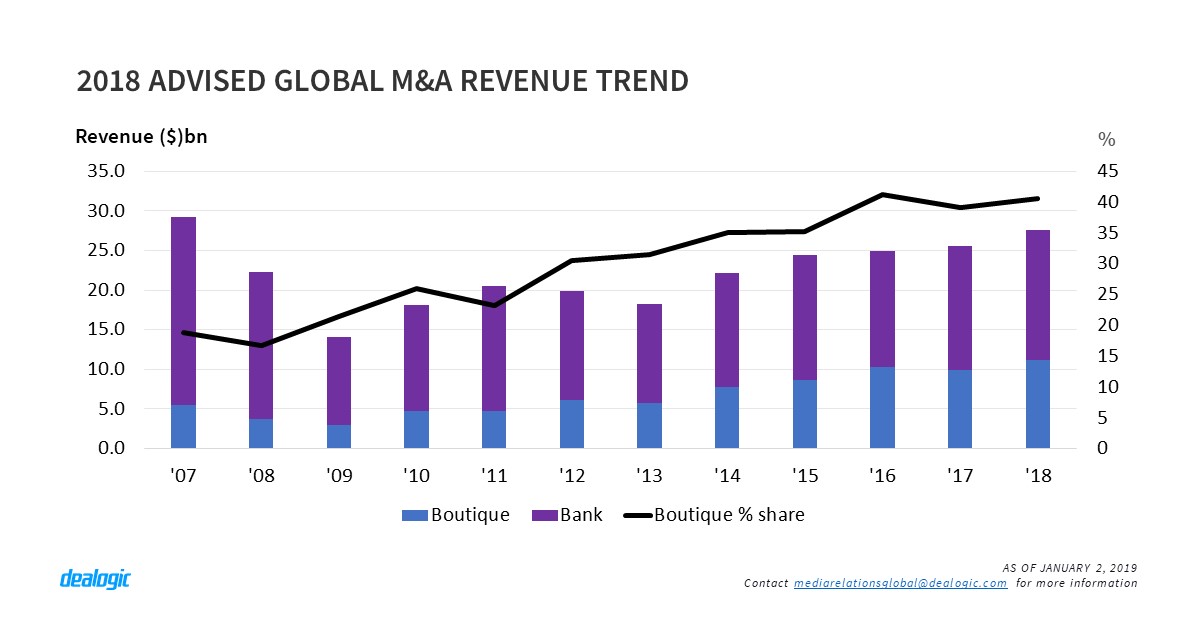

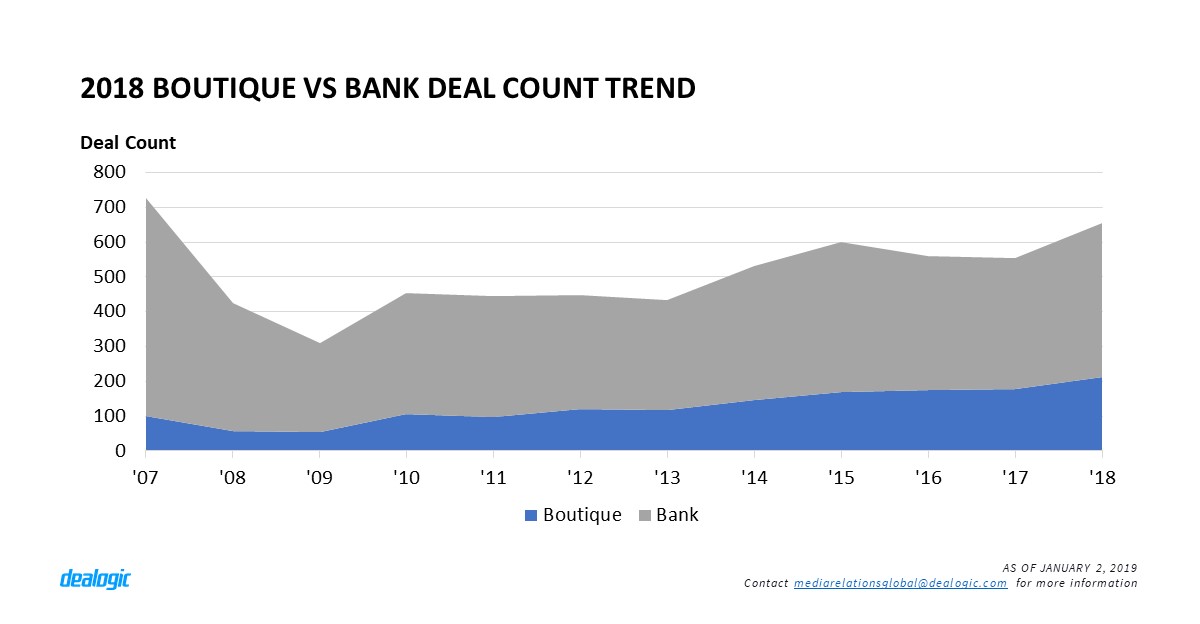

During 2018, advised global M&A volumes reached $3.35tn, its highest levels since the renowned M&A record-breaking year of 2015 ($3.63tn). Boutique M&A financial advisors increased the pressure on the global investment banks after increasing their share of global M&A volume to 40.9%, equating to $1.37tn in total volume, the highest percentage share on record so far. However, it’s not just volumes where the boutiques are continuing to squeeze. Boutiques also accounted for $11.2bn of revenue with investment banks accounting for $16.3bn, keeping on par with the previous record year of 2016. Multi-billion-dollar transactions continue to fuel the boutiques with boutique advisors participating in 211 $1bn+ transactions, also an all-time record.

US M&A activity 2018

