US and European yields converge

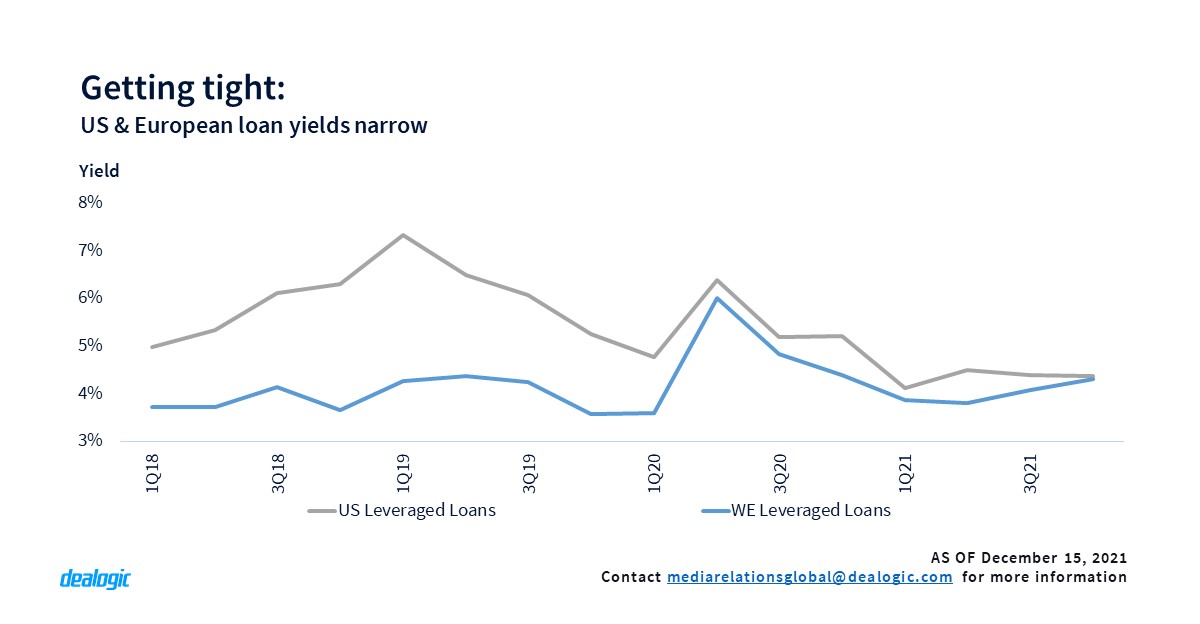

Yields gradually narrowed across the leveraged universe from pandemic-induced spikes in the 6-7% area to a range of 4.4-5.5% by end-2020, and these continued tightening in 1Q21. In the US institutional loan market, the weighted average yield reached its lowest point of 4.1% in 1Q21, with an average margin of 347 basis points (bps). However, margins then started to widen, with the yield climbing to 4.5% in 2Q21. The upward trend subsequently came to a halt, as the average yield slipped back marginally to 4.4% in 3Q-4Q21.

The widening in the European institutional loan market lagged slightly behind, with the weighted average yield continuing to stumble from 3.9% in 1Q21 to 3.8% in 2Q21, as investor demand temporarily outstripped supply. Average European yields then started to converge with the US market, rising to 4.1% in 3Q21 before timing out at 4.3% in 4Q21, with an average margin of 398bps.

In the US HY bond market, the weighted average yield tracked down to 5.2% in 1Q21 from 5.5% in 4Q20, and continued slowing to 5% and 4.8% in subsequent quarters. However, yields then recovered back to 5% in 4Q21.

In Europe, the weighted average HY bond yield slumped from 4.7% in 4Q20 to 3.9% in 1Q-2Q21. Yields then started pacing upward, climbing to 4.3% and 4.7% in the third and fourth quarter, respectively.

More topics covered in the report:

- Global Overview: Dash for cash – Leveraged issuance breaks all records, signs of easing up

- LevFin hitting the breaks as year-end looms

- Refinancing dominates, but M&A volumes set blistering pace

- CLOs set new records

- Finance tops sector standingsDas

For full access to the Global LevFin Highlights and access to Cortex, click here

Contact us for the underlying data, or learn more about the powerful Dealogic platform.