In 2017, US renewable energy project financing declined year-on-year in both volume and activity as non-renewables recovered.

Shadowed by the tax-credit fight

With the US Congress fighting over tax credits that would encourage investments into renewable energy projects, the market’s 2017 performance reflected worries that these incentives would come to a halt. Previously, renewables in the US project finance (PF) sphere increased from 48 projects in 2012 to 98 in 2016. However, 2017 saw year-on-year drops in volume and activity, reaching the lowest volume since 2014 with $12.8bn via 70 projects.

Continued tax credits for US renewable projects should boost 2018 performance, but other factors such as market caution may impact developments.

US non-renewables regaining significance

As US renewables face a potential loss of investments, non-renewables have quietly recovered in the background. After US non-renewable PF volume dropped from $20.4bn in 2014 to $14.9bn in 2015, then again to $12.4bn in 2016, 2017 showed a remarkable recovery to reach $18.3bn. Activity also recovered from 24 projects in 2016 to 34 last year, as US energy PF shifted back towards non-renewables.

Neighboring countries follow different directions

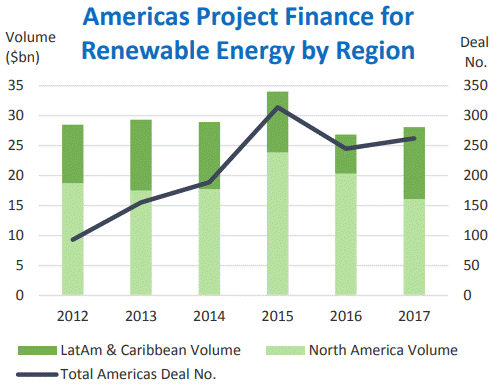

By 2017 renewable PF volume in the Americas, US neighbors Brazil and Canada ranked second and third, respectively. However, these two countries moved in opposite directions last year, reflecting the divergence between renewables in North America and Latin America & Caribbean.

Similar to the US, Canadian project financing dropped in the renewable energy sector. its volume fell from a record PF volume of $9.3bn in 2013 to $3.3bn in 2017. In contrast, Brazil has seen its renewables flourish. Last year, Brazil was the most active nation globally with 158 renewable energy projects and reached 5-year high of $9.5bn in volume. However, activity was still down from a peak of 181 projects set in 2015. As growth areas like wind farms remain strong in Latin America & Caribbean, the region could be competition to North America for total renewables volume.

-Written by Gergely Cseresnyés, Dealogic Research

Contact us for the underlying analysis on energy lending or learn more about the Dealogic platform.

Data source: Dealogic, as of February 8, 2018