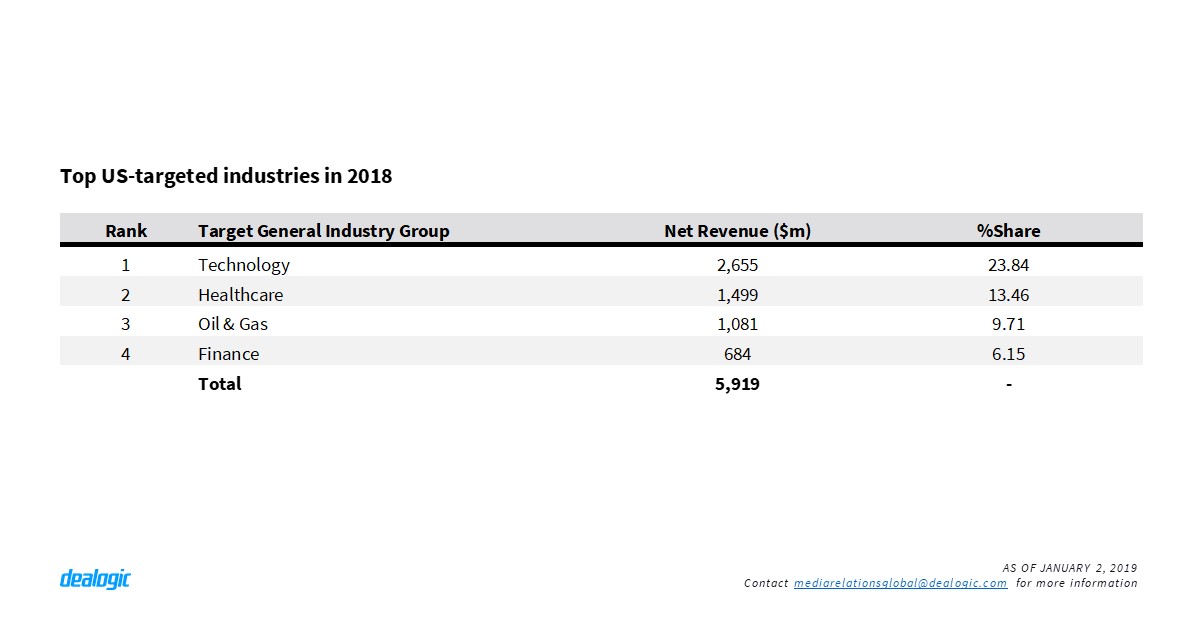

During 2018, US-targeted M&A volume reached a total of $1.74tn, via 7,791 deals. US outbound cross-border activity also reached $233.3bn via 1,476 deals, representing a 24.43% change when compared to the same period in 2017. An important contributor to this result were India targeted deals which was the second most targeted region by US companies, with $17.9bn via 63 deals in 2018, with Flipkart’s acquisition by Walmart Inc ($16.0bn) the main driver in 2018. The Oil & Gas sector also boomed in 2018, reaching $358.7bn via 770 deals, representing an increase of 17.3% during the same period in 2017. Mega deals including Andeavor Corp’s acquisition by Marathon Petroleum Corp ($35.8bn) and Energy Transfer Partners LP’s acquisition by Energy Transfer Equity LP ($57.5bn) were the highlights in this trend and the main drivers of volume.

