Average deal size of private equity-backed LBOs breach $1bn for the first time.

Private equity-backed LBOs highest since 2007

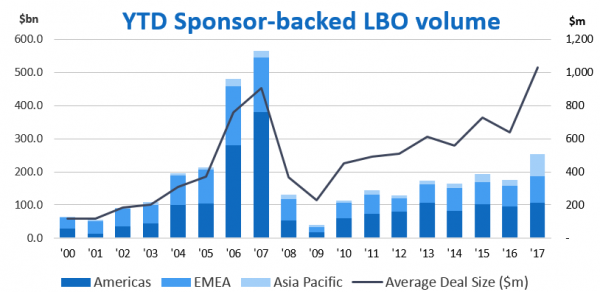

A decade after the financial crisis rocked the global economy, private equity (PE) firms have adapted to the recovering landscape. Historically low interest rates created opportunity for PE firms looking to buy. Investors seeking high returns have put capital into riskier securities, and financial sponsors are tapping into these pools. Global financial sponsor–backed LBO volume grew to $252.7bn this YTD, the highest YTD level since pre-crisis 2007 ($564.8bn).

Dry powder lights up billion-dollar deals

Sponsor–backed LBOs decline to the lowest activity in over a decade, while average deal size is at a historic high. The average global LBO breached $1bn for the first time on record, topping the $904m set in 2007. Successful fundraising and years of striking smaller deals have led sponsors to spend record levels of undeployed capital “dry powder”, ultimately leading to some of the biggest deals since the financial crisis. Japan-targeted LBO volume set the all-time record of $24.1bn this YTD, driven by Toshiba Memory and sponsor Bain Capital. Sponsors have also looked to a variety of sectors for potential targets, leading to the $6.7bn acquisition of office-supply retailer Staples by PE firm Sycamore Partners, and the $6.4bn buyout of telecom operator Nets A/S, led by PE firm Hellman & Friedman.

| Top Leveraged Buyouts Announced YTD | ||||

|---|---|---|---|---|

| Pos. | Target | Acquiring FS / Private Equity | Value | Date |

| 1 | Toshiba Memory | Bain Capital | $17.9bn | Sep 20 |

| 2 | Calpine | CPPIB; Energy Capital Partners | $17.4bn | Aug 18 |

| 3 | Global Logistic Prop | Hopu Investment Mgmt | $16.0bn | Jul 14 |

| 4 | Staples | Sycamore Partners | $6.8bn | Jun 28 |

| 5 | Nets A/S | GIC Special Invest; Advent Intl; Hellman & Friedman; Bain Capital; StepStone | $6.4bn | Sep 25 |

| 6 | Banco Popular Esp | Blackstone Grp | $6.0bn | Aug 8 |

| 7 | Belle Intl | CDH China Holdings Mgmt | $5.8bn | Apr 28 |

| 8 | Parexel Intl | Pamplona Capital Mgmt | $5.0bn | Jun 20 |

| 9 | West Corp | Thomas H Lee Partners; Quadrangle Grp; Apollo Global Mgmt | $4.9bn | May 9 |

| 10 | Aon Hewitt | Blackstone Grp | $4.8bn | Feb 10 |

Contact us for the underlying data and analysis on private equity firms, or learn more about the Dealogic platform.

Data source: Dealogic, as of October 23, 2017