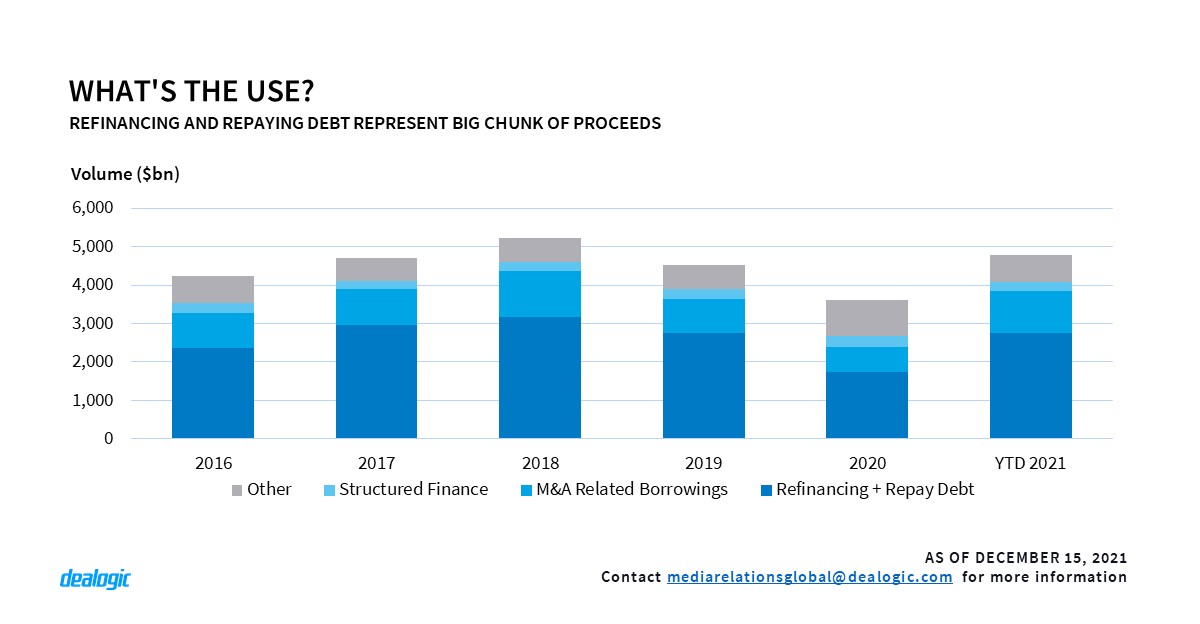

User friendly: Refinancing and M&A-driven financings on the rise

The use of proceeds for refinancing and the repayment of debt at USD 2.74trn YTD has already exceeded 2019 pre-pandemic figures, while M&A-related borrowing is up almost 73% from the whole of 2020 and around USD 100bn shy of 2018 – the highest figure in the past five years. This year has witnessed record levels of M&A, as risk appetite returned to executives and companies expended capital made available by cheap debt and frothy equity markets. Indeed, 2022 could see a wave of new-money issuance if M&A market conditions remain favorable.

More topics covered in the report:

- Global Overview: Leveraged loans enjoy banner 2021

- Stars in stripe: North America remains kings of leverage

- Settling up: 2022 looks big year for debt repayments

-

- Flower Power: Green and sustainable loans continue to bloom

-

For full access to the Global Loans Highlights and access to Cortex, click here

Contact us for the underlying data, or learn more about the powerful Dealogic platform.