EMEA highlights – European industries lead the way

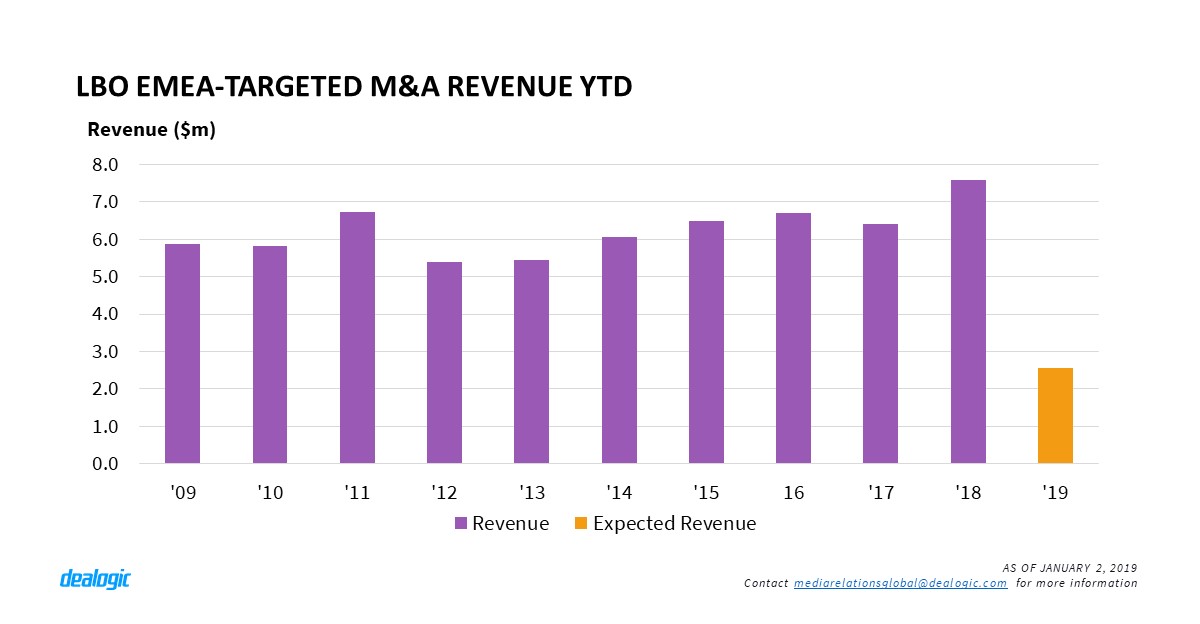

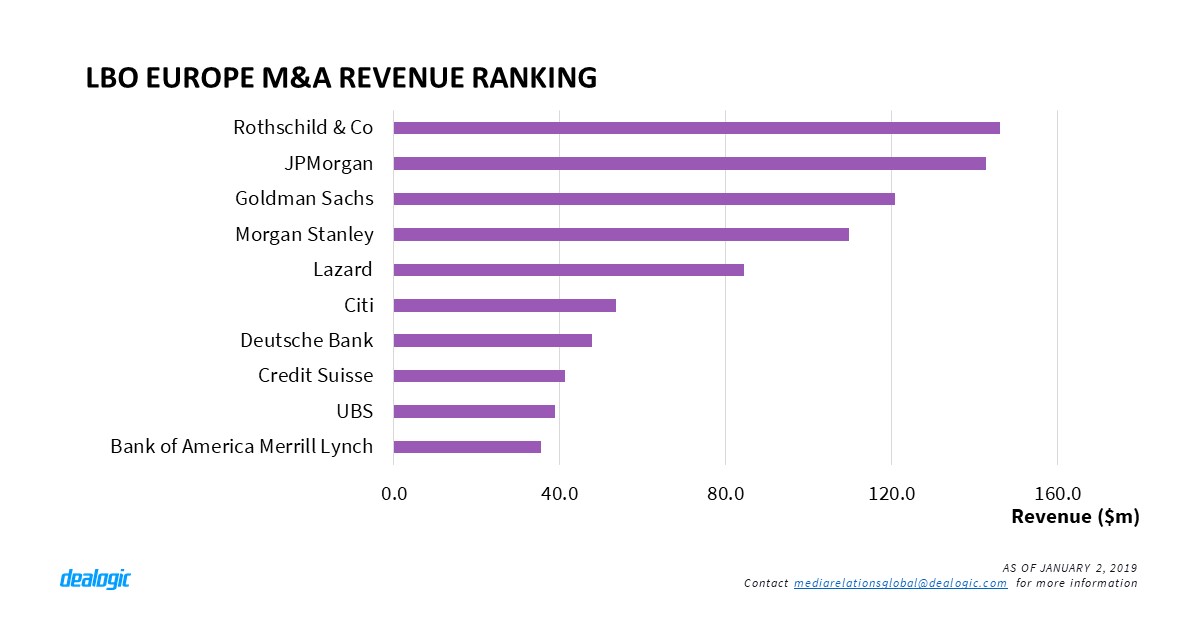

Throughout 2018, the healthcare industry was the most attractive and targeted industry with volume reaching the highest on record in the region with $184.1bn. The volume was mostly driven by mega deals such as Takeda Pharmaceutical’s acquisition of Shire plc for $81.4bn and GlaxoSmithKline’s buy-out of its consumer health joint venture with Novartis AG for $13bn. From a financial sponsor perspective, European chemical companies were the most winsome for sponsors with volume reaching $18.4bn, the highest volume on record. Overall, Europe was the main contributor to the rise of revenue in LBO EMEA targeted transactions by reaching $1.4bn in 2018, the highest revenue since 2007 ($2.1bn). The top LBO EMEA deal this year was Carlyle’s mega deal for the specialty chemical business of Dutch Akzo Nobel NV for $12.5bn.

