Global Overview: Size Matters

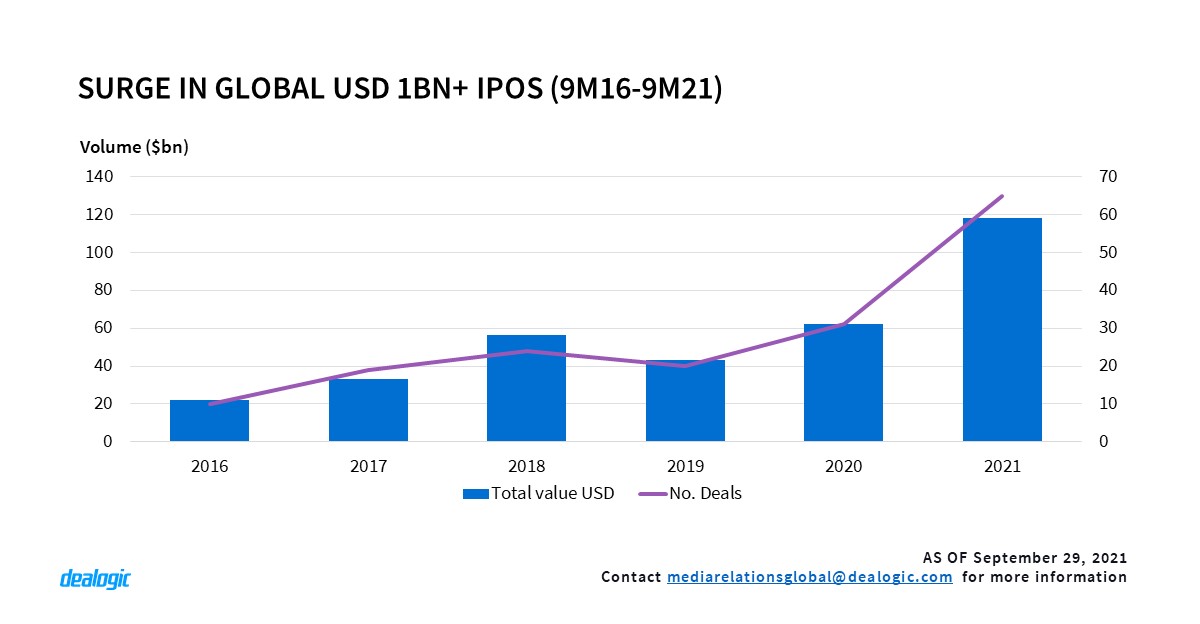

Even as PE funds, VCs, founders and corporate-led carve-outs form a widening pool of issuers, investors know what to look for: quality, liquidity and growth, according to Gareth McCartney, global co-head of ECM at UBS. Indeed, more mega-IPOs have happened in 2021 than ever before, with twice as many USD 1bn+ deals than in 2020. Europe, in particular, has seen “an unusual number of very high-quality assets coming to market”, contributing to the global frenzy, McCartney said.

More topics covered in the report:

- Global: IPO bonanza takes ECM to new heights

- As good it gets

- Americas: Overseas listing smash record

- SPAC to earth

- Fall in follow-ons

- EMEA: Catch me if you can

- Sponsored tech

- Little SPAC stress

- The Kroon

- APAC: China syndrome melts 3Q sentiment

- South Korea’s Krafton top IPO of 3Q

- One Sea, two deals

- Top 5 follow-ons in 3Q

- Top 5 equity-linked bond deals in 3Q

For full access to the Global ECM Highlights and access to Cortex, click here