US SPACs issuance collapse in 2Q

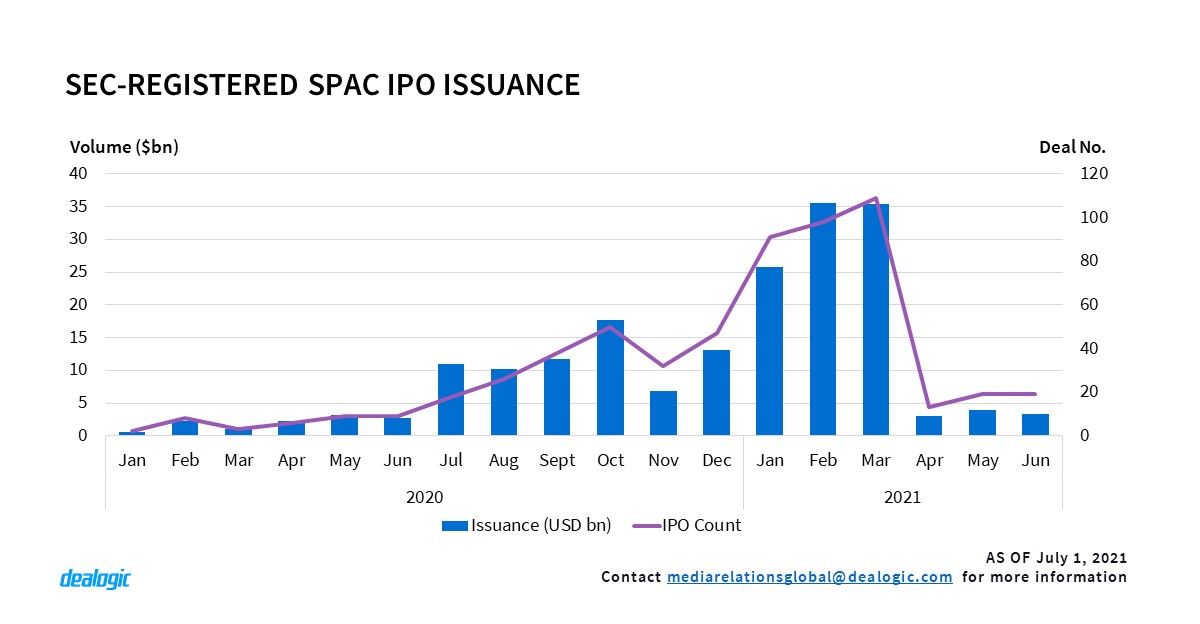

Special Purpose Acquisition Companies (SPACs) have fuelled IPO issuance on US exchanges over the last twelve months. So far this year, 350 SEC-registered SPAC IPOs have been priced, raising USD 107.6bn. However, SPAC IPO issuance dropped significantly in April, with the bulk of activity occurring in 1Q21.

SPAC business combinations have been a major theme of US M&A this year, with 155 deals worth USD 379bn announced in 1H21 alone. Although new issuances have declined in 2Q21, SPACs typically have a 24-month window to complete a transaction, so deals made by SPACs in the US could continue unabated in the coming quarters.

More topics covered in the report:

- Global M&A value reaches new highs in 1H21

- Global PE activity hits new records

- US takes more than half of global M&A value

- LBO activity on the rise

- European cross-border dealmaking gathers momentum

- SPACs, sponsors, and tech continue to drive European dealmaking

- Top European SPAC Acquisitions 1H21

- APAC landscape shaped by US-China Tech rivalry and regulatory pressure

For full access to the Global M&A Highlights and access to Cortex, click here