Global: Software eats the world

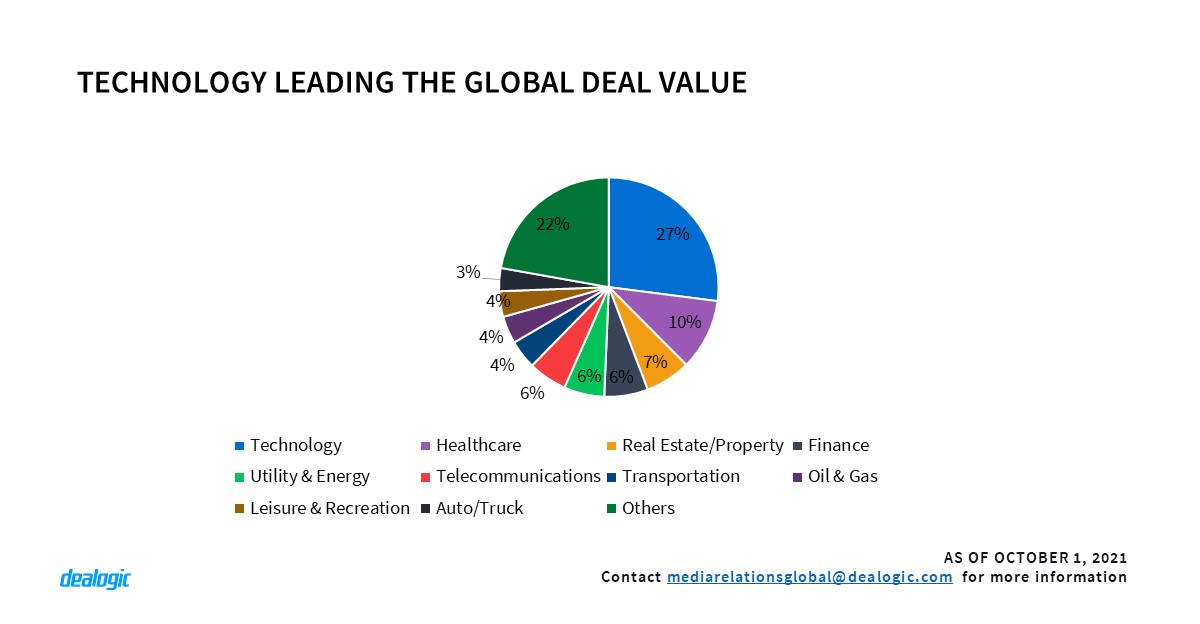

The idea that “software is eating the world” – expressed by venture capitalist Marc Andreessen in 2011 – has found its truest expression yet in 2021. Technology accounts for 27% of global deal value (USD 1.2tn across 8,797 deals) so far this year, the largest ever share.

Healthcare holds second place, with 10.5% of total deal value. This is followed by the real estate (6.7%), finance (6.4%), utility & energy (6%) and telecommunications (5.7%) sectors.

North America accounts for more than half (51.2%) of global deal value during the first nine months (9M21), followed by Asia-Pacific (21.6%) and Europe (21.3%).

More topics covered in the report:

- Global: World class – Global M&A hits record high

- US returns to form

- SPAC attack

- PE activity to break all records in 2021

- North America: US hits it out the park

- Techtonic

- Return of the barbarians?

- EMEA: Region mirrors global uptick as cross-border activity propels dealmaking

- Uptick in US investment drives EMEA M&A

- Technology, sponsors, and SPACs continue to rise

- APAC: Technology and Australia lift region’s M&A to new highs

- Aussie rules

- China’s SOEs dominate megadeals

- Technology remains APAC’s deal driver

For full access to the Global M&A Highlights and access to Cortex, click here