South Korea and India enjoy stellar IPO performances

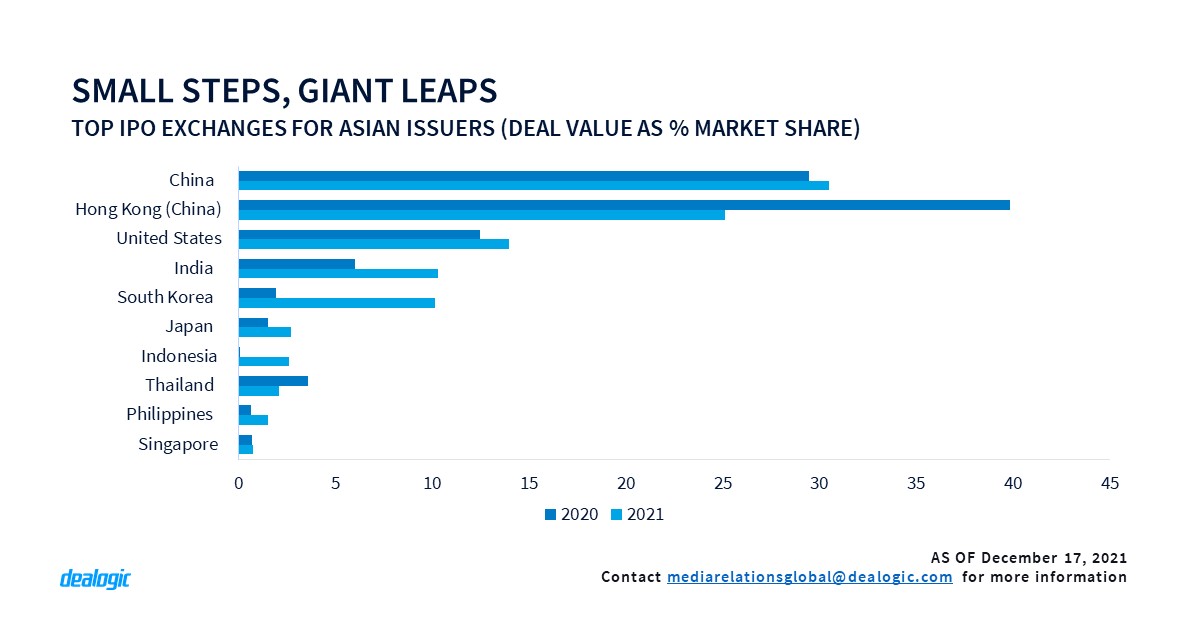

Asia-Pacific (APAC) exchanges have raised USD 170.3bn from 384 IPOs in 2021, well above 2020, when activity topped USD 130.3bn across 243 deals. Hong Kong’s exchange was surpassed by mainland China as the home of choice for Asian issuers, as India and South Korea saw a boom in new listings.

South Korea recorded 30 IPOs raising a combined USD 16.2bn, up from five deals fetching USD 2.36bn last year. India, on the other hand, hosted 58 listings so far this year for a combined USD 17bn. Deal volumes flew up from 14 IPOs, while proceeds more than doubled from the USD 7.45bn recorded in 2020.

It is not all about quantity, though. South Korea and India can also claim most of the top-performing IPOs in 2021. Among the 21 deals in Asia that posted a 50% to almost 300% gain versus their IPO price, most of them are from hot sectors affected by the pandemic, including healthcare, internet services and software development. Seven of the 21 deals are from India, six from South Korea, while the Shanghai Stock Exchange and its STAR Market share two seats. Hong Kong and Tokyo each cultivated two stellar IPOs, and the NASDAQ and Bursa Malaysia each hosted one shiny deal.

On the other hand, most of the worst performing IPOs by Asian companies were those of US-listed Chinese consumer services providers such as Tencent-backed insurance platform Waterdrop (down 88% to date) and fresh foods aggregator MissFresh (down 64% to date). When geopolitics kick in, ECM often feels the aftershock.

More topic covered in the report:

- Global Overview: Space race – ECM issuance rockets in 2021

- EMEA: To infinity and beyond

- Listing explosion

- Follow-ons making ground

- A brave new world

- North America: Total eclipse of heart

- Star trekkers

- Gravitational pull: SPAC pace slips, but still forges on

- APAC: Newcomers shine as sun sets on Hong Kong

- South Korea and India enjoys stellar IPO performances

- Hong Kong: deal universe shrinks

- Convertibles go big, follow-ons stay home

For full access to the Global DCM Highlights and access to Cortex, click here

Contact us for the underlying data, or learn more about the powerful Dealogic platform.