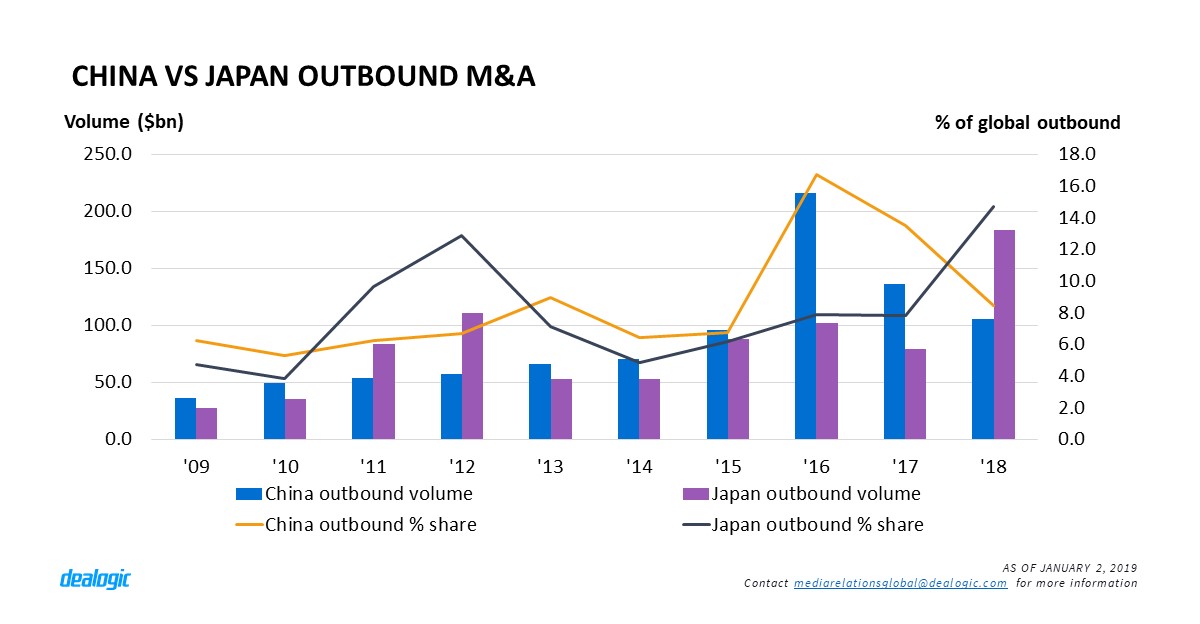

Japan overtakes China in outbound volume

China has been dominating the Asia Pacific outbound M&A volume since 2013, and for the first time this year, boosted by Takeda Pharmaceutical’s $81.5bn acquisition of Shire in April, it was outpaced by Japan which climbed to $184.2bn via 649 deals, up for more than two times year-on-year volume ($79.5bn from 685 deals in 2017), soaring to rank second of the global outbound volume following United States ($233.3bn via 1,476 deals).

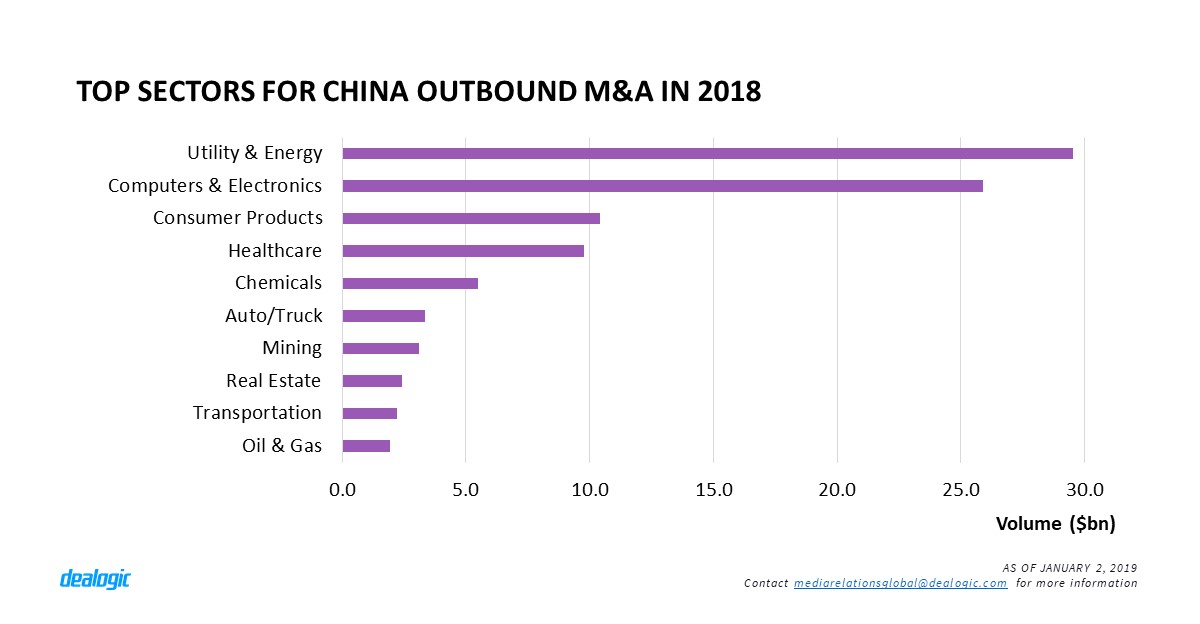

China outbound powered by EMEA utility & energy

Despite the second consecutive year drop of China M&A outbound volume to $105.4bn via 498 deals in 2018, China still ranked 4th of the global outbound volume following United States ($233.3bn), Japan ($184.2bn) and Canada ($116.4bn). Boosted by the China Three Gorges’ $27.5bn acquisition of Energias de Portugal-EDP announced in May this year — the second-largest China outbound M&A on record – EMEA-targeted China outbound M&A is up 36% in 2018 to $67.3bn (178 deals) from $49.6bn (226 deals) in 2017. This transaction also allowed the utility & energy sector to hit a record high in 2018, reaching $29.5bn via 28 deals.

– Written by Dealogic M&A Research

Data source: Dealogic, as of January 2, 2019

Contact us for the underlying data, or learn more about the powerful Dealogic platform.